Question: Someone help please. 29. You find a bond with 19 years until maturity that has a coupon rate of 8 percent and a yield to

Someone help please.

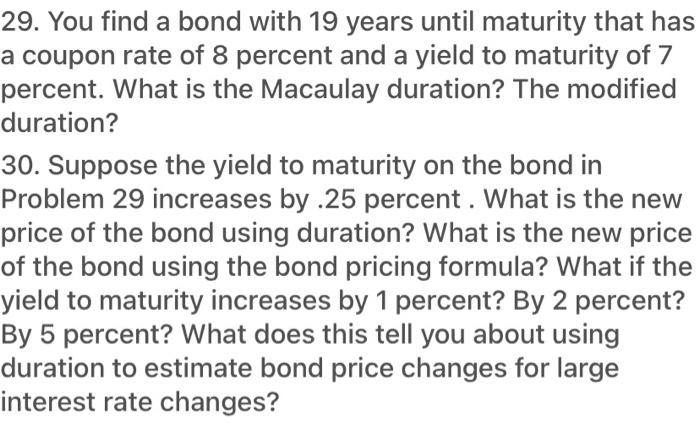

29. You find a bond with 19 years until maturity that has a coupon rate of 8 percent and a yield to maturity of 7 percent. What is the Macaulay duration? The modified duration? 30. Suppose the yield to maturity on the bond in Problem 29 increases by .25 percent. What is the new price of the bond using duration? What is the new price of the bond using the bond pricing formula? What if the yield to maturity increases by 1 percent? By 2 percent? By 5 percent? What does this tell you about using duration to estimate bond price changes for large interest rate changes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock