Question: someone please explain the solutions NPV& IRR Practice Problems 1. An entrepreneur is offered a service contract that will cost him $600,000 initially. The contract

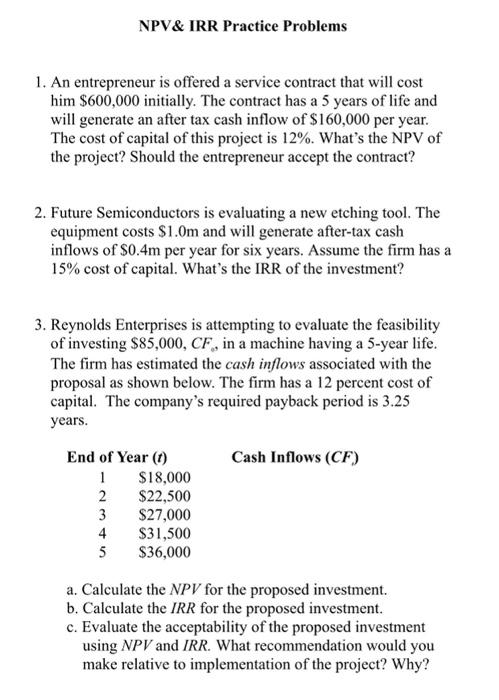

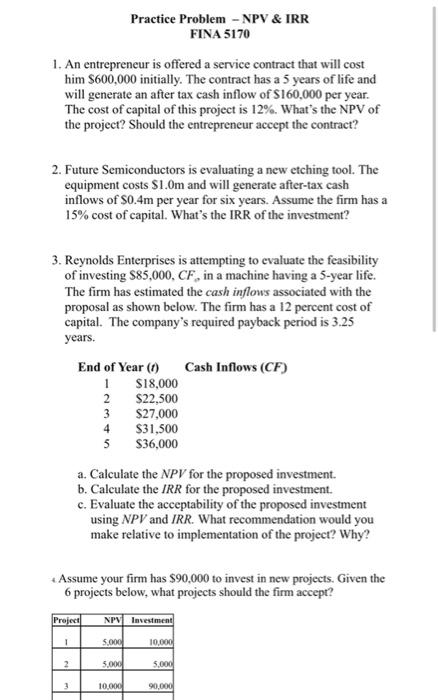

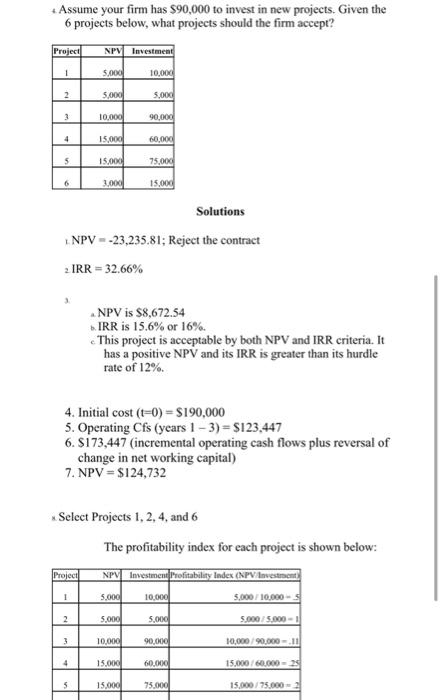

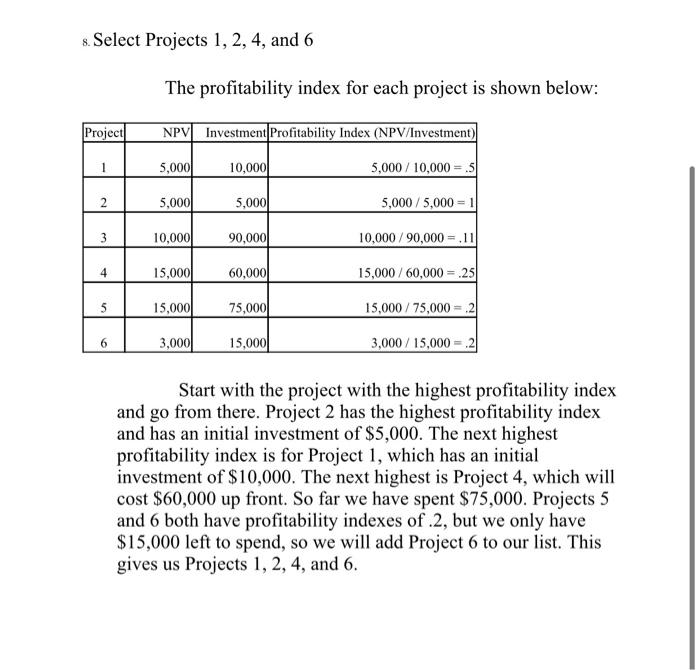

NPV& IRR Practice Problems 1. An entrepreneur is offered a service contract that will cost him $600,000 initially. The contract has a 5 years of life and will generate an after tax cash inflow of $160,000 per year. The cost of capital of this project is 12%. What's the NPV of the project? Should the entrepreneur accept the contract? 2. Future Semiconductors is evaluating a new etching tool. The equipment costs $1.0m and will generate after-tax cash inflows of $0.4m per year for six years. Assume the firm has a 15% cost of capital. What's the IRR of the investment? 3. Reynolds Enterprises is attempting to evaluate the feasibility of investing $85,000, CF, in a machine having a 5-year life. The firm has estimated the cash inflows associated with the proposal as shown below. The firm has a 12 percent cost of capital. The company's required payback period is 3.25 years. End of Year (1) Cash Inflows (CF) 1 $18,000 2 $22,500 3 $27,000 4 $31,500 5 $36,000 a. Calculate the NPV for the proposed investment. b. Calculate the IRR for the proposed investment. c. Evaluate the acceptability of the proposed investment using NPV and IRR. What recommendation would you make relative to implementation of the project? Why? Practice Problem - NPV & IRR FINA 5170 1. An entrepreneur is offered a service contract that will cost him S600,000 initially. The contract has a 5 years of life and will generate an after tax cash inflow of S160,000 per year. The cost of capital of this project is 12%. What's the NPV of the project? Should the entrepreneur accept the contract? 2. Future Semiconductors is evaluating a new etching tool. The equipment costs $1.Om and will generate after-tax cash inflows of S0.4m per year for six years. Assume the firm has a 15% cost of capital. What's the IRR of the investment? 3. Reynolds Enterprises is attempting to evaluate the feasibility of investing S85,000, CF, in a machine having a 5-year life. The firm has estimated the cash inflows associated with the proposal as shown below. The firm has a 12 percent cost of capital. The company's required payback period is 3.25 years. End of Year (0 Cash Inflows (CF) 1 $18,000 2 $22,500 3 $27,000 4 $31,500 5 $36,000 a. Calculate the NPV for the proposed investment. b. Calculate the IRR for the proposed investment. c. Evaluate the acceptability of the proposed investment using NPV and IRR. What recommendation would you make relative to implementation of the project? Why? Assume your firm has $90,000 to invest in new projects. Given the 6 projects below, what projects should the firm accept? Project NPV Investment 1 5.000 10,000 2 5.000 5.000 3 10.000 90.000 + Assume your firm has $90,000 to invest in new projects. Given the 6 projects below, what projects should the firm accept? Project NPV Investment 1 5.000 10,000 2 5.000 5,000 3 10,000 90,000 4 15,000 60,000 5 15.000 75,000 6 3.000 15,000 Solutions NPV -23.235.81; Reject the contract 2 IRR = 32.66% NPV is $8,672.54 IRR is 15.6% or 16% This project is acceptable by both NPV and IRR criteria. It has a positive NPV and its IRR is greater than its hurdle rate of 12%. 4. Initial cost (t=0) = $190,000 5. Operating Cfs (years 1 - 3) = $123,447 6. S173,447 (incremental operating cash flows plus reversal of change in net working capital) 7. NPV = $124,732 Select Projects 1, 2, 4, and 6 The profitability index for each project is shown below: NPV Investment profitability Index (NPV Investment 5.000 10.000 - 5 Project 1 5.000 10.000 2 5.000 5.000 5.000 5.000-11 3 10,000 90.000 10,000/ 90.000 - 11 4 15.00 60.000 15.000 60.000 5 15.000 75.000 15,000/75.000 $. Select Projects 1, 2, 4, and 6 The profitability index for each project is shown below: Project NPV Investment Profitability Index (NPV/Investment) 1 5,000 10,000 5,000 / 10,000 = 5 2 5,000 5,000 5,000 / 5,000 = 1 10,000 90,000 10,000/90,000 = 11 4 15,000 60,000 15,000 / 60,000 = 25 5 15,0001 75,0001 15,000 / 75,000 = -2 6 3,000 15,000 3,000 / 15,000 - 2 Start with the project with the highest profitability index and go from there. Project 2 has the highest profitability index and has an initial investment of $5,000. The next highest profitability index is for Project 1, which has an initial investment of $10,000. The next highest is Project 4, which will cost $60,000 up front. So far we have spent $75,000. Projects 5 and 6 both have profitability indexes of.2, but we only have $15,000 left to spend, so we will add Project 6 to our list. This gives us Projects 1, 2, 4, and 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts