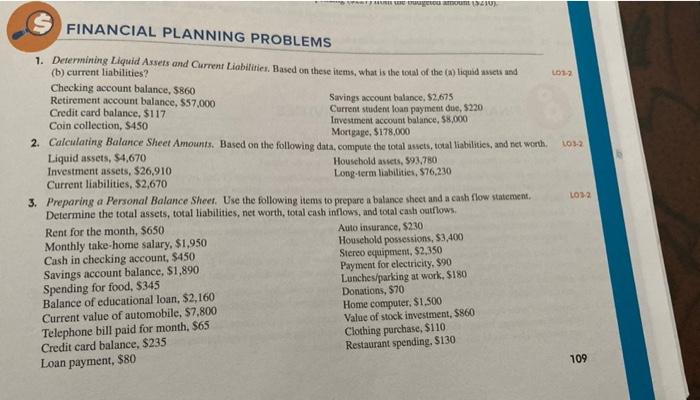

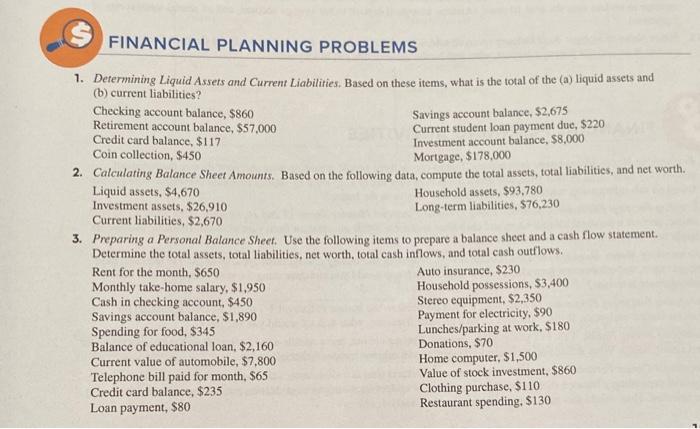

Question: Son 15210) FINANCIAL PLANNING PROBLEMS 1032 LO12 1. Determining Liquid Assets and Current Liabilities. Based on these items, what is the total of the )

Son 15210) FINANCIAL PLANNING PROBLEMS 1032 LO12 1. Determining Liquid Assets and Current Liabilities. Based on these items, what is the total of the ) liquid assets and (b) current linbilities? Checking account balance, 5860 Retirement account balance, 557,000 Savings account balance, $2675 Credit card balance, $117 Current student loan payment due, 5220 Coin collection, $450 Investment account balance 58,000 2. Calculating Balance Sheet Amounts. Based on the following data, compute the total assets, total liabilities, and net worth, Mortgage. $178.000 Liquid assets, $4,670 Investment assets, $26,910 Household assets, 593.780 Current liabilities, $2,670 Long-term liabilities, 576,230 3. Preparing a Personal Balance Sheet. Use the following items to prepare a balance sheet and a cash flow statement Determine the total assets, total liabilities, net worth, total cash inflows, and total cash outflows, Rent for the month, $650 Auto insurance, $230 Monthly take home salary, $1,950 Household possessions, $3,400 Cash in checking account, $450 Stereo equipment. $2,350 Savings account balance. $1,890 Payment for electricity, $90 Spending for food, $345 Lunches/parking at work, S180 Balance of educational loan, $2,160 Donations, 570 Current value of automobile, $7.800 Home computer. $1.500 Value of stock investment, $860 Telephone bill paid for month, $65 Clothing purchase, $110 Credit card balance, $235 Restaurant spending. $130 Loan payment, $80 109 FINANCIAL PLANNING PROBLEMS 1. Determining Liquid Assets and Current Liabilities. Based on these items, what is the total of the (a) liquid assets and (b) current liabilities? Checking account balance, $860 Retirement account balance, $57.000 Savings account balance, 52,675 Credit card balance, $117 Current student loan payment due, $220 Investment account balance. $8,000 Coin collection, $450 Mortgage, $178,000 2. Calculating Balance Sheet Amounts. Based on the following data, compute the total assets, total liabilities, and net worth. Liquid assets, $4,670 Household assets, $93.780 Investment assets. $26,910 Long-term liabilities, 576,230 Current liabilities, $2,670 3. Preparing a Personal Balance Sheet. Use the following items to prepare a balance sheet and a cash flow statement Determine the total assets, total liabilities, net worth, total cash inflows, and total cash outflows. Rent for the month, $650 Auto insurance, $230 Monthly take home salary, $1,950 Household possessions, $3,400 Cash in checking account, $450 Stereo equipment, $2,350 Savings account balance, $1,890 Payment for electricity, $90 Spending for food, $345 Lunches/parking at work, $180 Balance of educational loan, $2,160 Donations, $70 Current value of automobile, $7,800 Home computer, $1,500 Telephone bill paid for month, $65 Value of stock investment, $860 Credit card balance, $235 Clothing purchase, $110 Loan payment, $80 Restaurant spending, $130

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts