Question: Something is wrong, but im not sure what it could be. All of the transactions of Harding Trading Co. for the year have been journalized

Something is wrong, but im not sure what it could be.

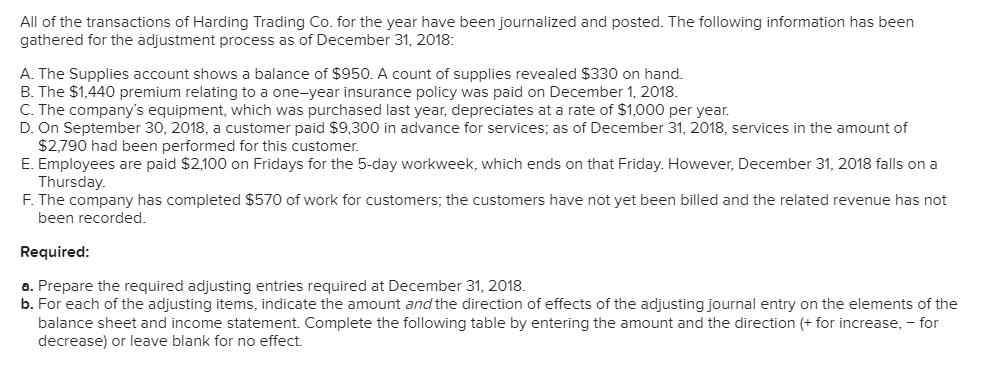

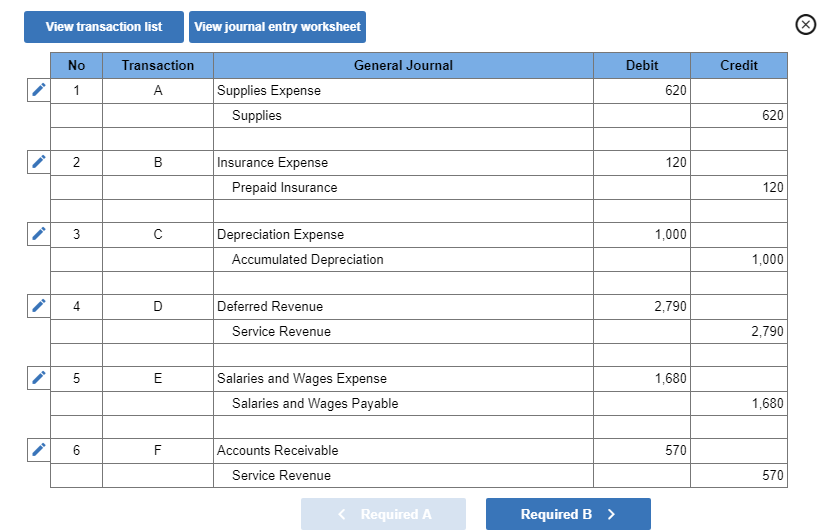

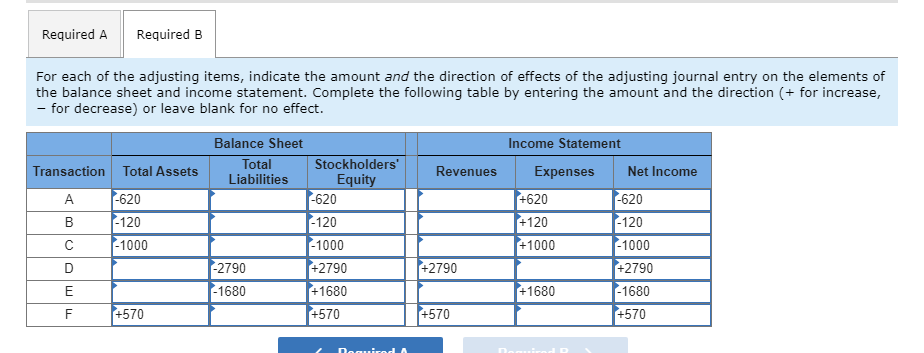

All of the transactions of Harding Trading Co. for the year have been journalized and posted. The following information has been gathered for the adjustment process as of December 31, 2018 A. The Supplies account shows a balance of $950. A count of supplies revealed $330 on hand B. The $1,440 premium relating to a one-year insurance policy was paid on December 1, 2018. C. The company's equipment,, which was purchased last year, depreciates at a rate of $1,000 per year. D. On September 30, 2018, a customer paid $9,300 in advance for services; as of December 31, 2018, services in the amount of $2,790 had been performed for this customer. E. Employees are paid $2,100 on Fridays for the 5-day workweek, which ends on that Friday. However, December 31, 2018 falls on a Thursday. F. The company has completed $570 of work for customers, the customers have not yet been billed and the related revenue has not been recorded Required: a. Prepare the required adjusting entries required at December 31, 2018. b. For each of the adjusting items, indicate the amount and the direction of effects of the adjusting journal entry on the elements of the balance sheet and income statement. Complete the following table by entering the amount and the direction (+for increase, for decrease) or leave blank for no effect. View transaction list View journal entry worksheet No General Journal Credit Transaction Debit Supplies Expense 1 A 620 Supplies 620 Insurance Expense 2 B 120 Prepaid Insurance 120 Depreciation Expense C 1,000 Accumulated Depreciation 1,000 Deferred Revenue 2,790 4 D 2,790 Service Revenue Salaries and Wages Expense E 1,680 Salaries and Wages Payable 1,680 Accounts Receivable 6 F 570 Service Revenue 570 Required B Required A LO Co Required B Required A For each of the adjusting items, indicate the amount and the direction of effects of the adjusting journal entry on the elements of the balance sheet and income statement. Complete the following table by entering the amount and the direction (+ for increase, - for decrease) or leave blank for no effect. Income Statement Balance Sheet Total Liabilities Stockholders' Transaction Total Assets Revenues Expenses Net Income Equity -620 -120 -620 -620 +620 -120 -1000 +120 -120 -1000 +1000 -1000 C -2790 +2790 +2790 +2790 D -1680 +1680 +1680 -1680 E +570 +570 +570 +570 F DoauireLA LL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts