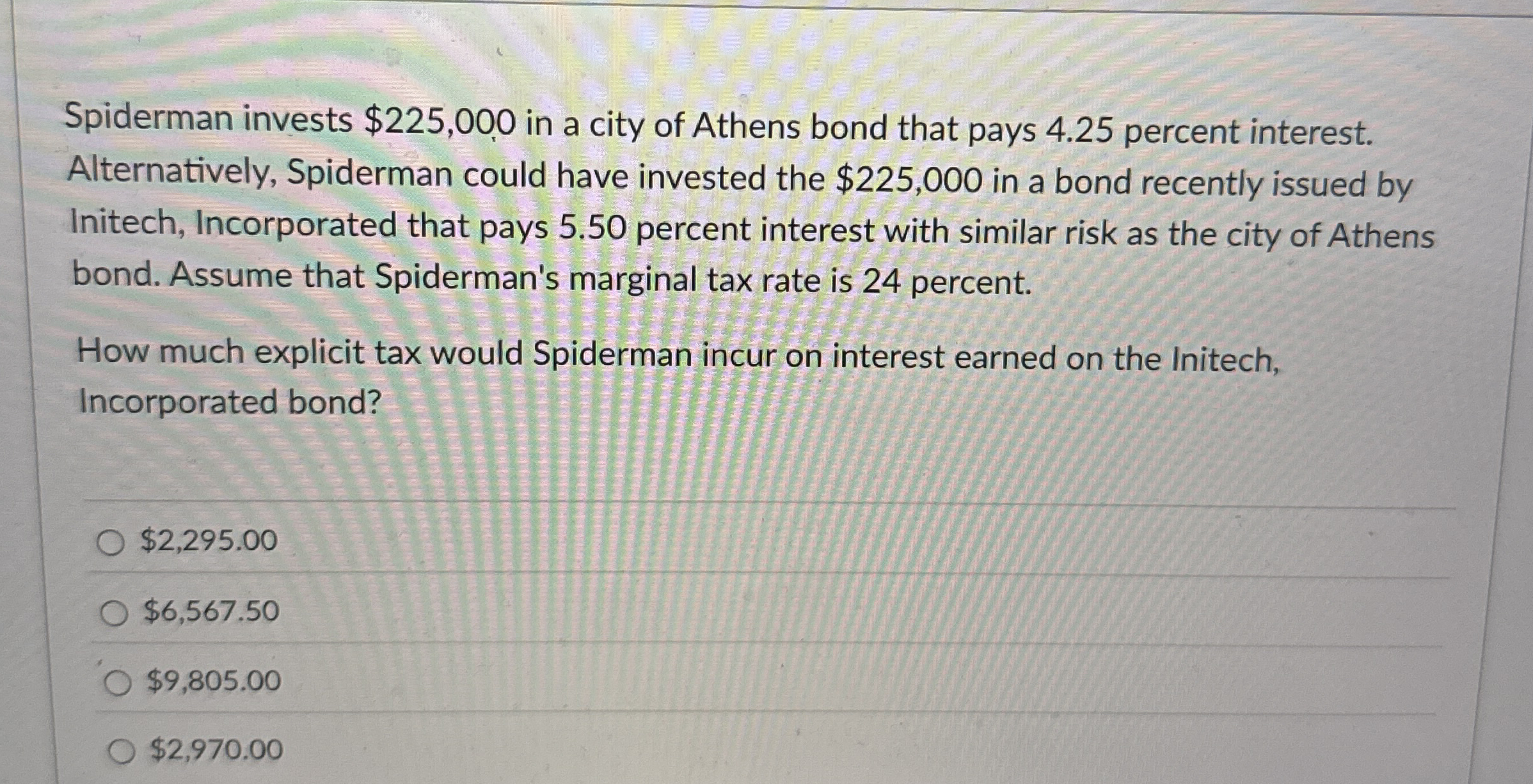

Question: Spiderman invests $ 2 2 5 , 0 0 0 in a city of Athens bond that pays 4 . 2 5 percent interest. Alternatively,

Spiderman invests $ in a city of Athens bond that pays percent interest. Alternatively, Spiderman could have invested the $ in a bond recently issued by Initech, Incorporated that pays percent interest with similar risk as the city of Athens bond. Assume that Spiderman's marginal tax rate is percent.

How much explicit tax would Spiderman incur on interest earned on the Initech, Incorporated bond?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock