Question: specifically need help with number 3 and the variation question below it. ADD BEE:118.03-8.04 el. Ex. (1), 1.316-2(a), 1.316. Code: 55 275(a)(1), 312(a)(1), 3 l

specifically need help with number 3 and the variation question below it.

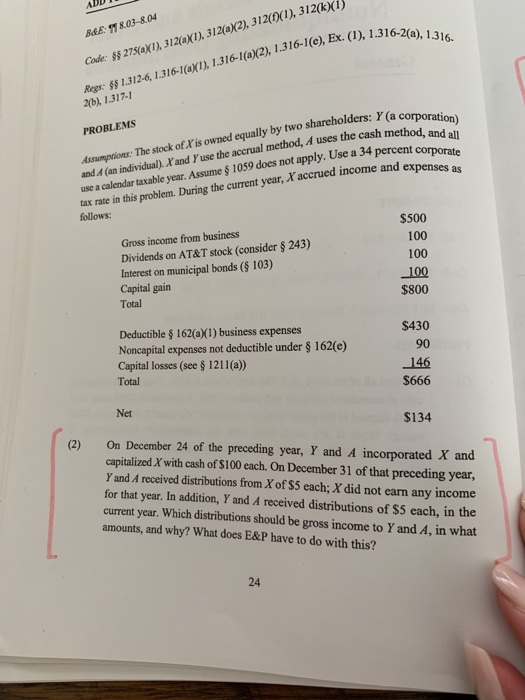

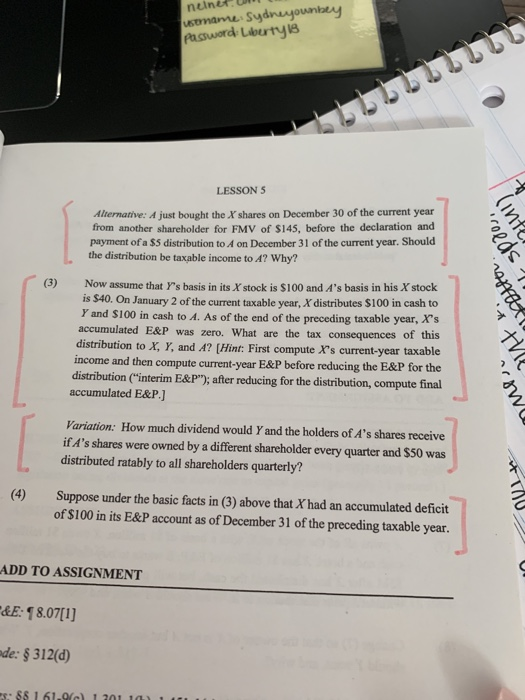

specifically need help with number 3 and the variation question below it. ADD BEE:118.03-8.04 el. Ex. (1), 1.316-2(a), 1.316. Code: 55 275(a)(1), 312(a)(1), 3 l 2(a)(2), 3 l 2()(1), 3 12(190 ) Ros:$1312-6,1316-00), 1316-1(0)12), 1.316-1e), Ex. (), 1.316. 2b),1.317-1 Assrumptions: The stock of.J'is owned equally by two shareholders: Y(a and.A (an individual),X'and 'use the accrual method, A uses the cash use a calendar taxable year. Assume $ 1059 does not apply. Use a 34 tax rate in this problem. During the current year, J'a PROBLEMS percent corporate Durins the current year, X accrued income and expenses as $500 Gross income from business 100 100 Dividends on AT&T stock (consider $ 243) Interest on municipal bonds ( 103) Capital gain 100 $800 Total Deductible $ 162(aX1) business expenses Noncapital expenses not deductible under Capital losses (see $ 1211(a) Total $430 90 146 $666 162(e) Net $134 (2) On December 24 of the preceding year, Y and A incorporated X and capitalized X with cash of $100 each. On December 31 of that preceding year, Y and A received distributions from Xof $5 each; X did not earn any income for that year. In addition, Y and A received distributions of $5 each, in the current year. Which distributions should be gross income to Y and A, in what amounts, and why? What does E&P have to do with this? 24 neine Sudnaxyounbuy Password Liburty LESSON 5 Alternative: A just bought the X shares on December 30 of the current year from another shareholder for FMV of $145, before the declaration and payment of a $5 distribution to A on December 31 of the current year. Should the distribution be taxable income to A? Why? ( Now assume that Y's basis in its Istock is S100 and A's basis in his X' stock is $40. On January 2 of the current taxable year, X distributes $100 in cash to Y and $100 in cash to A. As of the end of the preceding taxable year, X's accumulated E&P was zero. What are the tax consequences of this distribution to X, Y, and A? (Hint: First compute X's current-year taxable income and then compute current-year E&P before reducing the E&P for the distribution ("interim E&P"); after reducing for the distribution, compute final accumulated E&P.] Variation: How much dividend would Y and the holders of A's shares receive if A's shares were owned by a different shareholder every quarter and $50 was distributed ratably to all shareholders quarterly? (4) Suppose under the basic facts in (3) above that X had an accumulated deficit of $100 in its E&P account as of December 31 of the preceding taxable year. ADD TO ASSIGNMENT &E: 18.07[1] de: $312(d) ADD BEE:118.03-8.04 el. Ex. (1), 1.316-2(a), 1.316. Code: 55 275(a)(1), 312(a)(1), 3 l 2(a)(2), 3 l 2()(1), 3 12(190 ) Ros:$1312-6,1316-00), 1316-1(0)12), 1.316-1e), Ex. (), 1.316. 2b),1.317-1 Assrumptions: The stock of.J'is owned equally by two shareholders: Y(a and.A (an individual),X'and 'use the accrual method, A uses the cash use a calendar taxable year. Assume $ 1059 does not apply. Use a 34 tax rate in this problem. During the current year, J'a PROBLEMS percent corporate Durins the current year, X accrued income and expenses as $500 Gross income from business 100 100 Dividends on AT&T stock (consider $ 243) Interest on municipal bonds ( 103) Capital gain 100 $800 Total Deductible $ 162(aX1) business expenses Noncapital expenses not deductible under Capital losses (see $ 1211(a) Total $430 90 146 $666 162(e) Net $134 (2) On December 24 of the preceding year, Y and A incorporated X and capitalized X with cash of $100 each. On December 31 of that preceding year, Y and A received distributions from Xof $5 each; X did not earn any income for that year. In addition, Y and A received distributions of $5 each, in the current year. Which distributions should be gross income to Y and A, in what amounts, and why? What does E&P have to do with this? 24 neine Sudnaxyounbuy Password Liburty LESSON 5 Alternative: A just bought the X shares on December 30 of the current year from another shareholder for FMV of $145, before the declaration and payment of a $5 distribution to A on December 31 of the current year. Should the distribution be taxable income to A? Why? ( Now assume that Y's basis in its Istock is S100 and A's basis in his X' stock is $40. On January 2 of the current taxable year, X distributes $100 in cash to Y and $100 in cash to A. As of the end of the preceding taxable year, X's accumulated E&P was zero. What are the tax consequences of this distribution to X, Y, and A? (Hint: First compute X's current-year taxable income and then compute current-year E&P before reducing the E&P for the distribution ("interim E&P"); after reducing for the distribution, compute final accumulated E&P.] Variation: How much dividend would Y and the holders of A's shares receive if A's shares were owned by a different shareholder every quarter and $50 was distributed ratably to all shareholders quarterly? (4) Suppose under the basic facts in (3) above that X had an accumulated deficit of $100 in its E&P account as of December 31 of the preceding taxable year. ADD TO ASSIGNMENT &E: 18.07[1] de: $312(d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts