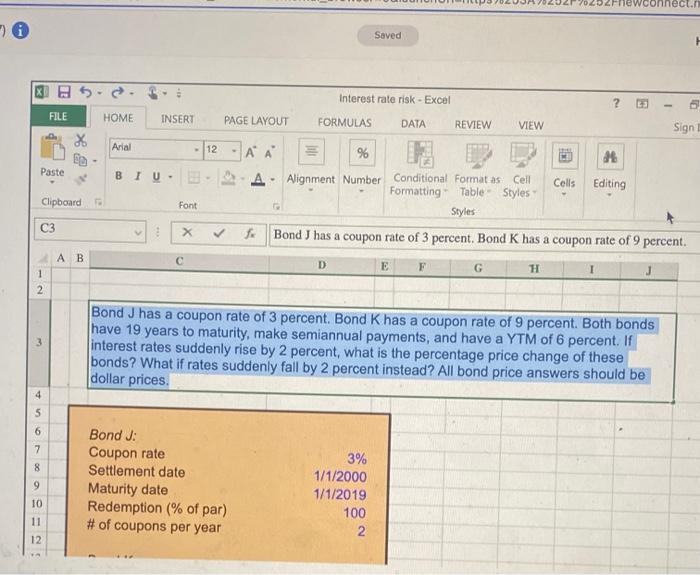

Question: Soved begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|l|l} & A & B & C & D & E & F & G & H & I & J hline 1

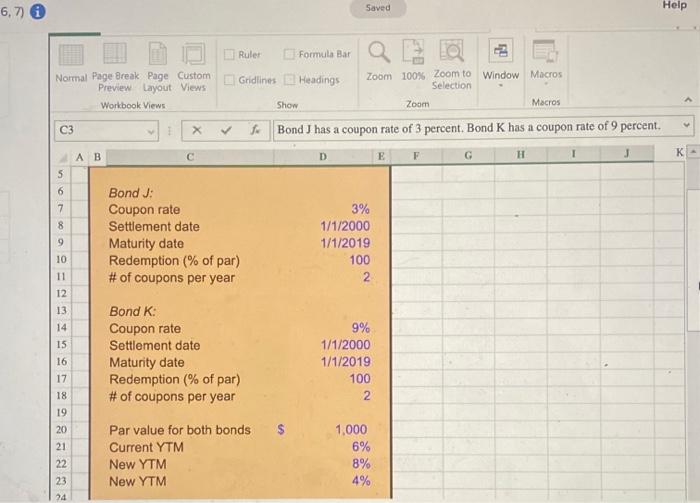

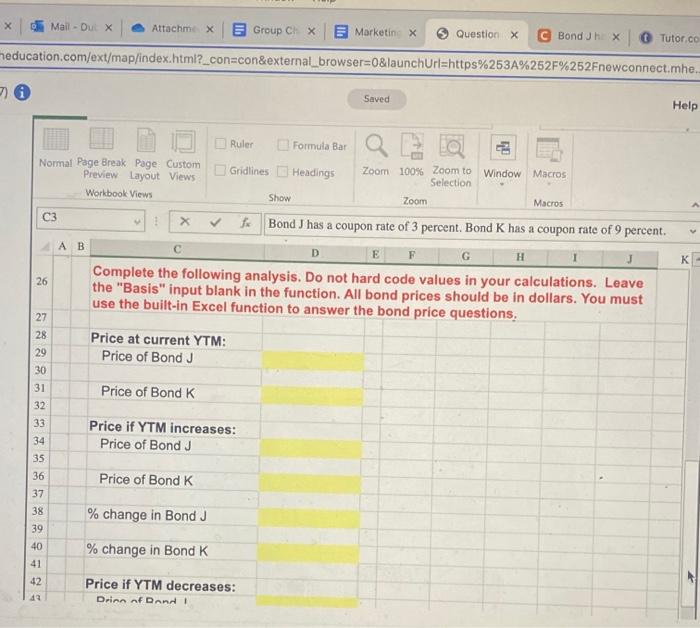

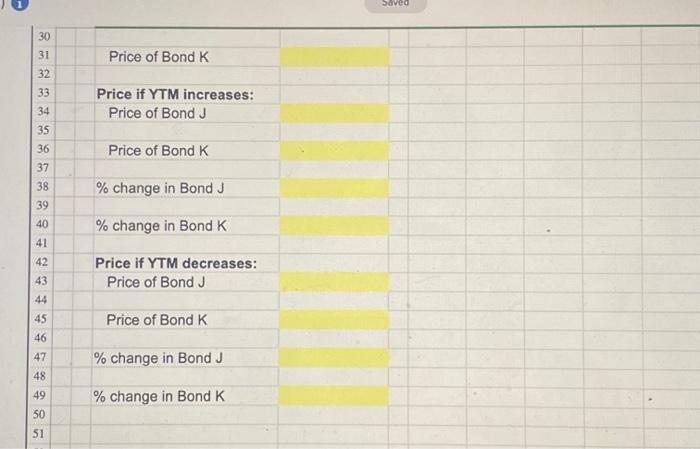

Soved \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|l|l} & A & B & C & D & E & F & G & H & I & J \\ \hline 1 & & & & & & & & & \end{tabular} Bond J has a coupon rate of 3 percent. Bond K has a coupon rate of 9 percent. Both bonds have 19 years to maturity, make semiannual payments, and have a YTM of 6 percent. If interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds? What if rates suddenly fall by 2 percent instead? All bond price answers should be dollar prices. # of coupons per year \begin{tabular}{|l|l} 30 & \\ 31 & Price of Bond K \\ 32 & \\ 33 & Prica if YT M in \end{tabular} Price if YTM increases: Price of Bond J Price of Bond K % change in Bond J % change in Bond K Price if YTM decreases: Price of Bond J Price of Bond K % change in Bond J % change in Bond K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts