Question: Specific calculations needed for c) and d), please. 4. You obtain information on three bonds issued by the government of Canada. All bonds have a

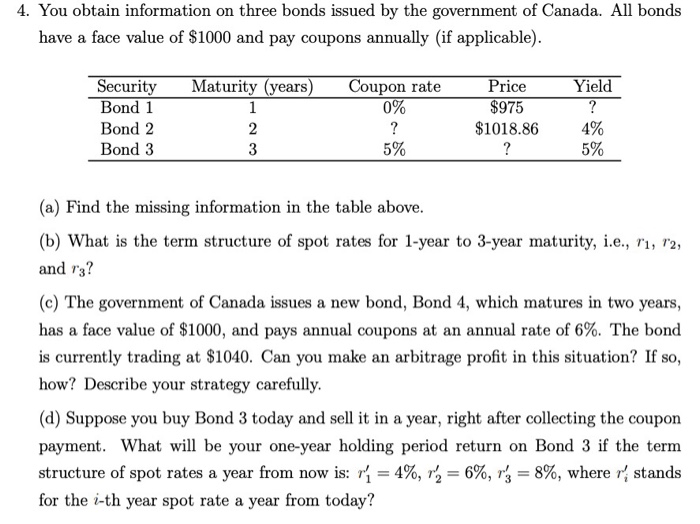

4. You obtain information on three bonds issued by the government of Canada. All bonds have a face value of $1000 and pay coupons annually (if applicable). Security Bond 1 Bond 2 Bond 3 Maturity (years) Coupon rate 0% Price $975 $1018.86 Yield 4% (a) Find the missing information in the table above (b) What is the term structure of spot rates for 1-year to 3-year maturity, i.e., r, r2, and r3? (c) The government of Canada issues a new bond, Bond 4, which matures in two years has a face value of $1000, and pays annual coupons at an annual rate of 6%. The bond is currently trading at $1040. Can you make an arbitrage profit in this situation? If so how? Describe your strategy carefully (d) Suppose you buy Bond 3 today and sel it in a year, right after collecting the coupon payment. What will be your one-year holding period return on Bond 3 if the term structure of spot rates a year from now is: r-4%,7-6%, r4-896, where r, stands for the i-th year spot rate a year from today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts