Question: someone please help me out i will really apperacite it and please answer the whole question i really request you The partnership of Seymour, Packard,

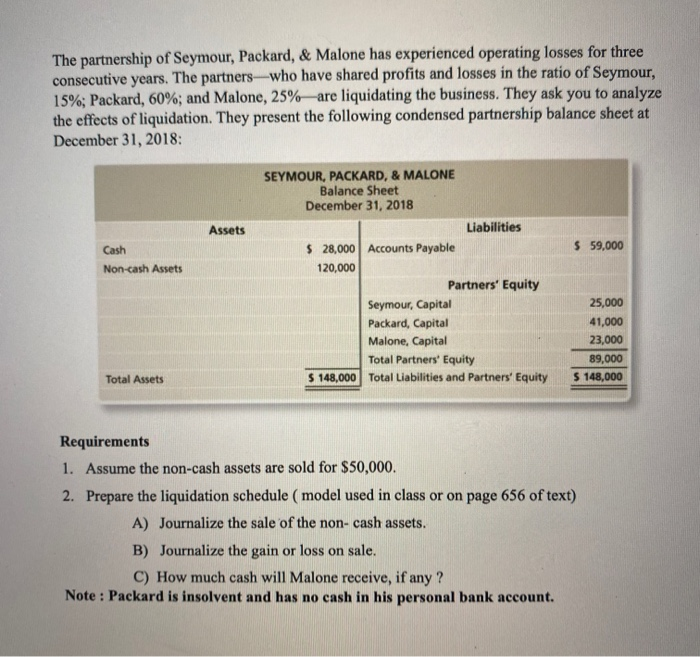

The partnership of Seymour, Packard, & Malone has experienced operating losses for three consecutive years. The partners who have shared profits and losses in the ratio of Seymour, 15%; Packard, 60%; and Malone, 25% are liquidating the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sheet at December 31, 2018: Assets $ 59,000 Cash Non-cash Assets SEYMOUR, PACKARD, & MALONE Balance Sheet December 31, 2018 Liabilities $ 28,000 Accounts Payable 120,000 Partners' Equity Seymour, Capital Packard, Capital Malone, Capital Total Partners' Equity S 148,000 Total Liabilities and Partners' Equity 25,000 41,000 23,000 89,000 $ 148,000 Total Assets Requirements 1. Assume the non-cash assets are sold for $50,000. 2. Prepare the liquidation schedule (model used in class or on page 656 of text) A) Journalize the sale of the non-cash assets. B) Journalize the gain or loss on sale. C) How much cash will Malone receive, if any? Note : Packard is insolvent and has no cash in his personal bank account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts