Question: Some recent financial statements for Mathison, Inc., follow. MATHISON, INC. Balance Sheets as of December 31, 2020 and 2021 2020 2021 2020 2021 Assets Liabilities

| Some recent financial statements for Mathison, Inc., follow. |

| MATHISON, INC. Balance Sheets as of December 31, 2020 and 2021 | ||||||||||

| 2020 | 2021 | 2020 | 2021 | |||||||

| Assets | Liabilities and Owners Equity | |||||||||

| Current assets | Current liabilities | |||||||||

| Cash | $ | 5,298 | $ | 5,827 | Accounts payable | $ | 3,754 | $ | 5,986 | |

| Accounts receivable | 7,707 | 9,477 | Notes payable | 2,045 | 3,055 | |||||

| Inventory | 12,150 | 22,956 | Other | 152 | 179 | |||||

| Total | $ | 25,155 | $ | 38,260 | Total | $ | 5,951 | $ | 9,220 | |

| Long-term debt | $ | 22,700 | $ | 19,000 | ||||||

| Owners equity | ||||||||||

| Common stock | ||||||||||

| and paid-in surplus | $ | 43,000 | $ | 43,000 | ||||||

| Fixed assets | Accumulated retained earnings | 28,805 | 47,189 | |||||||

| Net plant and equipment | $ | 75,301 | $ | 80,149 | Total | $ | 71,805 | $ | 90,189 | |

| Total assets | $ | 100,456 | $ | 118,409 | Total liabilities and owners equity | $ | 100,456 | $ | 118,409 | |

| MATHISON, INC. 2021 Income Statement | ||||

| Sales | $ | 249,854 | ||

| Cost of goods sold | 204,317 | |||

| Depreciation | 8,730 | |||

| EBIT | $ | 36,807 | ||

| Interest paid | 2,811 | |||

| Taxable income | $ | 33,996 | ||

| Taxes | 7,139 | |||

| Net income | $ | 26,857 | ||

| Dividends | $ | 8,473 | ||

| Retained earnings | 18,384 | |||

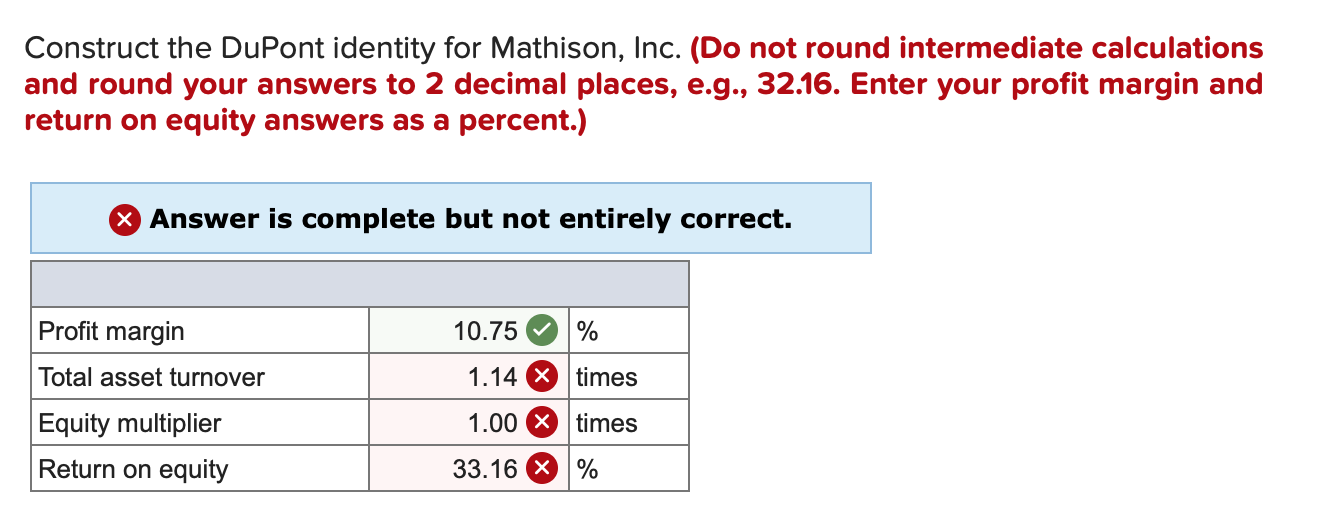

| Construct the DuPont identity for Mathison, Inc. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter your profit margin and return on equity answers as a percent.) |

Construct the DuPont identity for Mathison, Inc. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter your profit margin and return on equity answers as a percent.) X Answer is complete but not entirely correct. Profit margin Total asset turnover Equity multiplier Return on equity % times times 10.75 1.14 1.00 33.16 X %

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock