Question: South Tel Technologies is considering whether or not to refund a $90 million, 8% annual coupon, 30 -year bond issue that was sold 5 years

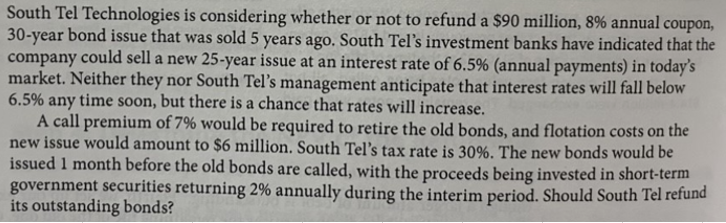

South Tel Technologies is considering whether or not to refund a $90 million, 8% annual coupon, 30 -year bond issue that was sold 5 years ago. South Tel's investment banks have indicated that the company could sell a new 25 -year issue at an interest rate of 6.5% (annual payments) in today's market. Neither they nor South Tel's management anticipate that interest rates will fall below 6.5% any time soon, but there is a chance that rates will increase. A call premium of 7% would be required to retire the old bonds, and flotation costs on the new issue would amount to $6 million. South Tel's tax rate is 30%. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being invested in short-term government securities returning 2% annually during the interim period. Should South Tel refund its outstanding bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts