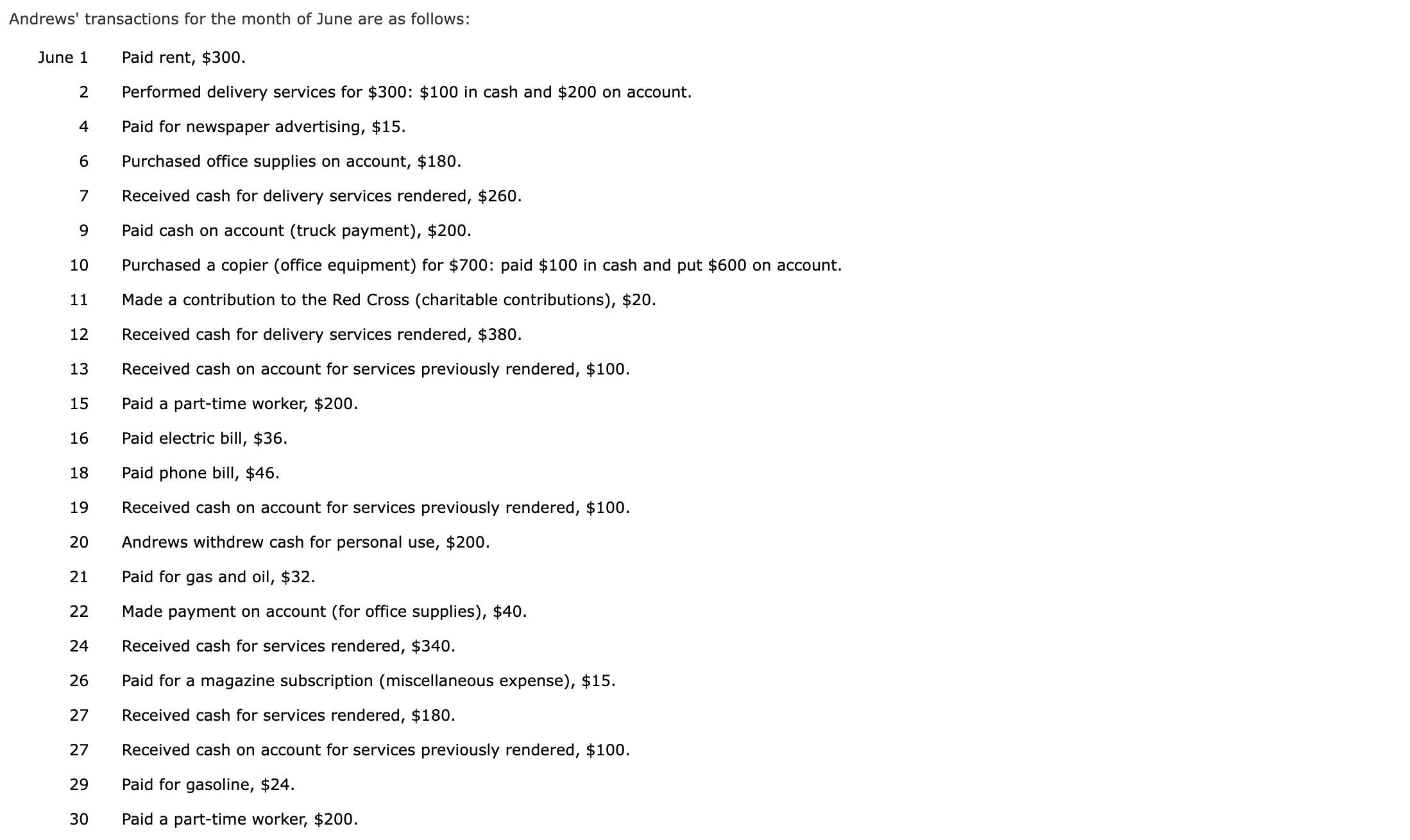

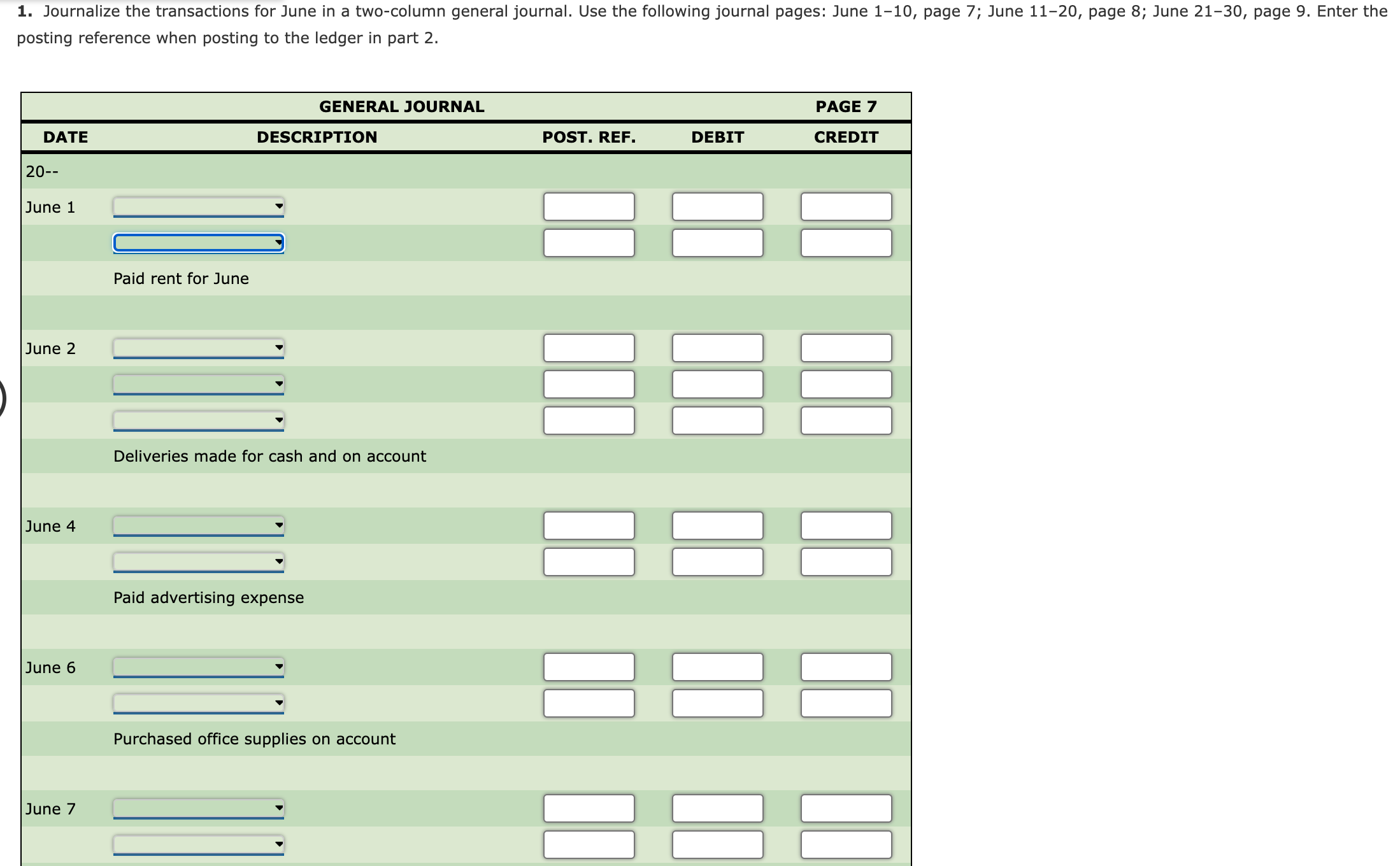

Question: Someone please help me answer this questions. 1. Journalize the transactions for June in a two-column general journal. Use the following journal pages: June 110,

![Expense } & \multirow[b]{3}{*}{ CREDIT } & ACCOUNT NO. & 534 \\](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e5270618d59_76566e5270581c6e.jpg)

Someone please help me answer this questions.

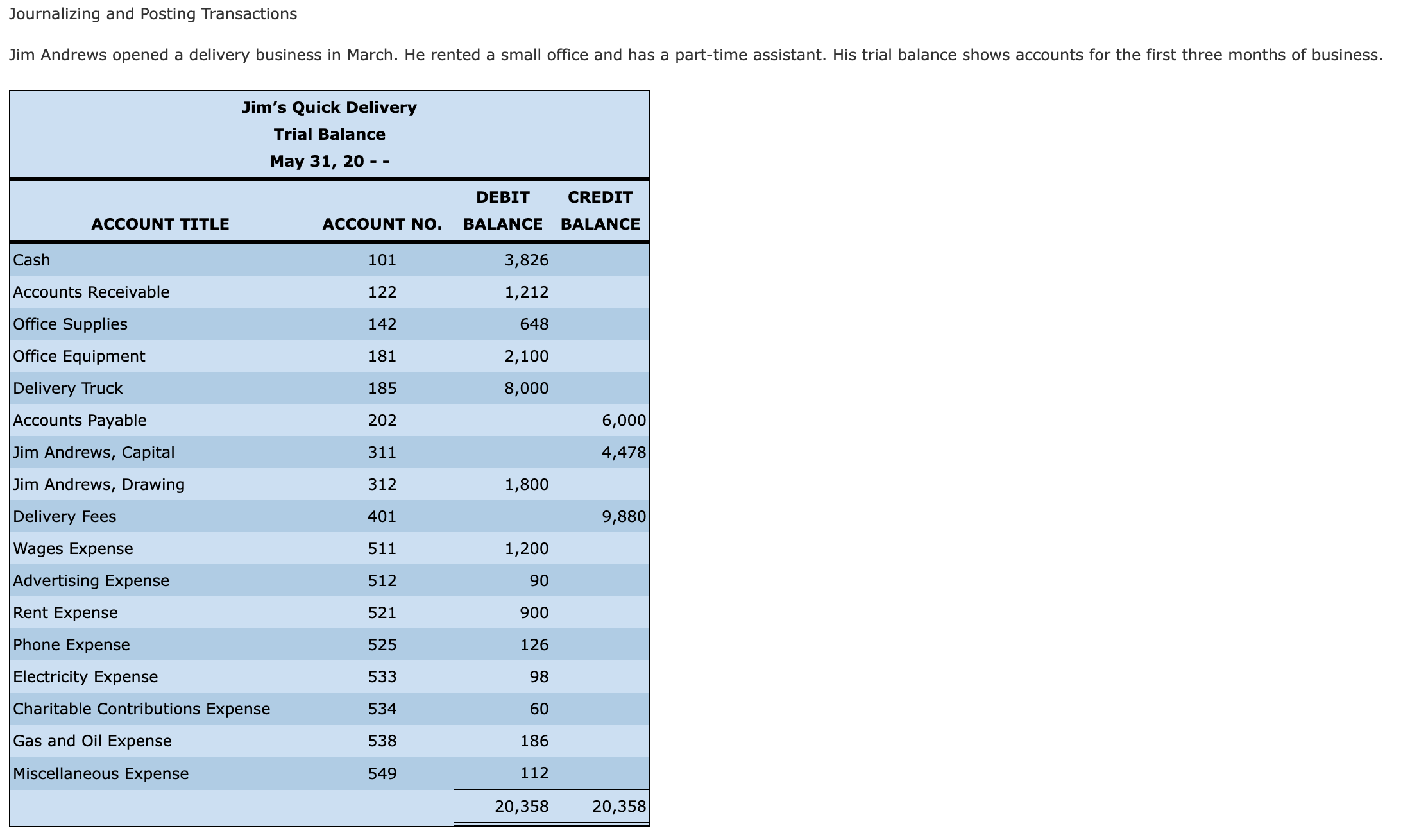

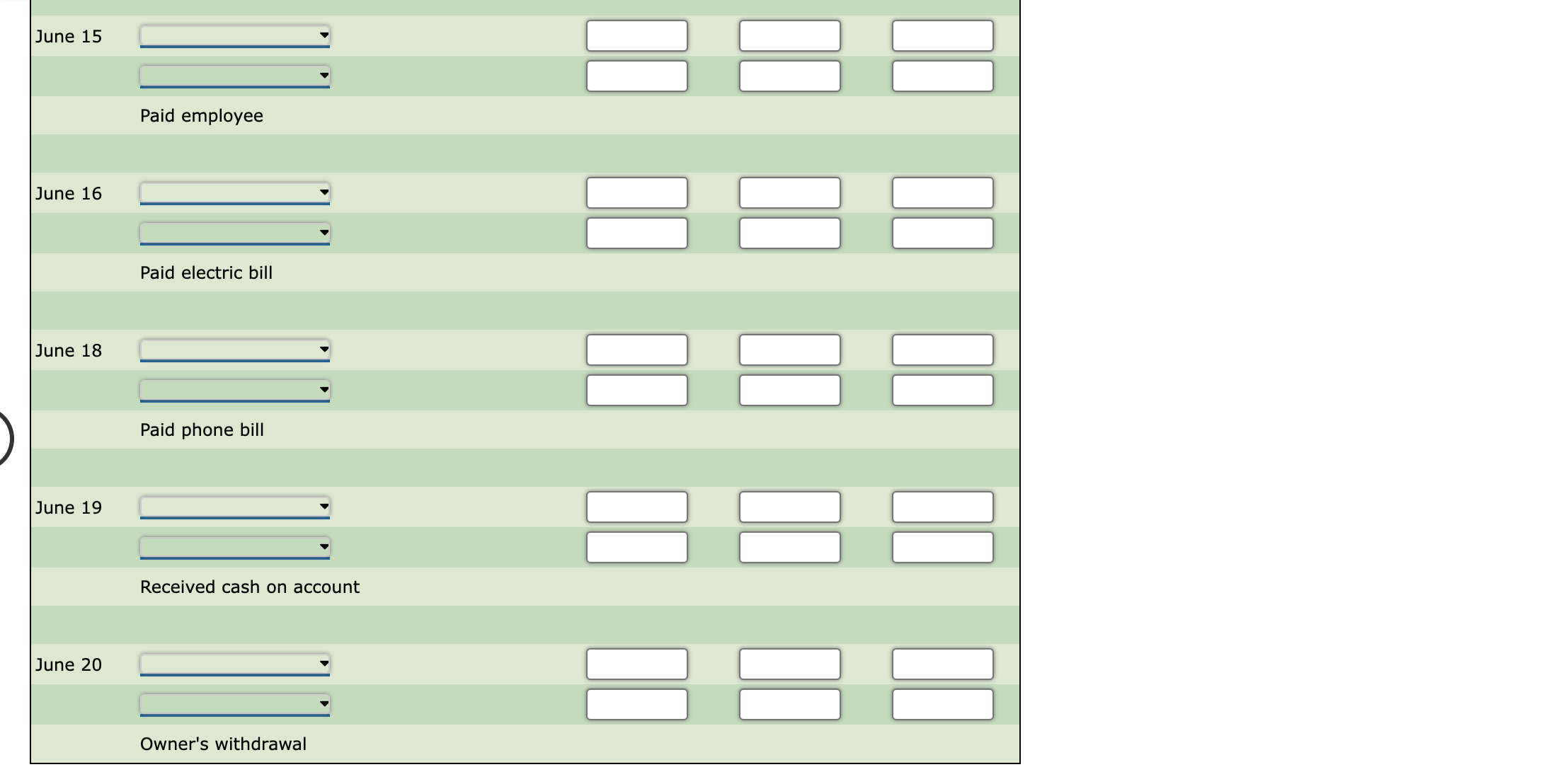

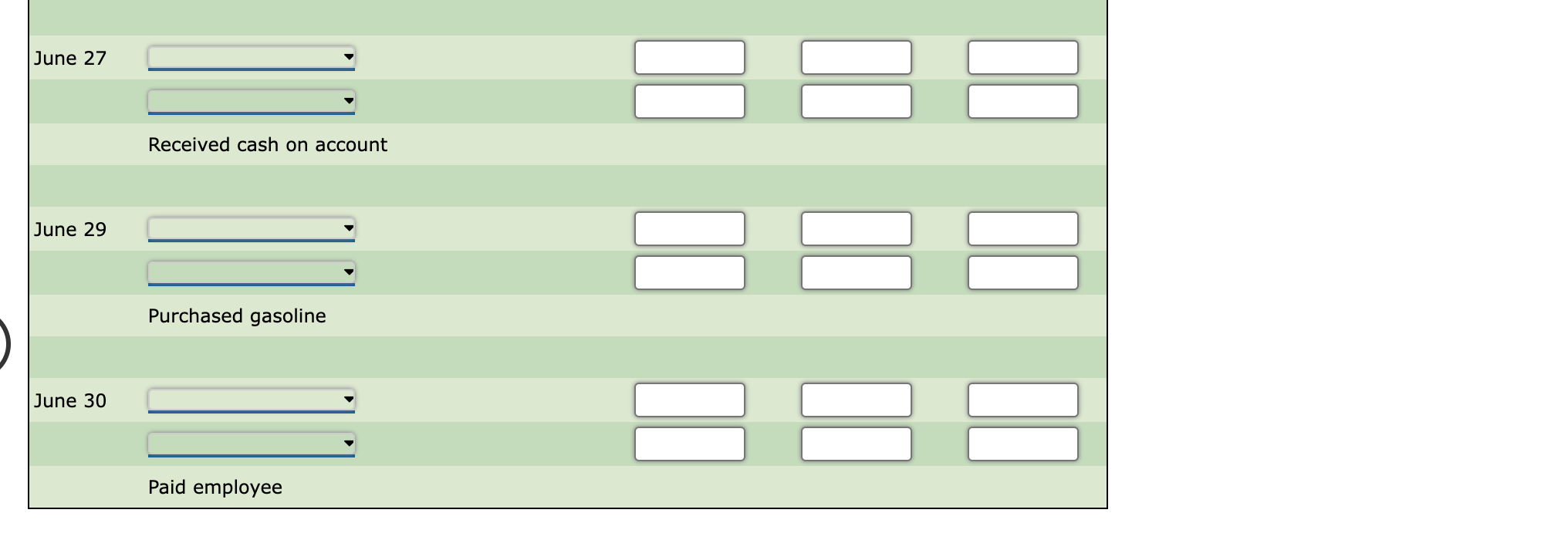

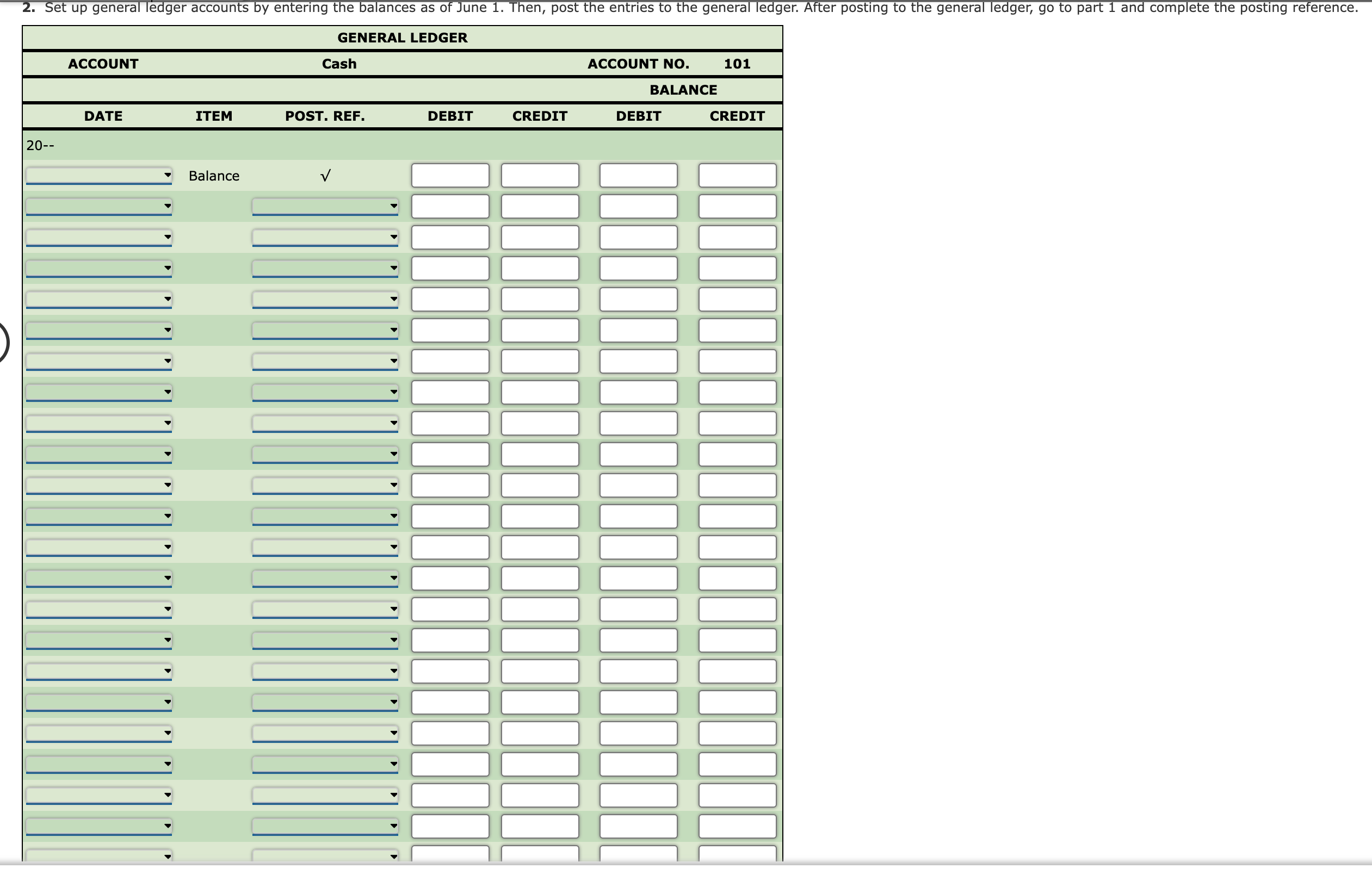

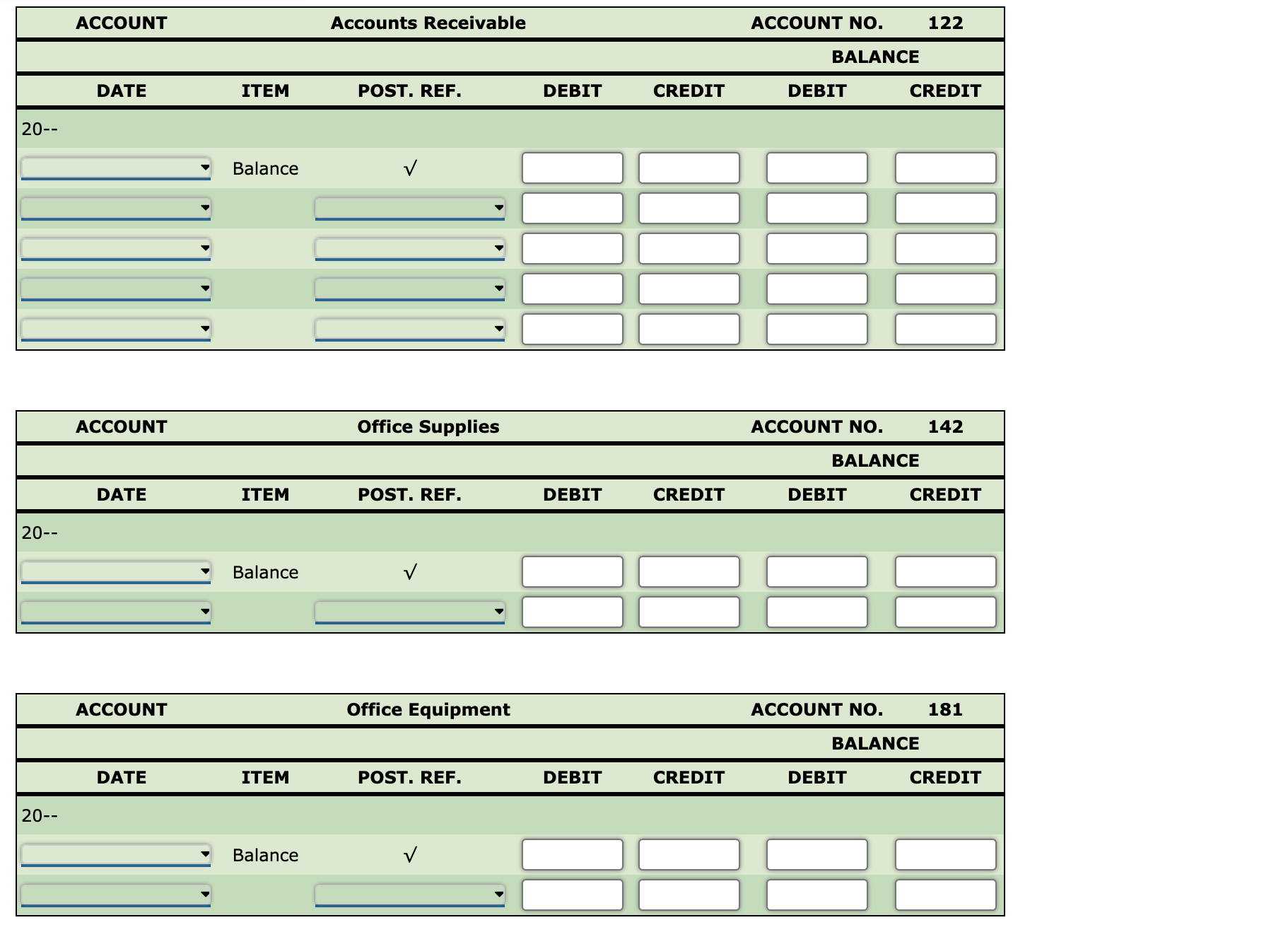

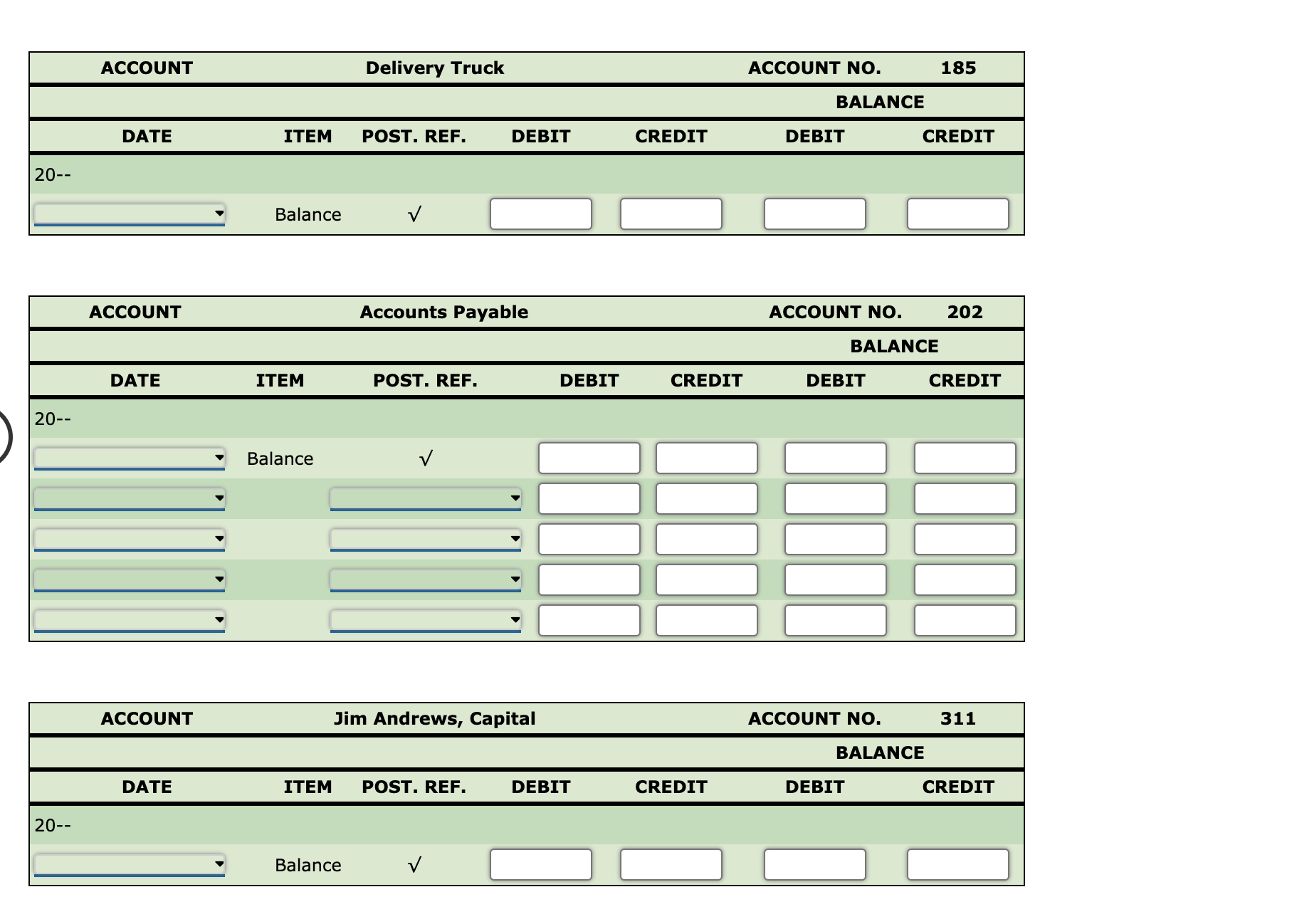

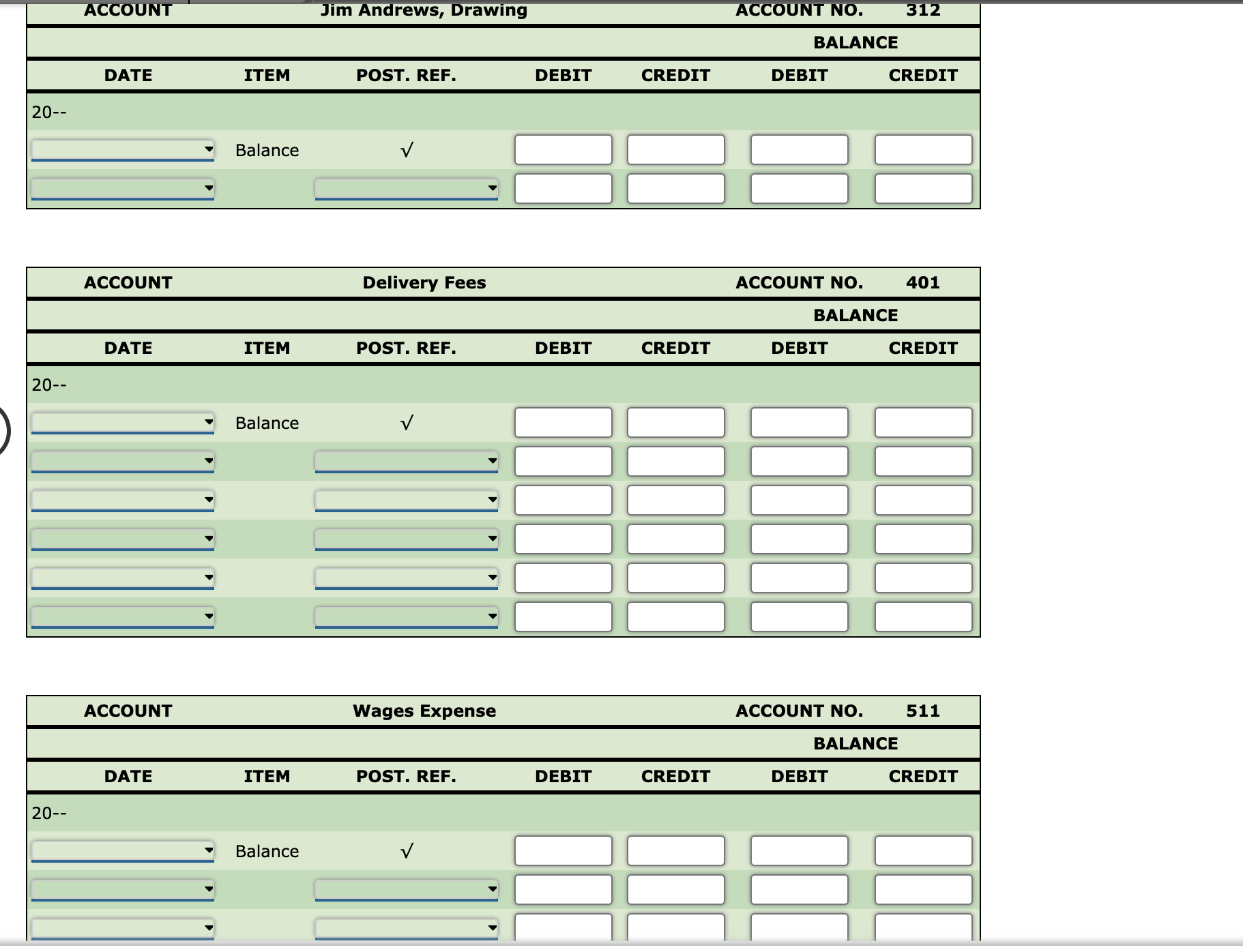

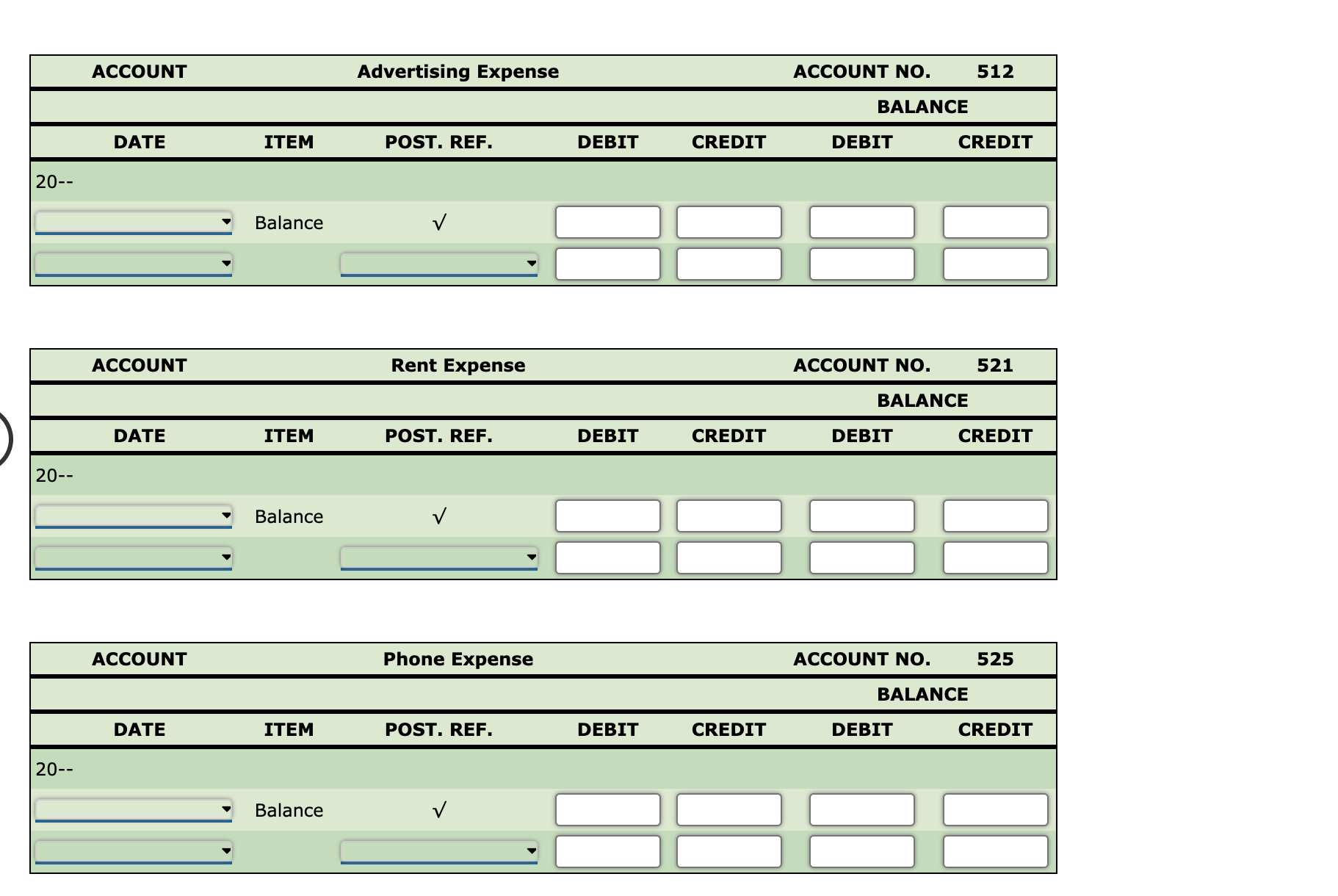

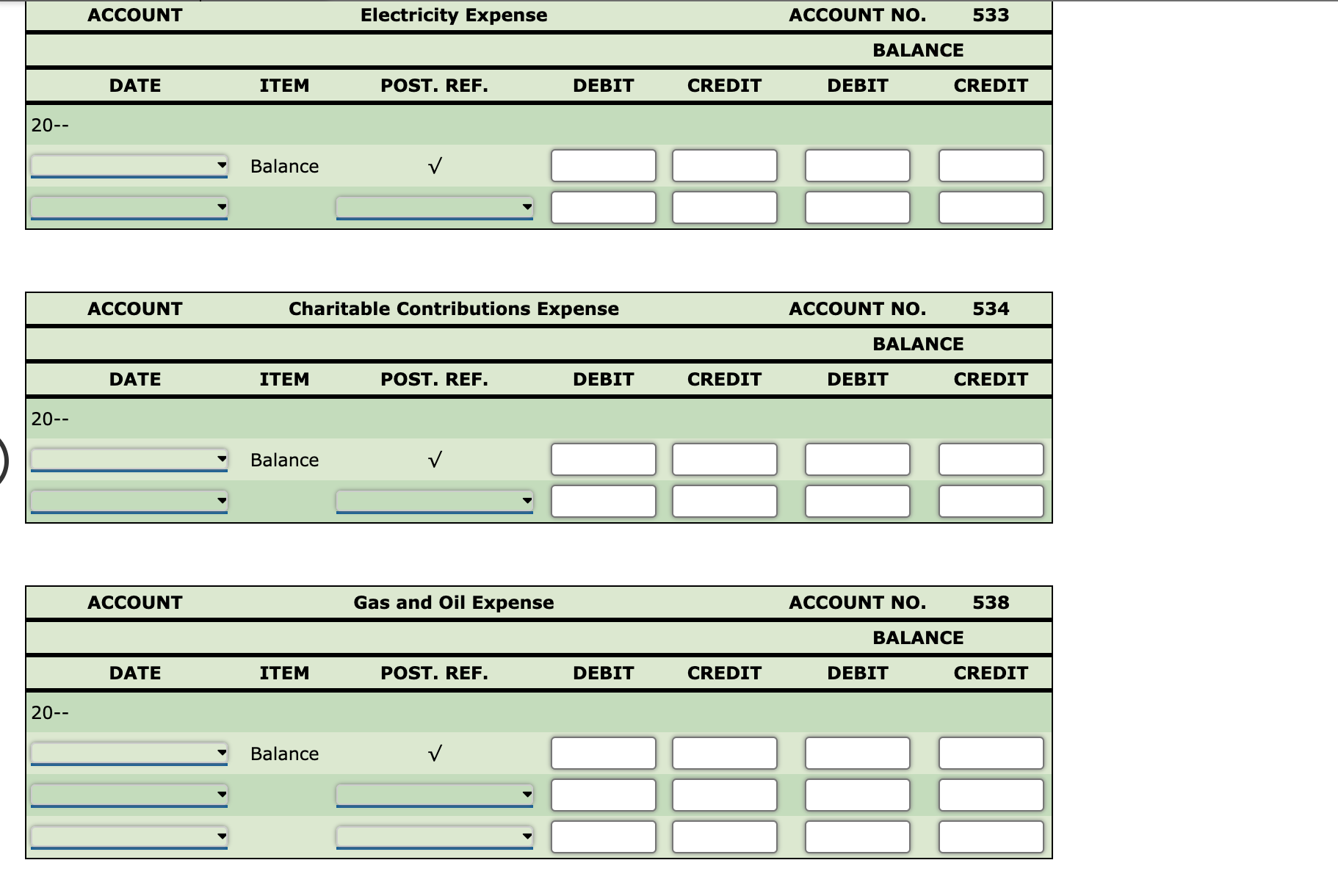

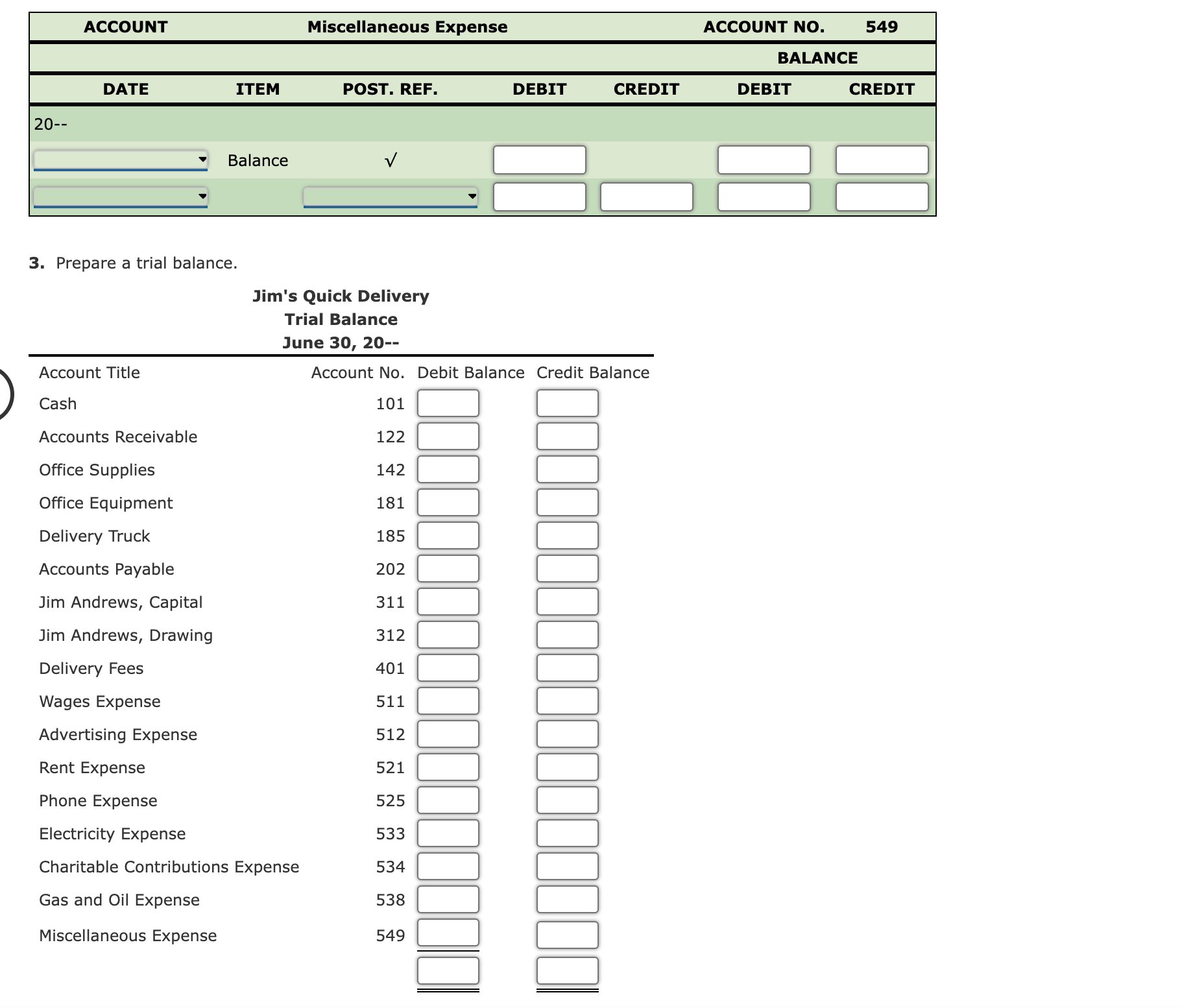

1. Journalize the transactions for June in a two-column general journal. Use the following journal pages: June 110, page 7 ; June 1120, page 8 ; June 2130, page 9 . Enter the posting reference when posting to the ledger in part 2 . \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline ACCOUNT & & \multicolumn{3}{|c|}{ Charitable Contributions Expense } & \multirow[b]{3}{*}{ CREDIT } & ACCOUNT NO. & 534 \\ \hline & & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline \multicolumn{2}{|l|}{ DATE } & ITEM & POST. REF. & DEBIT & & DEBIT & CREDIT \\ \hline \multicolumn{8}{|l|}{20} \\ \hline & = & Balance & & & & & \\ \hline & = & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Gas and Oil Expens & & & ACCOUNT NO. & 538 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline= & Balance & & & & & \\ \hline= & & = & & & & \\ \hline= & & = & & & & \\ \hline \end{tabular} June 27 Received cash on account June 29 Purchased gasoline June 30 Paid employee \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Office Supp & & & ACCOUNT NO. & 142 \\ \hline & & \multirow[b]{2}{*}{ POST. REF. } & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & & & & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline & Balance & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Office Equipn & & & ACCOUNT NO. & 181 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline & Balance & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Delivery Trt & & & ACCOUNT NO. & 185 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline & Balance & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & m Andrews, & ital & & ACCOUNT NO. & 311 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline= & Balance & & & & & \\ \hline \end{tabular} Andrews' transactions for the month of June are as follows: June 1 Paid rent, $300. 2 Performed delivery services for $300 : $100 in cash and $200 on account. 4 Paid for newspaper advertising, $15. 6 Purchased office supplies on account, $180. 7 Received cash for delivery services rendered, $260. 9 Paid cash on account (truck payment), $200. 10 Purchased a copier (office equipment) for $700 : paid $100 in cash and put $600 on account. 11 Made a contribution to the Red Cross (charitable contributions), \$20. 12 Received cash for delivery services rendered, $380. 13 Received cash on account for services previously rendered, $100. 15 Paid a part-time worker, $200. 16 Paid electric bill, $36. 18 Paid phone bill, $46. 19 Received cash on account for services previously rendered, $100. 20 Andrews withdrew cash for personal use, $200. 21 Paid for gas and oil, $32. 22 Made payment on account (for office supplies), $40. 24 Received cash for services rendered, $340. 26 Paid for a magazine subscription (miscellaneous expense), \$15. 27 Received cash for services rendered, $180. 27 Received cash on account for services previously rendered, $100. 29 Paid for gasoline, $24. 30 Paid a part-time worker, $200. \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Rent Exper & & & ACCOUNT NO. & 521 \\ \hline & & \multirow[b]{2}{*}{ POST. REF. } & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & & & & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline & Balance & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Phone Expe & & & ACCOUNT NO. & 525 \\ \hline & & \multirow[b]{2}{*}{ POST. REF. } & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & & & & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline & Balance & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} 3. Prepare a trial balance. June 9 Made partial payment on truck June 10 Purchased copier Journalizing and Posting Transactions Jim Andrews opened a delivery business in March. He rented a small office and has a part-time assistant. His trial balance shows accounts for the first three months of business. June 15 Paid employee June 16 Paid electric bill June 18 Paid phone bill June 19 Received cash on account June 20 Owner's withdrawal 1. Journalize the transactions for June in a two-column general journal. Use the following journal pages: June 110, page 7 ; June 1120, page 8 ; June 2130, page 9 . Enter the posting reference when posting to the ledger in part 2 . \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline ACCOUNT & & \multicolumn{3}{|c|}{ Charitable Contributions Expense } & \multirow[b]{3}{*}{ CREDIT } & ACCOUNT NO. & 534 \\ \hline & & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline \multicolumn{2}{|l|}{ DATE } & ITEM & POST. REF. & DEBIT & & DEBIT & CREDIT \\ \hline \multicolumn{8}{|l|}{20} \\ \hline & = & Balance & & & & & \\ \hline & = & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Gas and Oil Expens & & & ACCOUNT NO. & 538 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline= & Balance & & & & & \\ \hline= & & = & & & & \\ \hline= & & = & & & & \\ \hline \end{tabular} June 27 Received cash on account June 29 Purchased gasoline June 30 Paid employee \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Office Supp & & & ACCOUNT NO. & 142 \\ \hline & & \multirow[b]{2}{*}{ POST. REF. } & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & & & & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline & Balance & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Office Equipn & & & ACCOUNT NO. & 181 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline & Balance & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Delivery Trt & & & ACCOUNT NO. & 185 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline & Balance & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & m Andrews, & ital & & ACCOUNT NO. & 311 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline= & Balance & & & & & \\ \hline \end{tabular} Andrews' transactions for the month of June are as follows: June 1 Paid rent, $300. 2 Performed delivery services for $300 : $100 in cash and $200 on account. 4 Paid for newspaper advertising, $15. 6 Purchased office supplies on account, $180. 7 Received cash for delivery services rendered, $260. 9 Paid cash on account (truck payment), $200. 10 Purchased a copier (office equipment) for $700 : paid $100 in cash and put $600 on account. 11 Made a contribution to the Red Cross (charitable contributions), \$20. 12 Received cash for delivery services rendered, $380. 13 Received cash on account for services previously rendered, $100. 15 Paid a part-time worker, $200. 16 Paid electric bill, $36. 18 Paid phone bill, $46. 19 Received cash on account for services previously rendered, $100. 20 Andrews withdrew cash for personal use, $200. 21 Paid for gas and oil, $32. 22 Made payment on account (for office supplies), $40. 24 Received cash for services rendered, $340. 26 Paid for a magazine subscription (miscellaneous expense), \$15. 27 Received cash for services rendered, $180. 27 Received cash on account for services previously rendered, $100. 29 Paid for gasoline, $24. 30 Paid a part-time worker, $200. \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Rent Exper & & & ACCOUNT NO. & 521 \\ \hline & & \multirow[b]{2}{*}{ POST. REF. } & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & & & & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline & Balance & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Phone Expe & & & ACCOUNT NO. & 525 \\ \hline & & \multirow[b]{2}{*}{ POST. REF. } & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & & & & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{ 20-- } \\ \hline & Balance & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} 3. Prepare a trial balance. June 9 Made partial payment on truck June 10 Purchased copier Journalizing and Posting Transactions Jim Andrews opened a delivery business in March. He rented a small office and has a part-time assistant. His trial balance shows accounts for the first three months of business. June 15 Paid employee June 16 Paid electric bill June 18 Paid phone bill June 19 Received cash on account June 20 Owner's withdrawal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts