Question: Sonia is buying a project that will return $120,000/year for the first 5-years, and $130,000/year for the next 5-years. She invests only if she

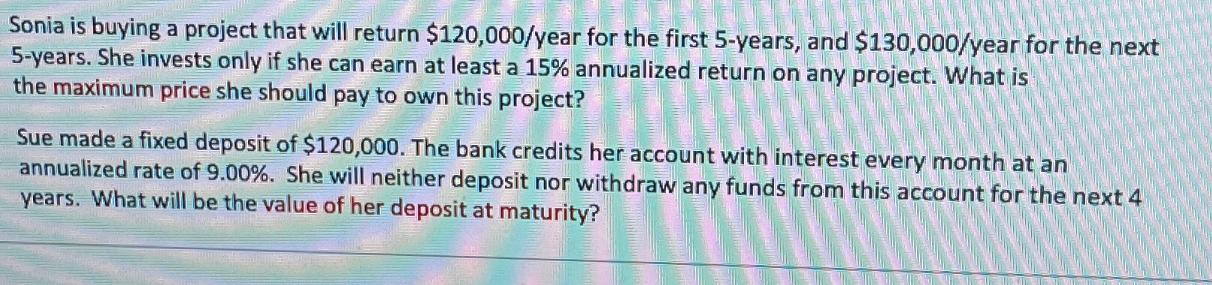

Sonia is buying a project that will return $120,000/year for the first 5-years, and $130,000/year for the next 5-years. She invests only if she can earn at least a 15% annualized return on any project. What is the maximum price she should pay to own this project? Sue made a fixed deposit of $120,000. The bank credits her account with interest every month at an annualized rate of 9.00%. She will neither deposit nor withdraw any funds from this account for the next 4 years. What will be the value of her deposit at maturity?

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

To calculate the maximum price Sonia should pay to own the project we need to find the present value ... View full answer

Get step-by-step solutions from verified subject matter experts