Question: **Source: From Target (TGT) form 10k ( 10-K reports on SEC.GOV and most recent year report should be used for some ratio analysis ) 1a.

**Source: From Target (TGT) form 10k ( 10-K reports on SEC.GOV and most recent year report should be used for some ratio analysis )

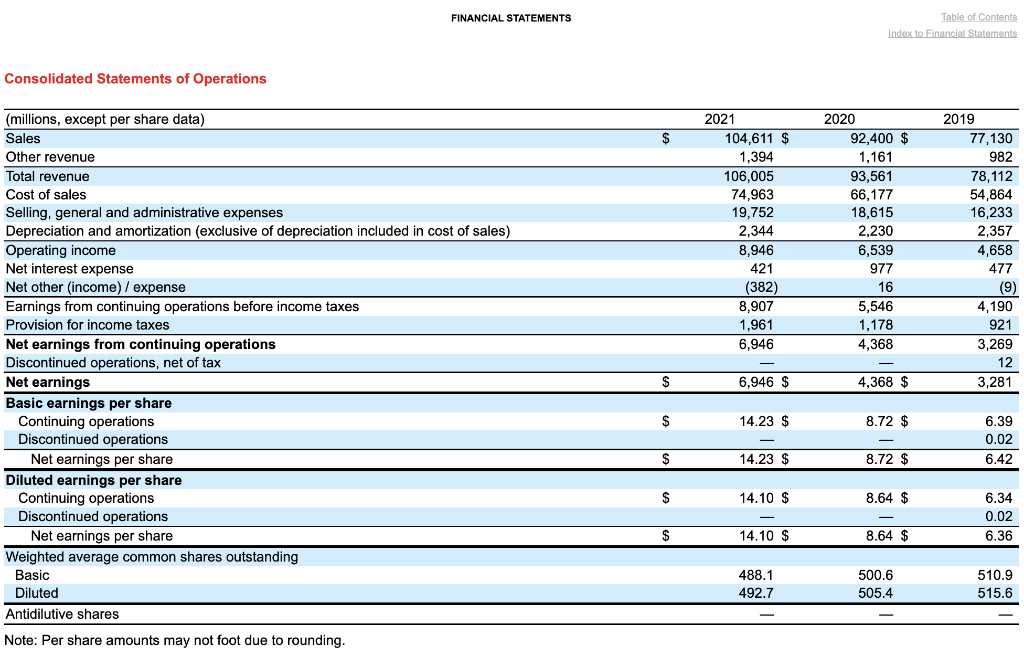

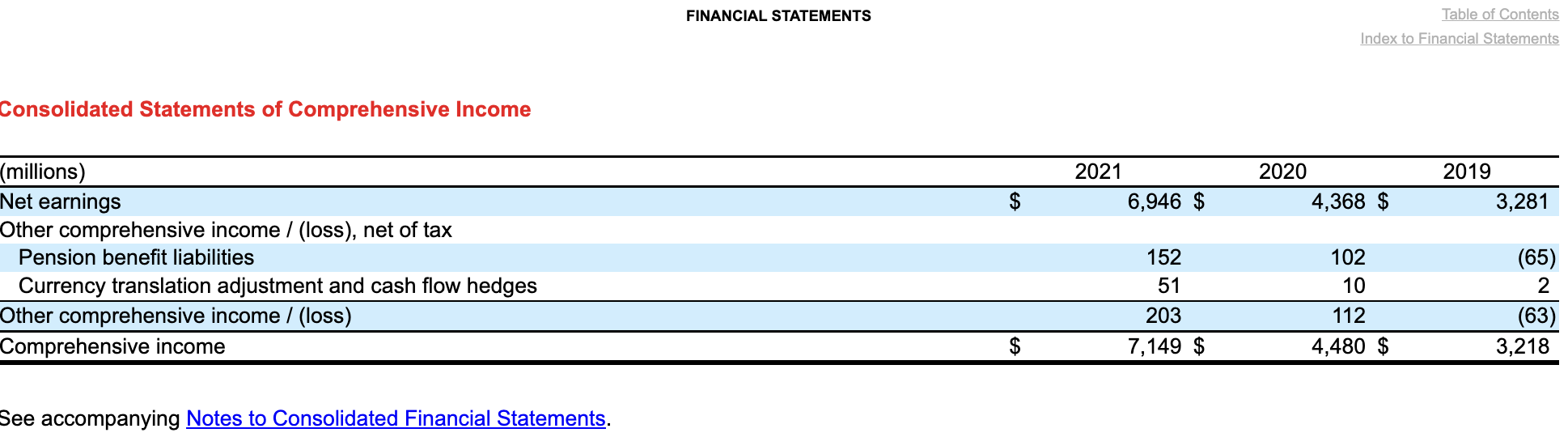

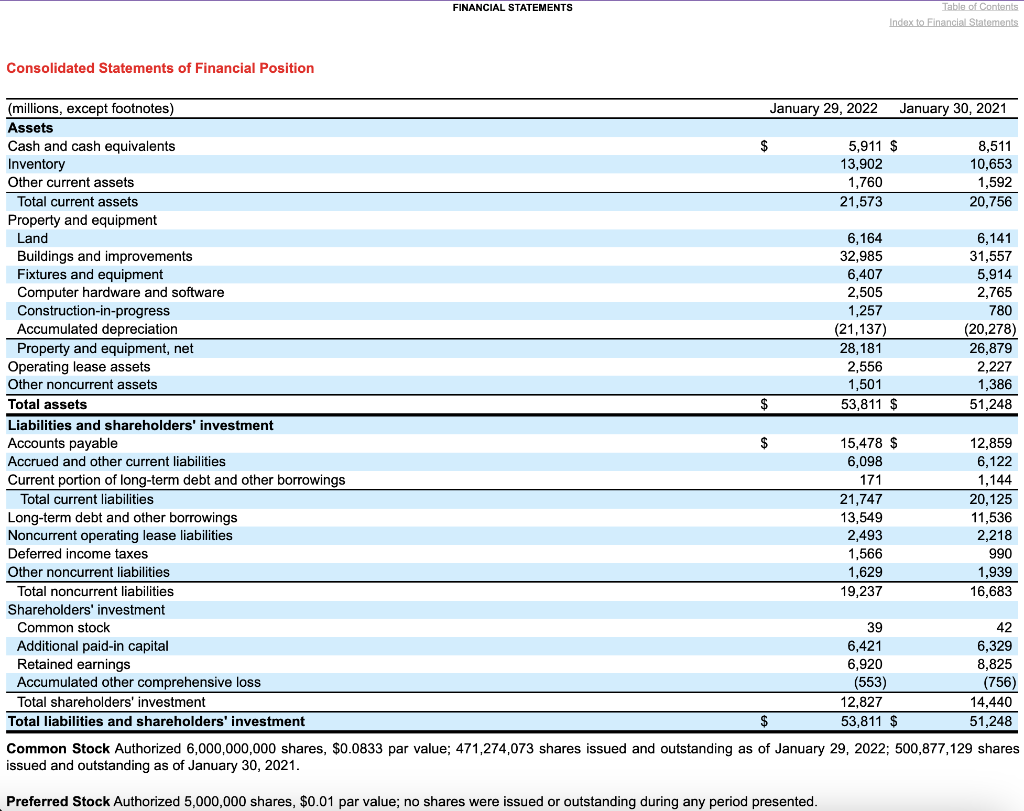

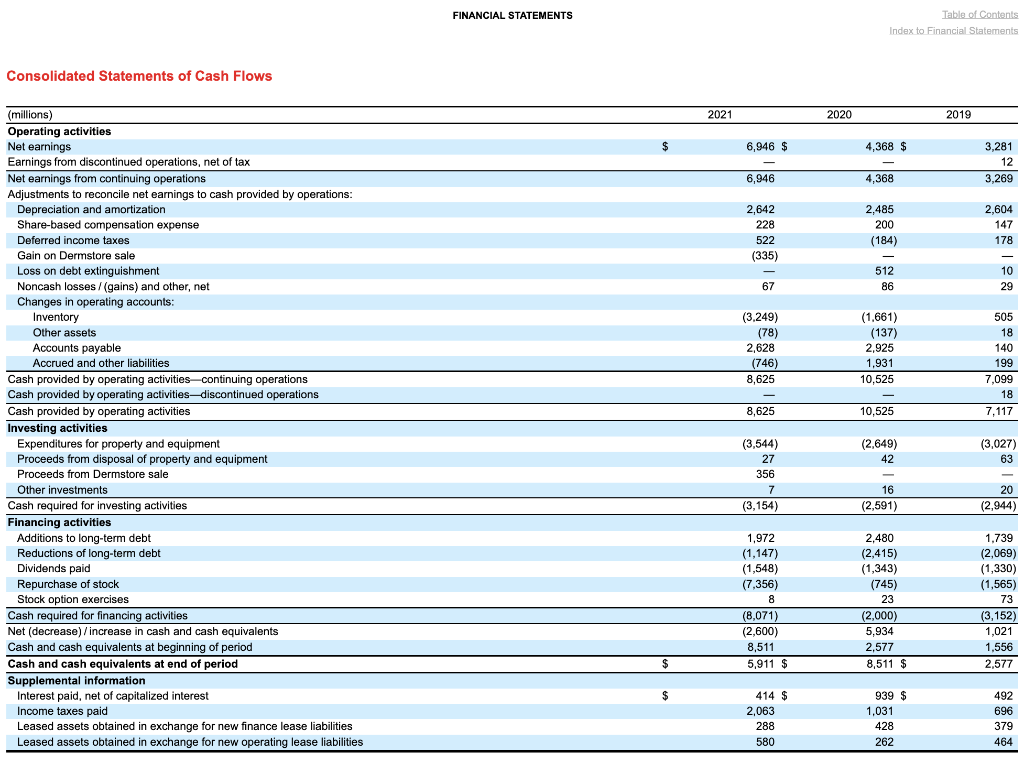

1a. Identify the Return on Asset (ROA), Return on Equity (ROE), and Asset Turnover. 1b. What proportion of total assets is financed by owners? 1c. Compute the RNOA 1d. Determine the relative proportion of liabilities and equity.

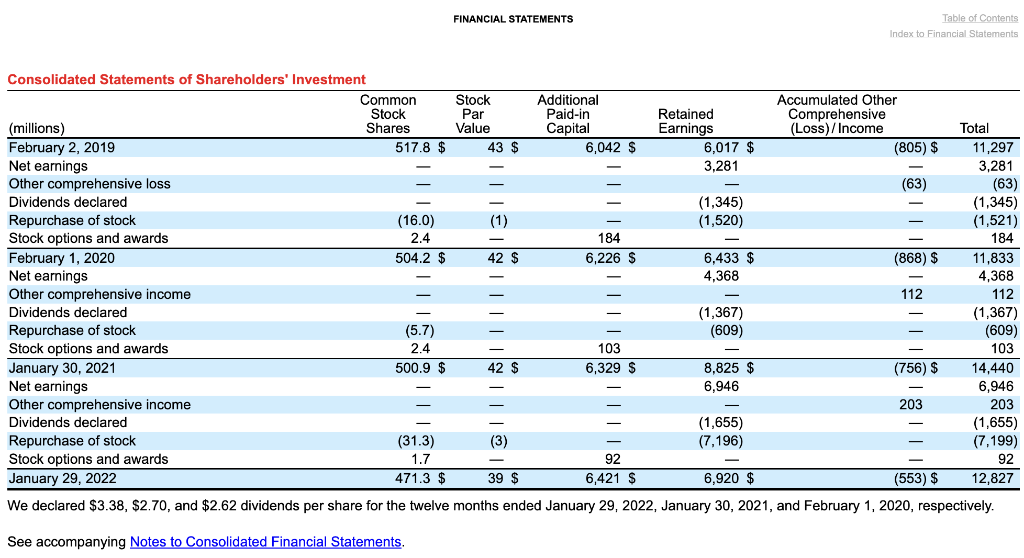

FINANCIAL STATEMENTS Table of Contents Consolidated Statements of Operations FINANCIAL STATEMENTS Table of Contents Consolidated Statements of Comprehensive Income See accompanying Notes to Consolidated Financial Statements. FINANCIAL STATEMENTS Table of Contents Consolidated Statements of Financial Position Consolidated Statements of Cash Flows FINANCIAL STATEMENTS Table of Contents Index to Financial Statements We declared $3.38,$2.70, and $2.62 dividends per share for the twelve months ended January 29, 2022, January 30 , 2021, and February 1,2020 , respectively. See accompanying Notes to Consolidated Financial Statements. FINANCIAL STATEMENTS Table of Contents Consolidated Statements of Operations FINANCIAL STATEMENTS Table of Contents Consolidated Statements of Comprehensive Income See accompanying Notes to Consolidated Financial Statements. FINANCIAL STATEMENTS Table of Contents Consolidated Statements of Financial Position Consolidated Statements of Cash Flows FINANCIAL STATEMENTS Table of Contents Index to Financial Statements We declared $3.38,$2.70, and $2.62 dividends per share for the twelve months ended January 29, 2022, January 30 , 2021, and February 1,2020 , respectively. See accompanying Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts