Question: someone pls help asap thank u Dextra Computing sells merchandise for $7,000 cash on September 30( cost of merchandise is 54,900). Dextra collects 5% sales

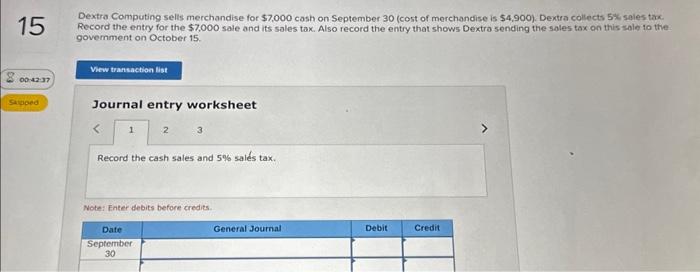

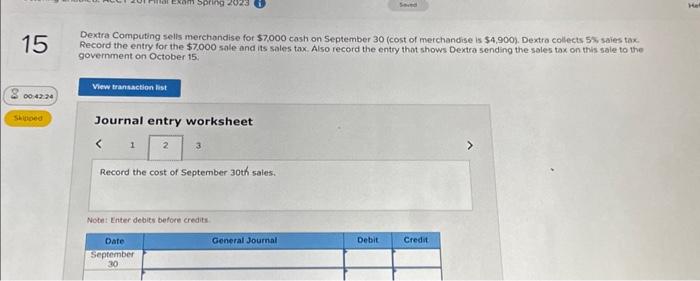

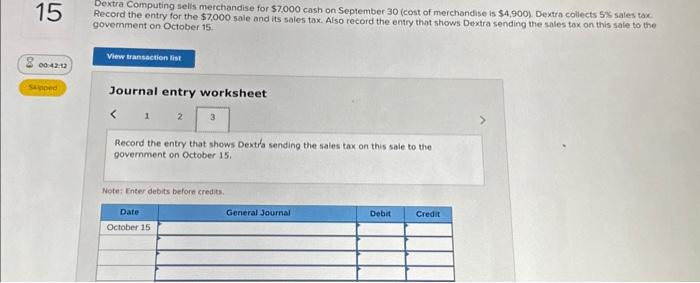

Dextra Computing sells merchandise for $7,000 cash on September 30( cost of merchandise is 54,900). Dextra collects 5% sales tax . Record the entry for the $7,000 sale and its sales tax. Also record the entry that shows Dextro sending the sales tox on this sole to the govemment on October 15 . Dextra Computing sells merchandise for $7,000 cash on 5 eptember 30(cost of merchandise is $4,900). Dextro collects 5% saies tax Record the entry for the $7,000 sale and its sales tax. Also record the entry that shows Dextra sending the sales tax on this sale to the government on October 15 . Journal entry worksheet Mofil: Lrmer deaue berote erenilil Rectra Computing selis merchandise for $7,000 cash on September 30 (cost of merchandise is $4,900) Dextro coliects 5% sales tak Record the entry for the $7,000 sale and its sales tax. Also record the entry that shows Dextra sending the sales tox on this sale to the goverment on October 15 . Journal entry worksheet Record the entry that shows Dextra sending the sales tax on this sale to the government on October 15 . Note: Eineer debits before credts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts