Question: Sorry for the long question but I will rate correct answers, thank you in advance! Question 6-10 Challenge Problem -10. 1. Develop a pro forma

Sorry for the long question but I will rate correct answers, thank you in advance!

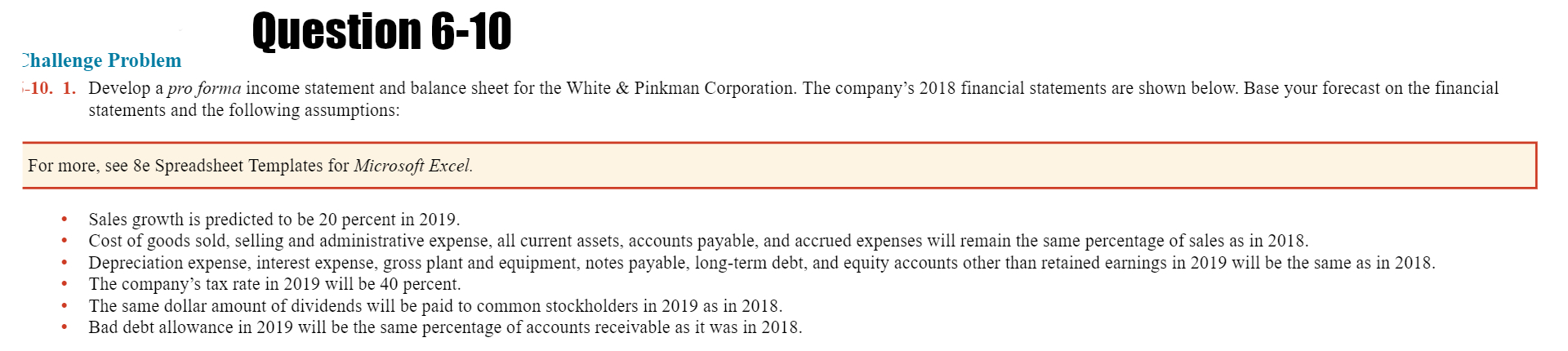

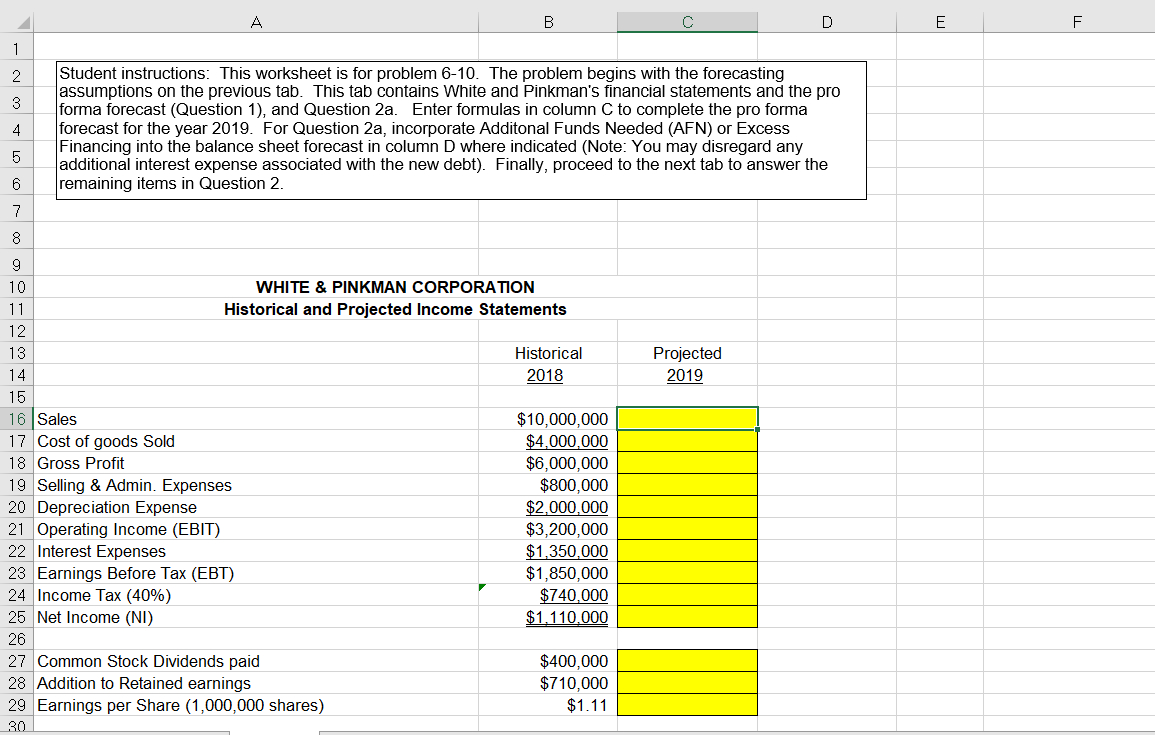

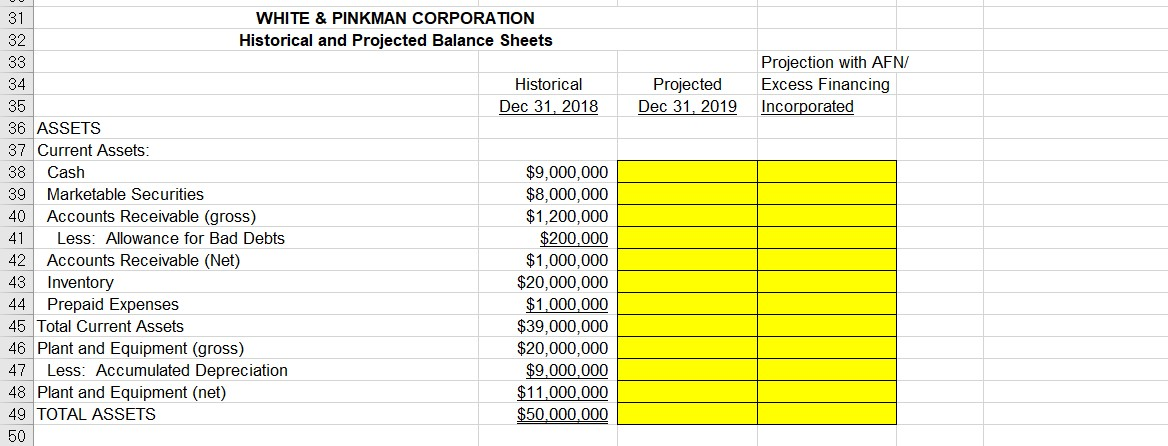

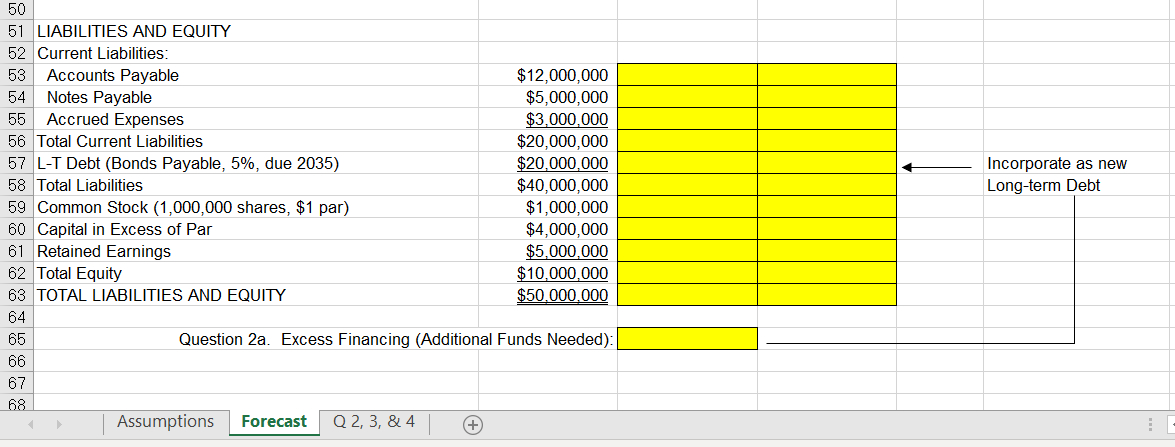

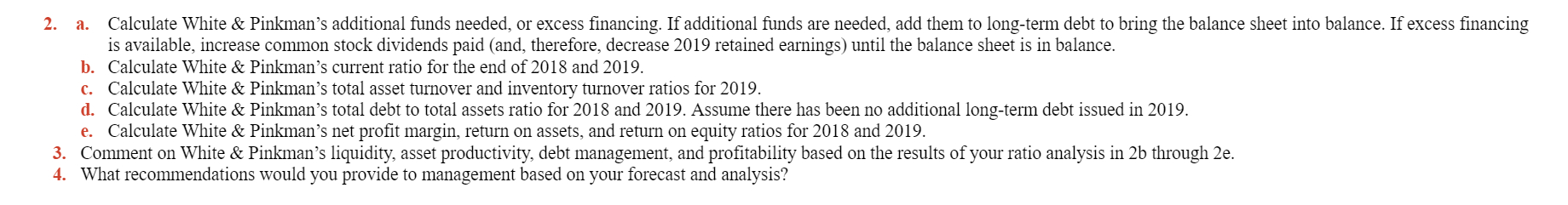

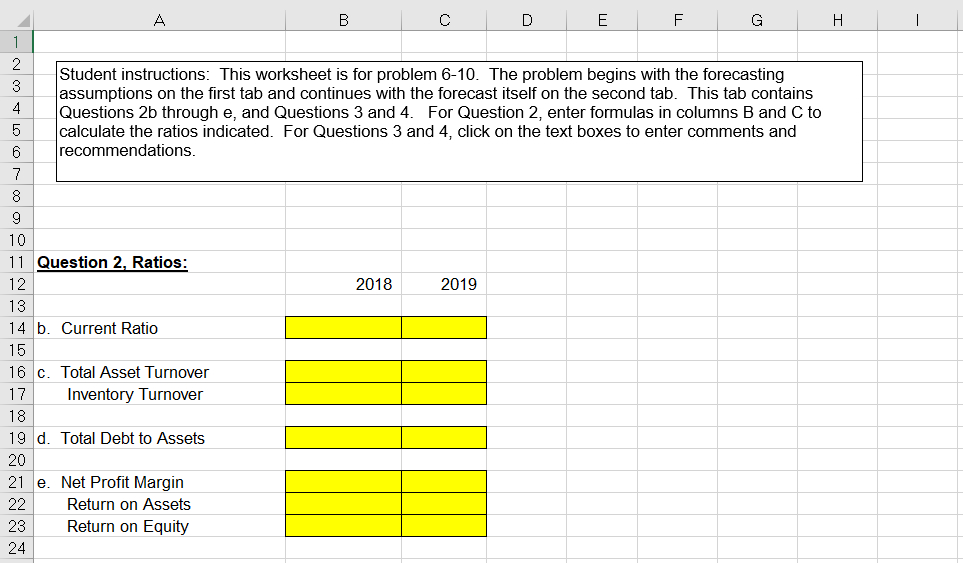

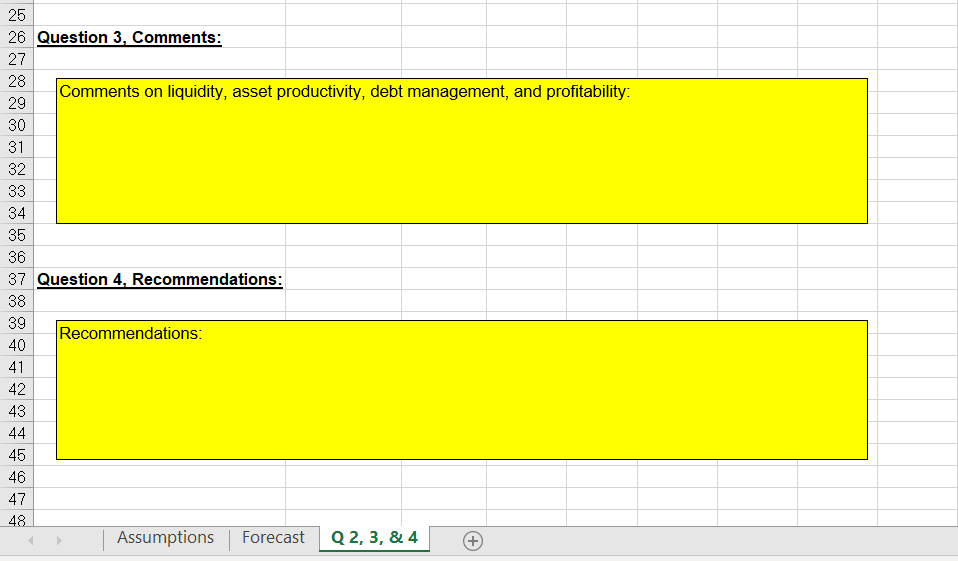

Question 6-10 Challenge Problem -10. 1. Develop a pro forma income statement and balance sheet for the White & Pinkman Corporation. The company's 2018 financial statements are shown below. Base your forecast on the financial statements and the following assumptions: For more, see 8e Spreadsheet Templates for Microsoft Excel. Sales growth is predicted to be 20 percent in 2019. Cost of goods sold, selling and administrative expense, all current assets, accounts payable, and accrued expenses will remain the same percentage of sales as in 2018. Depreciation expense, interest expense, gross plant and equipment, notes payable, long-term debt, and equity accounts other than retained earnings in 2019 will be the same as in 2018. The company's tax rate in 2019 will be 40 percent. The same dollar amount of dividends will be paid to common stockholders in 2019 as in 2018. Bad debt allowance in 2019 will be the same percentage of accounts receivable as it was in 2018. 4 Student instructions: This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on the previous tab. This tab contains White and Pinkman's financial statements and the pro forma forecast (Question 1), and Question 2a. Enter formulas in column C to complete the pro forma forecast for the year 2019. For Question 2a, incorporate Additonal Funds Needed (AFN) or Excess Financing into the balance sheet forecast in column D where indicated (Note: You may disregard any additional interest expense associated with the new debt). Finally, proceed to the next tab to answer the remaining items in Question 2. 5 6 WHITE & PINKMAN CORPORATION Historical and Projected Income Statements 12 13 Historical 2018 Projected 2019 14 15 16 Sales 17 Cost of goods Sold 18 Gross Profit 19 Selling & Admin. Expenses 20 Depreciation Expense 21 Operating Income (EBIT) 22 Interest Expenses 23 Earnings Before Tax (EBT) 24 Income Tax (40%) 25 Net Income (NI) 26 27 Common Stock Dividends paid 28 Addition to Retained earnings 29 Earnings per Share (1,000,000 shares) 30 $10,000,000 $4,000,000 $6,000,000 $800,000 $2,000,000 $3,200,000 $1,350,000 $1,850,000 $740,000 $1.110.000 $400,000 $710,000 $1.11 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets 33 Historical Dec 31, 2018 Projected Dec 31, 2019 Projection with AFN/ Excess Financing Incorporated 35 36 ASSETS 37 Current Assets: 38 Cash 39 Marketable Securities 40 Accounts Receivable (gross) 41 Less: Allowance for Bad Debts 42 Accounts Receivable (Net) 43 Inventory 44 Prepaid Expenses 45 Total Current Assets 46 Plant and Equipment (gross) 47 Less: Accumulated Depreciation 48 Plant and Equipment (net) 49 TOTAL ASSETS 50 $9,000,000 $8,000,000 $1,200,000 $200,000 $1,000,000 $20,000,000 $1,000,000 $39,000,000 $20,000,000 $9,000,000 $11,000,000 $50.000.000 2. a. Calculate White & Pinkman's additional funds needed, or excess financing. If additional funds are needed, add them to long-term debt to bring the balance sheet into balance. If excess financing is available, increase common stock dividends paid (and, therefore, decrease 2019 retained earnings) until the balance sheet is in balance. b. Calculate White & Pinkman's current ratio for the end of 2018 and 2019. c. Calculate White & Pinkman's total asset turnover and inventory turnover ratios for 2019. d. Calculate White & Pinkman's total debt to total assets ratio for 2018 and 2019. Assume there has been no additional long-term debt issued in 2019. e. Calculate White & Pinkman's net profit margin, return on assets, and return on equity ratios for 2018 and 2019. 3. Comment on White & Pinkman's liquidity, asset productivity, debt management, and profitability based on the results of your ratio analysis in 2b through 2e. 4. What recommendations would you provide to management based on your forecast and analysis? C D E F G H I - SLON Student instructions: This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on the first tab and continues with the forecast itself on the second tab. This tab contains Questions 2b through e, and Questions 3 and 4. For Question 2, enter formulas in columns B and C to calculate the ratios indicated. For Questions 3 and 4, click on the text boxes to enter comments and recommendations. 2018 2019 11 Question 2. Ratios: 12 13 14 b. Current Ratio 15 16 c. Total Asset Turnover 17 Inventory Turnover 18 19 d. Total Debt to Assets 20 21 e. Net Profit Margin 22 Return on Assets Return on Equity 23 25 26 Question 3, Comments: 27 Comments on liquidity, asset productivity, debt management, and profitability: 29 28 30 31 32 33 34 35 36 37 Question 4, Recommendations: 38 39 Recommendations: 40 41 42 43 44 45 46 47 48 Q 2, 3, & 4 Forecast Assumptions Question 6-10 Challenge Problem -10. 1. Develop a pro forma income statement and balance sheet for the White & Pinkman Corporation. The company's 2018 financial statements are shown below. Base your forecast on the financial statements and the following assumptions: For more, see 8e Spreadsheet Templates for Microsoft Excel. Sales growth is predicted to be 20 percent in 2019. Cost of goods sold, selling and administrative expense, all current assets, accounts payable, and accrued expenses will remain the same percentage of sales as in 2018. Depreciation expense, interest expense, gross plant and equipment, notes payable, long-term debt, and equity accounts other than retained earnings in 2019 will be the same as in 2018. The company's tax rate in 2019 will be 40 percent. The same dollar amount of dividends will be paid to common stockholders in 2019 as in 2018. Bad debt allowance in 2019 will be the same percentage of accounts receivable as it was in 2018. 4 Student instructions: This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on the previous tab. This tab contains White and Pinkman's financial statements and the pro forma forecast (Question 1), and Question 2a. Enter formulas in column C to complete the pro forma forecast for the year 2019. For Question 2a, incorporate Additonal Funds Needed (AFN) or Excess Financing into the balance sheet forecast in column D where indicated (Note: You may disregard any additional interest expense associated with the new debt). Finally, proceed to the next tab to answer the remaining items in Question 2. 5 6 WHITE & PINKMAN CORPORATION Historical and Projected Income Statements 12 13 Historical 2018 Projected 2019 14 15 16 Sales 17 Cost of goods Sold 18 Gross Profit 19 Selling & Admin. Expenses 20 Depreciation Expense 21 Operating Income (EBIT) 22 Interest Expenses 23 Earnings Before Tax (EBT) 24 Income Tax (40%) 25 Net Income (NI) 26 27 Common Stock Dividends paid 28 Addition to Retained earnings 29 Earnings per Share (1,000,000 shares) 30 $10,000,000 $4,000,000 $6,000,000 $800,000 $2,000,000 $3,200,000 $1,350,000 $1,850,000 $740,000 $1.110.000 $400,000 $710,000 $1.11 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets 33 Historical Dec 31, 2018 Projected Dec 31, 2019 Projection with AFN/ Excess Financing Incorporated 35 36 ASSETS 37 Current Assets: 38 Cash 39 Marketable Securities 40 Accounts Receivable (gross) 41 Less: Allowance for Bad Debts 42 Accounts Receivable (Net) 43 Inventory 44 Prepaid Expenses 45 Total Current Assets 46 Plant and Equipment (gross) 47 Less: Accumulated Depreciation 48 Plant and Equipment (net) 49 TOTAL ASSETS 50 $9,000,000 $8,000,000 $1,200,000 $200,000 $1,000,000 $20,000,000 $1,000,000 $39,000,000 $20,000,000 $9,000,000 $11,000,000 $50.000.000 2. a. Calculate White & Pinkman's additional funds needed, or excess financing. If additional funds are needed, add them to long-term debt to bring the balance sheet into balance. If excess financing is available, increase common stock dividends paid (and, therefore, decrease 2019 retained earnings) until the balance sheet is in balance. b. Calculate White & Pinkman's current ratio for the end of 2018 and 2019. c. Calculate White & Pinkman's total asset turnover and inventory turnover ratios for 2019. d. Calculate White & Pinkman's total debt to total assets ratio for 2018 and 2019. Assume there has been no additional long-term debt issued in 2019. e. Calculate White & Pinkman's net profit margin, return on assets, and return on equity ratios for 2018 and 2019. 3. Comment on White & Pinkman's liquidity, asset productivity, debt management, and profitability based on the results of your ratio analysis in 2b through 2e. 4. What recommendations would you provide to management based on your forecast and analysis? C D E F G H I - SLON Student instructions: This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on the first tab and continues with the forecast itself on the second tab. This tab contains Questions 2b through e, and Questions 3 and 4. For Question 2, enter formulas in columns B and C to calculate the ratios indicated. For Questions 3 and 4, click on the text boxes to enter comments and recommendations. 2018 2019 11 Question 2. Ratios: 12 13 14 b. Current Ratio 15 16 c. Total Asset Turnover 17 Inventory Turnover 18 19 d. Total Debt to Assets 20 21 e. Net Profit Margin 22 Return on Assets Return on Equity 23 25 26 Question 3, Comments: 27 Comments on liquidity, asset productivity, debt management, and profitability: 29 28 30 31 32 33 34 35 36 37 Question 4, Recommendations: 38 39 Recommendations: 40 41 42 43 44 45 46 47 48 Q 2, 3, & 4 Forecast Assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts