Question: sorry, here is question 10 and the answer Consider question 10. Suppose that Ms. Barkley sold SF3,985, his principal investment amount, forward at the forward

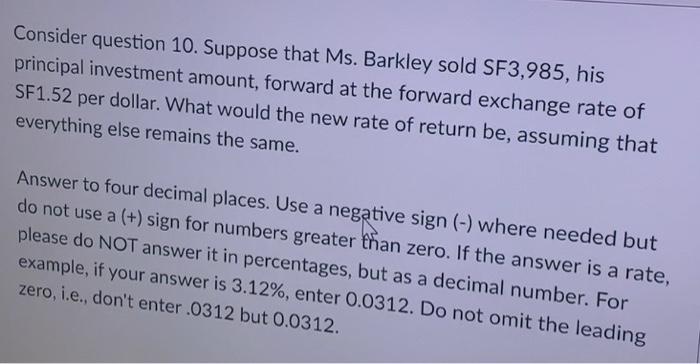

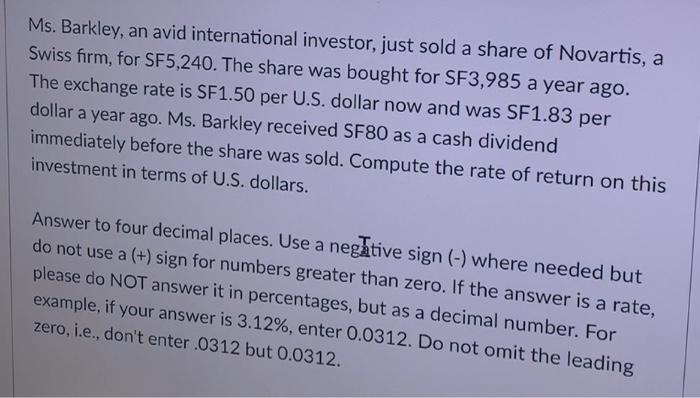

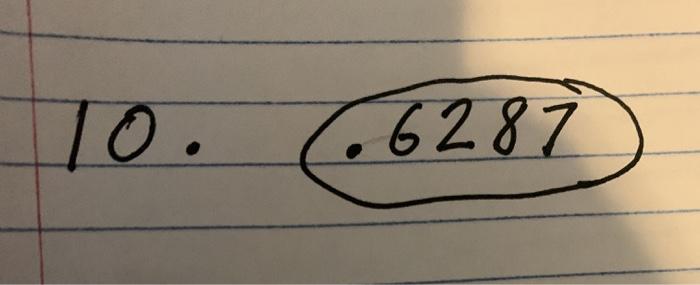

Consider question 10. Suppose that Ms. Barkley sold SF3,985, his principal investment amount, forward at the forward exchange rate of SF1.52 per dollar. What would the new rate of return be, assuming that everything else remains the same. Answer to four decimal places. Use a negative sign (-) where needed but do not use a (+) sign for numbers greater than zero. If the answer is a rate, please do NOT answer it in percentages, but as a decimal number. For example, if your answer is 3.12%, enter 0.0312. Do not omit the leading zero, i.e., don't enter .0312 but 0.0312. Ms. Barkley, an avid international investor, just sold a share of Novartis, a Swiss firm, for SF5,240. The share was bought for SF3,985 a year ago. The exchange rate is SF1.50 per U.S. dollar now and was SF1.83 per dollar a year ago. Ms. Barkley received SF80 as a cash dividend immediately before the share was sold. Compute the rate of return on this investment in terms of U.S. dollars. Answer to four decimal places. Use a negative sign (-) where needed but do not use a (+) sign for numbers greater than zero. If the answer is a rate, please do NOT answer it in percentages, but as a decimal number. For example, if your answer is 3.12%, enter 0.0312. Do not omit the leading zero, i.e., don't enter .0312 but 0.0312. 10. (66287

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts