Question: Some help on this question would be great! This is a multiple choice question. a.CADBE b.ADCEB Hint: you do not need to calculate duration in

Some help on this question would be great! This is a multiple choice question.

a.CADBE

b.ADCEB

Hint: you do not need to calculate duration in order to answer this question correctly. The general rule is that the later the investor gets paid, the more interest rate sensitive the bond will be. Other things equal, a bond with a longer maturity will be more sensitive to interest rate changes. Other things equal, a bond with a higher coupon rate will be less sensitive to interest rates changes.

c.BEDAC

d.EBDAC

e.DACBE

f.CDAEB

g.BEADC

h.CADEB

i.EBADC

j.CDABE

k.ADCBE

The answer is not "b".

Part 2.

B is correct. But cannot explain C.C is incorrect.

B is correct. But cannot explain C.C is incorrect.

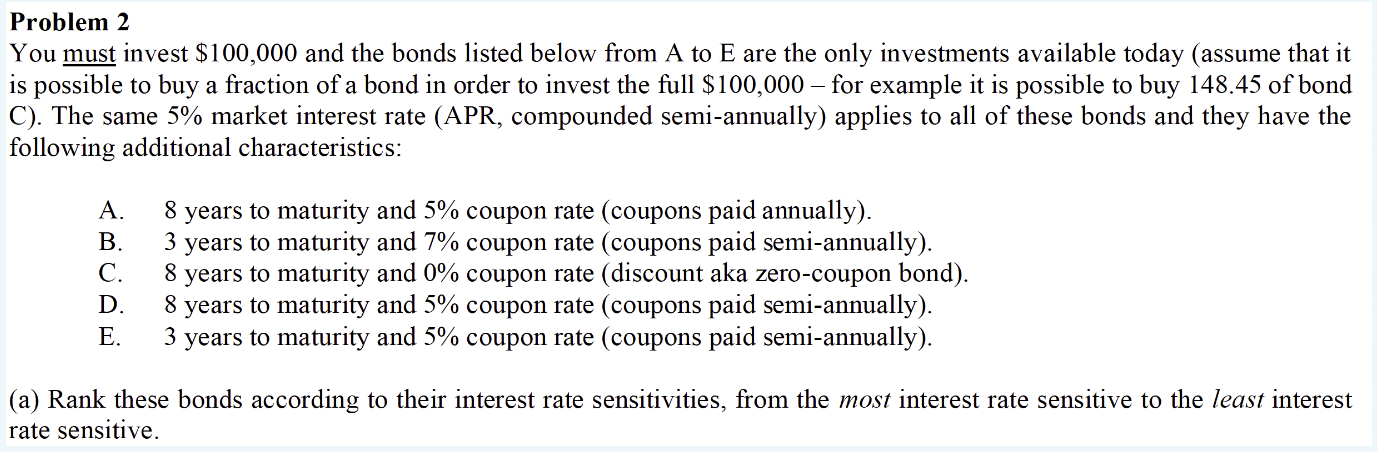

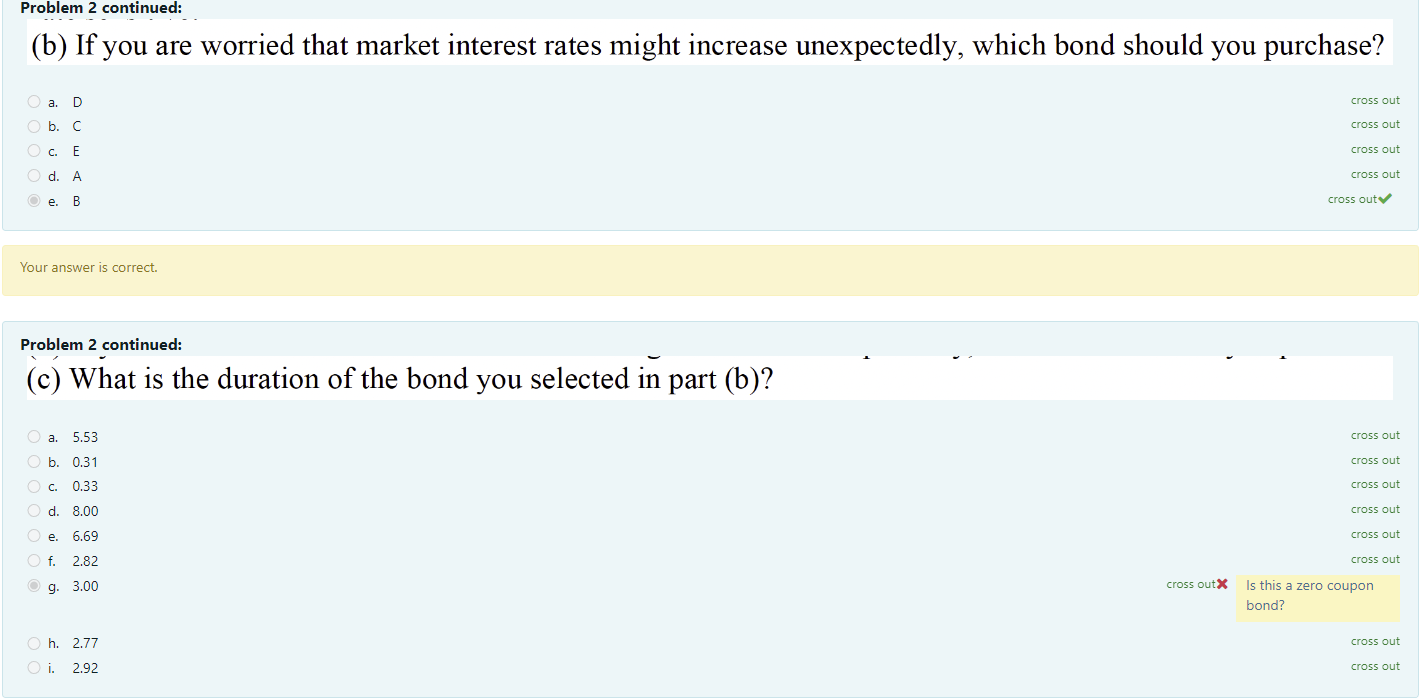

You must invest $100,000 and the bonds listed below from A to E are the only investments available today (assume that it is possible to buy a fraction of a bond in order to invest the full $100,000-for example it is possible to buy 148.45 of bond C). The same 5\% market interest rate (APR, compounded semi-annually) applies to all of these bonds and they have the following additional characteristics: A. 8 years to maturity and 5% coupon rate (coupons paid annually). B. 3 years to maturity and 7% coupon rate (coupons paid semi-annually). C. 8 years to maturity and 0% coupon rate (discount aka zero-coupon bond). D. 8 years to maturity and 5% coupon rate (coupons paid semi-annually). E. 3 years to maturity and 5% coupon rate (coupons paid semi-annually). (a) Rank these bonds according to their interest rate sensitivities, from the most interest rate sensitive to the least interest rate sensitive. (b) If you are worried that market interest rates might increase unexpectedly, which bond should you purchase? a.Db.Cc.Ed.Ae.B Your answer is correct. Problem 2 continued: (c) What is the duration of the bond you selected in part (b)? a.b.c.d.e.f.g.h.i.5.530.310.338.006.692.823.002.772.92

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts