Question: SPECIAL REQUIRMENT: Answer just (b) and (c) part briefly. Consider domestic (UK) and foreign (US) government bonds with annual interest rates 0.03 and 0.02, respectively.

SPECIAL REQUIRMENT: Answer just (b) and (c) part briefly.

SPECIAL REQUIRMENT: Answer just (b) and (c) part briefly.

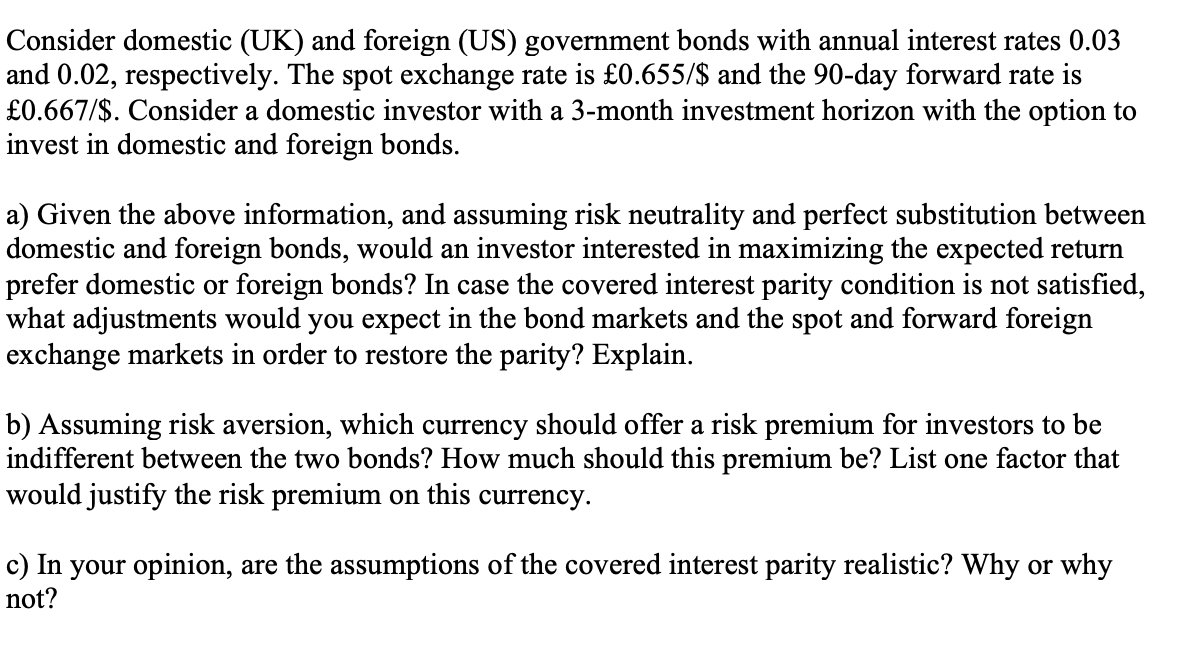

Consider domestic (UK) and foreign (US) government bonds with annual interest rates 0.03 and 0.02, respectively. The spot exchange rate is 0.655/$ and the 90-day forward rate is 0.667/$. Consider a domestic investor with a 3-month investment horizon with the option to invest in domestic and foreign bonds. a) Given the above information, and assuming risk neutrality and perfect substitution between domestic and foreign bonds, would an investor interested in maximizing the expected return prefer domestic or foreign bonds? In case the covered interest parity condition is not satisfied, what adjustments would you expect in the bond markets and the spot and forward foreign exchange markets in order to restore the parity? Explain. b) Assuming risk aversion, which currency should offer a risk premium for investors to be indifferent between the two bonds? How much should this premium be? List one factor that would justify the risk premium on this currency. c) In your opinion, are the assumptions of the covered interest parity realistic? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts