Question: Spencer traded its old machine for a newer model on January 1, 2020. The old machine was purchased on January 1, 2016 at a cost

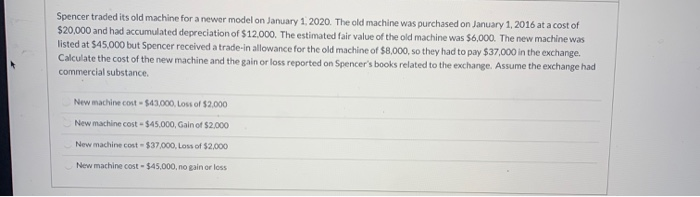

Spencer traded its old machine for a newer model on January 1, 2020. The old machine was purchased on January 1, 2016 at a cost of $20,000 and had accumulated depreciation of $12,000. The estimated fair value of the old machine was $6,000. The new machine was listed at $45,000 but Spencer received a trade-in allowance for the old machine of $8,000, so they had to pay $37,000 in the exchange. Calculate the cost of the new machine and the gain or loss reported on Spencer's books related to the exchange. Assume the exchange had commercial substance New machine cost-$43.000 loss of $2.000 New machine cost - $45.000, Gain of $2.000 New machine cost - $37.000, Loss of $2,000 New machine cost - $45.000, no gain or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts