Question: someone please answer part a b and d 7. a) Draw a diagram showing the security market line and use it to help explain the

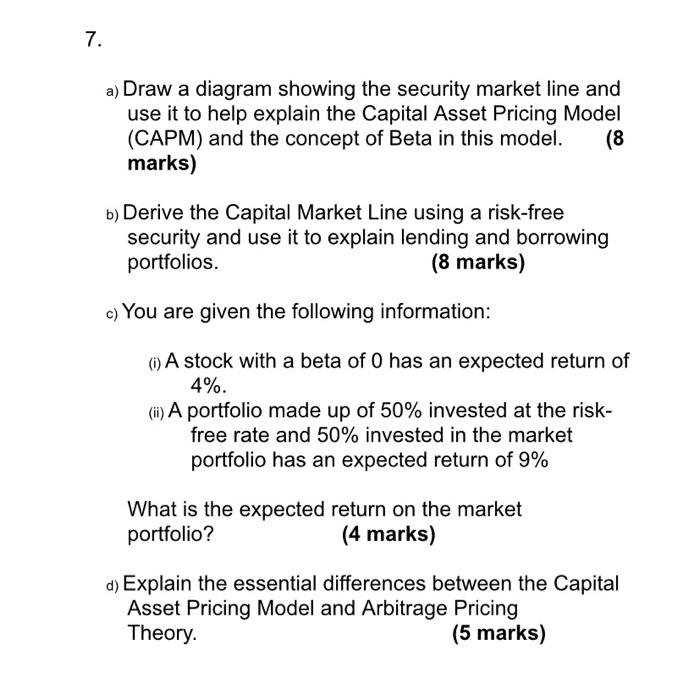

7. a) Draw a diagram showing the security market line and use it to help explain the Capital Asset Pricing Model (CAPM) and the concept of Beta in this model. (8 marks) b) Derive the Capital Market Line using a risk-free security and use it to explain lending and borrowing portfolios. (8 marks) c) You are given the following information: ( A stock with a beta of 0 has an expected return of 4%. (ii) A portfolio made up of 50% invested at the risk- free rate and 50% invested in the market portfolio has an expected return of 9% What is the expected return on the market portfolio? (4 marks) d) Explain the essential differences between the Capital Asset Pricing Model and Arbitrage Pricing Theory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts