Question: #SPECIAL NOTE..... I NEED THE ANSWER ASAP WITH PROPER EXPLAINATION + MORE QUESATION FOR PRACTICE + THIS QUEASTION IS RELATED STRATEGIC MANAGMENT Q. Study the

#SPECIAL NOTE..... I NEED THE ANSWER ASAP WITH PROPER EXPLAINATION + MORE QUESATION FOR PRACTICE +

THIS QUEASTION IS RELATED STRATEGIC MANAGMENT

THIS QUEASTION IS RELATED STRATEGIC MANAGMENT

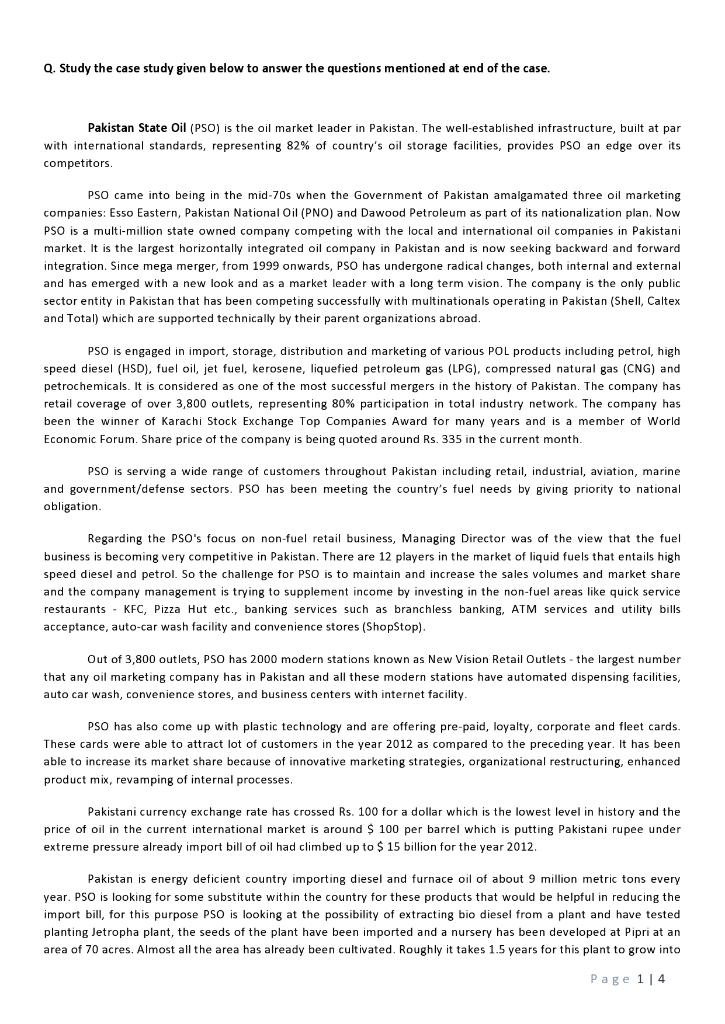

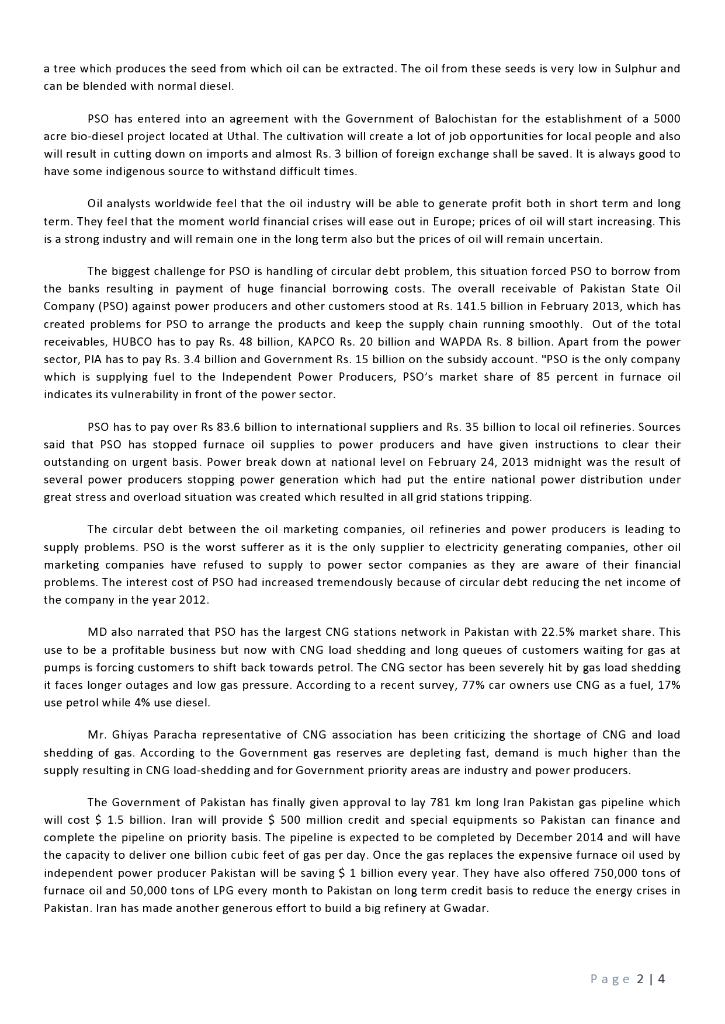

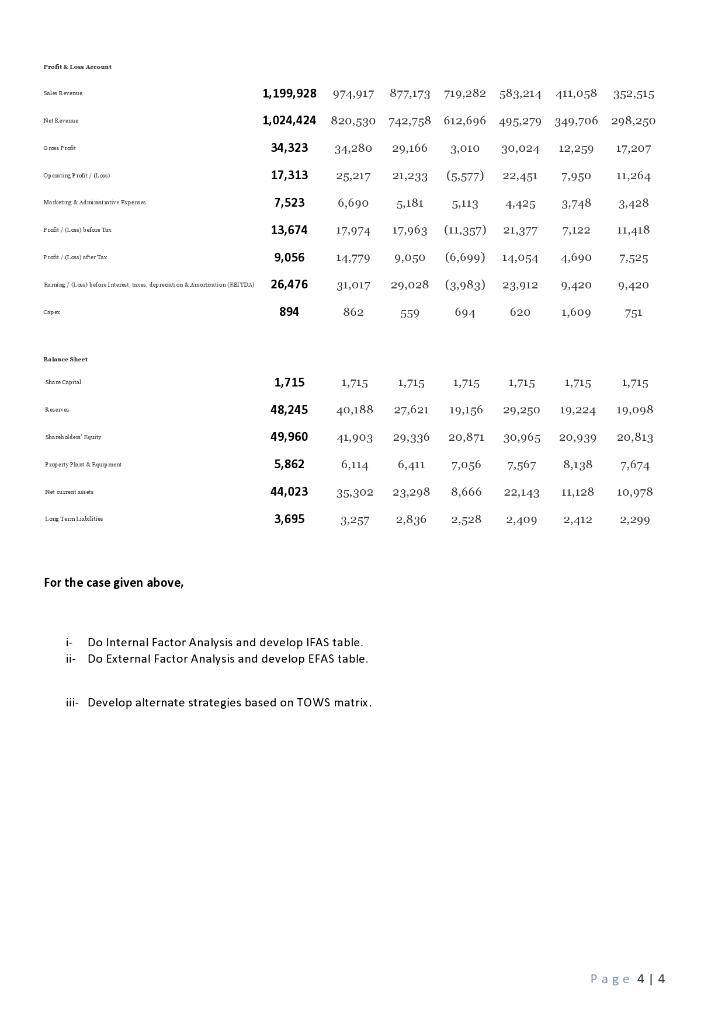

Q. Study the case study given below to answer the questions mentioned at end of the case. Pakistan State Oil (PSO) is the oil market leader in Pakistan. The well-established infrastructure, built at par with international standards, representing 82% of country's oil storage facilities, provides PSO an edge over its competitors. PSO came into being in the mid-70s when the Government of Pakistan amalgamated three oil marketing companies: Esso Eastern, Pakistan National Oil (PNO) and Dawood Petroleum as part of its nationalization plan. Now PSO is a multi-million state owned company competing with the local and international oil companies in Pakistani market. It is the largest horizontally integrated oil company in Pakistan and is now seeking backward and forward integration. Since mega merger, from 1999 onwards, PSO has undergone radical changes, both internal and external and has emerged with a new look and as a market leader with a long term vision. The company is the only public sector entity in Pakistan that has been competing successfully with multinationals operating in Pakistan (Shell, Caltex and Total) which are supported technically by their parent organizations abroad. PSO is engaged in import, storage, distribution and marketing of various POL products including petrol, high speed diesel (HSD), fuel oil, jet fuel, kerosene, liquefied petroleum gas (LPG), compressed natural gas (CNG) and petrochemicals. It is considered as one of the most successful mergers in the history of Pakistan. The company has retail coverage of over 3,800 outlets, representing 80% participation in total industry network. The company has been the winner of Karachi Stock Exchange Top Companies Award for many years and is a member of World Economic Forum. Share price of the company is being quoted around Rs. 335 in the current month. PSO is serving a wide range of customers throughout Pakistan including retail, industrial, aviation, marine and government/defense sectors. PSO has been meeting the country's fuel needs by giving priority to national obligation. Regarding the PSO's focus on non-fuel retail business, Managing Director was of the view that the fuel business is becoming very competitive in Pakistan. There are 12 players in the market of liquid fuels that entails high speed diesel and petrol. So the challenge for PSO is to maintain and increase the sales volumes and market share and the company management is trying to supplement income by investing in the non-fuel areas like quick service restaurants - KFC, Pizza Hut etc., banking services such as branchless banking, ATM services and utility bills acceptance, auto-car wash facility and convenience stores (ShopStop). Out of 3,800 outlets, PSO has 2000 modern stations known as New Vision Retail Outlets - the largest number that any oil marketing company has in Pakistan and all these modern stations have automated dispensing facilities, auto car wash, convenience stores, and business centers with internet facility. PSO has also come up with plastic technology and are offering pre-paid, loyalty, corporate and fleet cards. These cards were able to attract lot of customers in the year 2012 as compared to the preceding year. It has been able to increase its market share because of innovative marketing strategies, organizational restructuring, enhanced product mix, revamping of internal processes. Pakistani currency exchange rate has crossed Rs. 100 for a dollar which is the lowest level in history and the price of oil in the current international market is around $100 per barrel which is putting Pakistani rupee under extreme pressure already import bill of oil had climbed up to $15 billion for the year 2012 . Pakistan is energy deficient country importing diesel and furnace oil of about 9 million metric tons every year. PSO is looking for some substitute within the country for these products that would be helpful in reducing the import bill, for this purpose PSO is looking at the possibility of extracting bio diesel from a plant and have tested planting Jetropha plant, the seeds of the plant have been imported and a nursery has been developed at Pipri at an area of 70 acres. Almost all the area has already been cultivated. Roughly it takes 1.5 years for this plant to grow into Page1|4 a tree which produces the seed from which oil can be extracted. The oil from these seeds is very low in Sulphur and can be blended with normal diesel. PSO has entered into an agreement with the Government of Balochistan for the establishment of a 5000 acre bio-diesel project located at Uthal. The cultivation will create a lot of job opportunities for local people and also will result in cutting down on imports and almost Rs. 3 billion of foreign exchange shall be saved. It is always good to have some indigenous source to withstand difficult times. Oil analysts worldwide feel that the oil industry will be able to generate profit both in short term and long term. They feel that the moment world financial crises will ease out in Europe; prices of oil will start increasing. This is a strong industry and will remain one in the long term also but the prices of oil will remain uncertain. The biggest challenge for PSO is handling of circular debt problem, this situation forced PSO to borrow from the banks resulting in payment of huge financial borrowing costs. The overall receivable of Pakistan State Oil Company (PSO) against power producers and other customers stood at Rs. 141.5 billion in February 2013 , which has created problems for PSO to arrange the products and keep the supply chain running smoothly. Out of the total receivables, HUBCO has to pay Rs, 48 billion, KAPCO R5. 20 billion and WAPDA Rs, 8 billion. Apart from the power sector, PIA has to pay Rs. 3.4 billion and Government Rs. 15 billion on the subsidy account. "PSO is the only company which is supplying fuel to the Independent Power Producers, PSO's market share of 85 percent in furnace oil indicates its vulnerability in front of the power sector. PSO has to pay over Rs 83.6 billion to international suppliers and Rs. 35 billion to local oil refineries. Sources said that PSO has stopped furnace oil supplies to power producers and have given instructions to clear their outstanding on urgent basis. Power break down at national level on February 24,2013 midnight was the result of several power producers stopping power generation which had put the entire national power distribution under great stress and overload situation was created which resulted in all grid stations tripping. The circular debt between the oil marketing companies, oil refineries and power producers is leading to supply problems. PSO is the worst sufferer as it is the only supplier to electricity generating companies, other oil marketing companies have refused to supply to power sector companies as they are aware of their financial problems. The interest cost of PSO had increased tremendously because of circular debt reducing the net income of the company in the year 2012. MD also narrated that PSO has the largest CNG stations network in Pakistan with 22.5% market share. This use to be a profitable business but now with CNG load shedding and long queues of customers waiting for gas at pumps is forcing customers to shift back towards petrol. The CNG sector has been severely hit by gas load shedding it faces longer outages and low gas pressure. According to a recent survey, 77\% car owners use CNG as a fuel, 17% use petrol while 4% use diesel. Mr. Ghiyas Paracha representative of CNG association has been criticizing the shortage of CNG and load shedding of gas. According to the Government gas reserves are depleting fast, demand is much higher than the supply resulting in CNG load-shedding and for Government priority areas are industry and power producers. The Government of Pakistan has finally given approval to lay 781km long Iran Pakistan gas pipeline which will cost \$1.5 billion. Iran will provide \$500 million credit and special equipments so Pakistan can finance and complete the pipeline on priority basis. The pipeline is expected to be completed by December 2014 and will have the capacity to deliver one billion cubic feet of gas per day. Once the gas replaces the expensive furnace oil used by independent power producer Pakistan will be saving \$ 1 billion every year. They have also offered 750,000 tons of furnace oil and 50,000 tons of LPG every month to Pakistan on long term credit basis to reduce the energy crises in Pakistan. Iran has made another generous effort to build a big refinery at Gwadar. Page24 For the case given above, i- Do Internal Factor Analysis and develop IFAS table. ii- Do External Factor Analysis and develop EFAS table. iii- Develop alternate strategies based on TOWS matrix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts