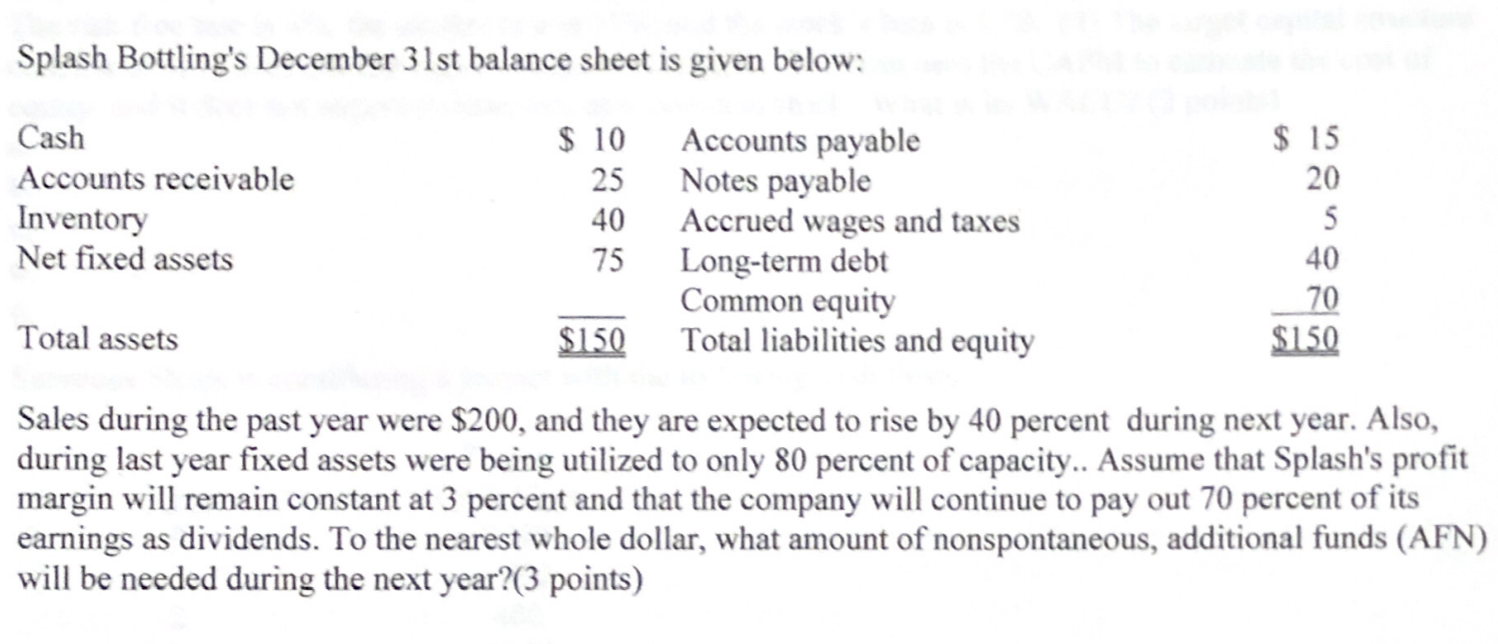

Question: Splash Bottling's December 31st balance sheet is given below: $ 15 Cash Accounts receivable Inventory Net fixed assets $ 10 25 40 75 Accounts payable

Splash Bottling's December 31st balance sheet is given below: $ 15 Cash Accounts receivable Inventory Net fixed assets $ 10 25 40 75 Accounts payable Notes payable Accrued wages and taxes Long-term debt Common equity Total liabilities and equity 70 Total assets $150 $150 Sales during the past year were $200, and they are expected to rise by 40 percent during next year. Also, during last year fixed assets were being utilized to only 80 percent of capacity.. Assume that Splash's profit margin will remain constant at 3 percent and that the company will continue to pay out 70 percent of its earnings as dividends. To the nearest whole dollar, what amount of nonspontaneous, additional funds (AFN) will be needed during the next year?(3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts