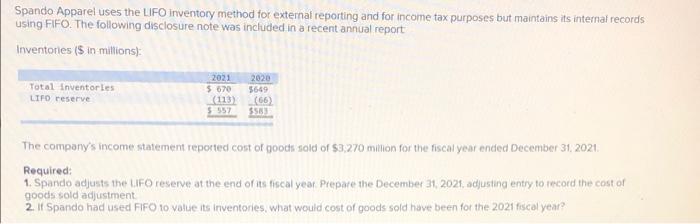

Question: Spando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure

Spando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report Inventories (5 in millions): Total Inventores LIFO reserve 2021 5670 (113) 2020 5649 (66) SSN The company's income statement reported cost of good sold of $3,270 million for the fiscal year ended December 31, 2021 Required: 1. Spando adjusts the UFO reserve at the end of its fiscal year Prepare the December 31, 2021, adjusting entry to record the cost or goods sold adjustment 2. If Spando had used FIFO 10 value its inventories, what would cost of goods sold have been for the 2021 fiscal year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts