Question: someone help me please 217 CHAPTER 6 Capital Budgeting: Valuing Business Cash Flows 14. (C 14. (Cash-flow analysis) The ZZZ Company is considering investing in

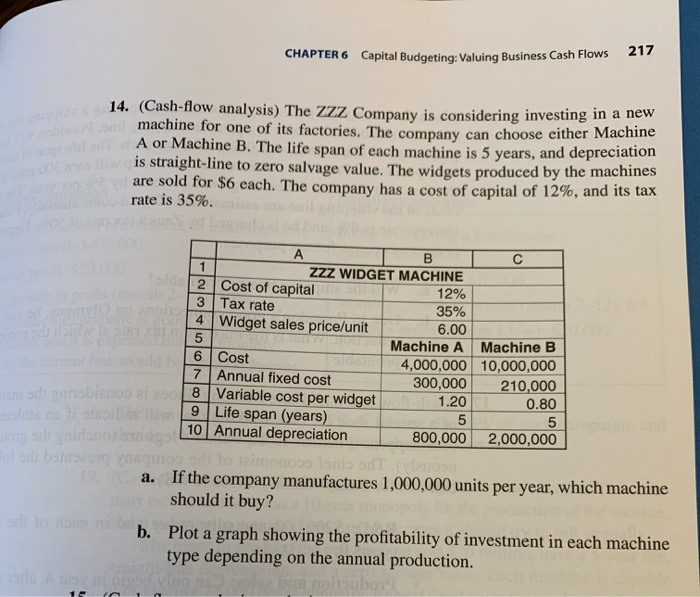

217 CHAPTER 6 Capital Budgeting: Valuing Business Cash Flows 14. (C 14. (Cash-flow analysis) The ZZZ Company is considering investing in a new machine for one of its factories. The company can choose either Machine A or Machine B. The life span of each machine is 5 years, and depreciation is straight-line to zero salvage value. The widgets produced by the macmes are sold for $6 each. The company has a cost of capital of 12%, and its tax rate is 35%. are sold B A ZZZ WIDGET MACHINE 2 Cost of capital 12% 3 Tax rate 35% 4 Widget sales price/unit 6.00 Machine A Machine B 6 Cost 4,000,000 10,000,000 7 Annual fixed cost 300,000 210,000 8 Variable cost per widget 1.20 0.80 9 Life span (years) 10 Annual depreciation 800,000 2,000,000 5 DIOD a. If the company manufactures 1,000,000 units per year, which machine should it buy? b. Plot a graph showing the profitability of investment in each machine type depending on the annual production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts