Question: someone is looking at a project that require 80,000 in fixed asset and 20,000 in net working capital. the project is expected to produce annual

someone is looking at a project that require 80,000 in fixed asset and 20,000 in net working capital. the project is expected to produce annual sales and associated costs of 110,000 and 70,000 respectively. it has a 4 year life. the company used straight line depreciation to zero book valur over the life of yhe project. tax rate is 35^. what id the annual operating cash flow?

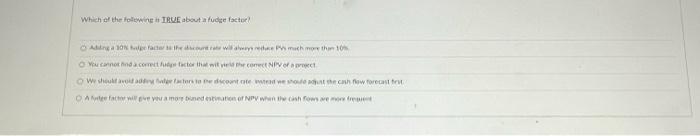

Which it the Boltwire it IRUE about a fuctse factoe

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock