Question: Some help on these 2 please Trans Union Corporation issued 5,300 shares for $50 per share in the current year, and it issued 10,300 shares

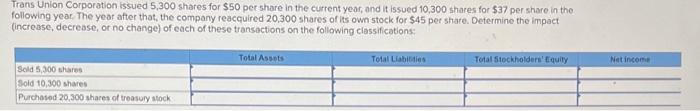

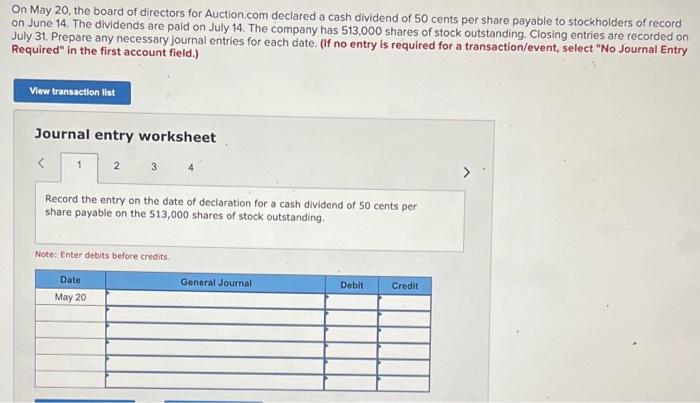

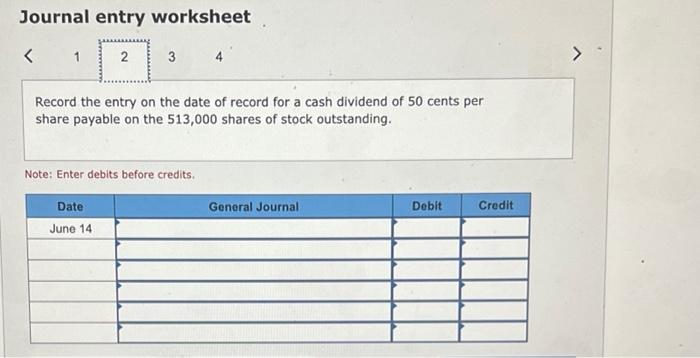

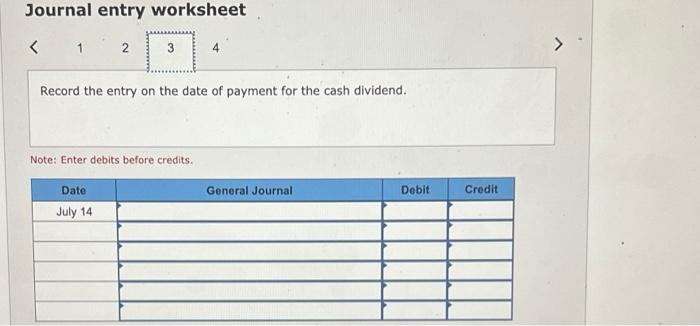

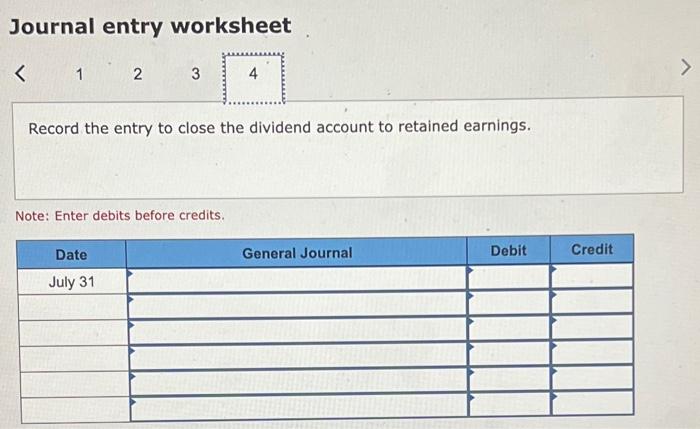

Trans Union Corporation issued 5,300 shares for $50 per share in the current year, and it issued 10,300 shares for $37 per share in the following year. The year after that, the company reacquired 20,300 shares of its own stock for $45 per share. Determine the impact (increase, decrease, or no change) of each of these transactions on the following classifications: Sold 5,300 shares Sold 10,300 shares Purchased 20,300 shares of treasury stock Total Assets Total Liabilities Total Stockholders' Equity Net income On May 20, the board of directors for Auction.com declared a cash dividend of 50 cents per share payable to stockholders of record on June 14. The dividends are paid on July 14. The company has 513,000 shares of stock outstanding. Closing entries are recorded on July 31. Prepare any necessary journal entries for each date. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts