Question: Splendid Candy Company is considering purchasing a second chocolate dipping machine in order to expand its business. The information Splendid has accumulated regarding the new

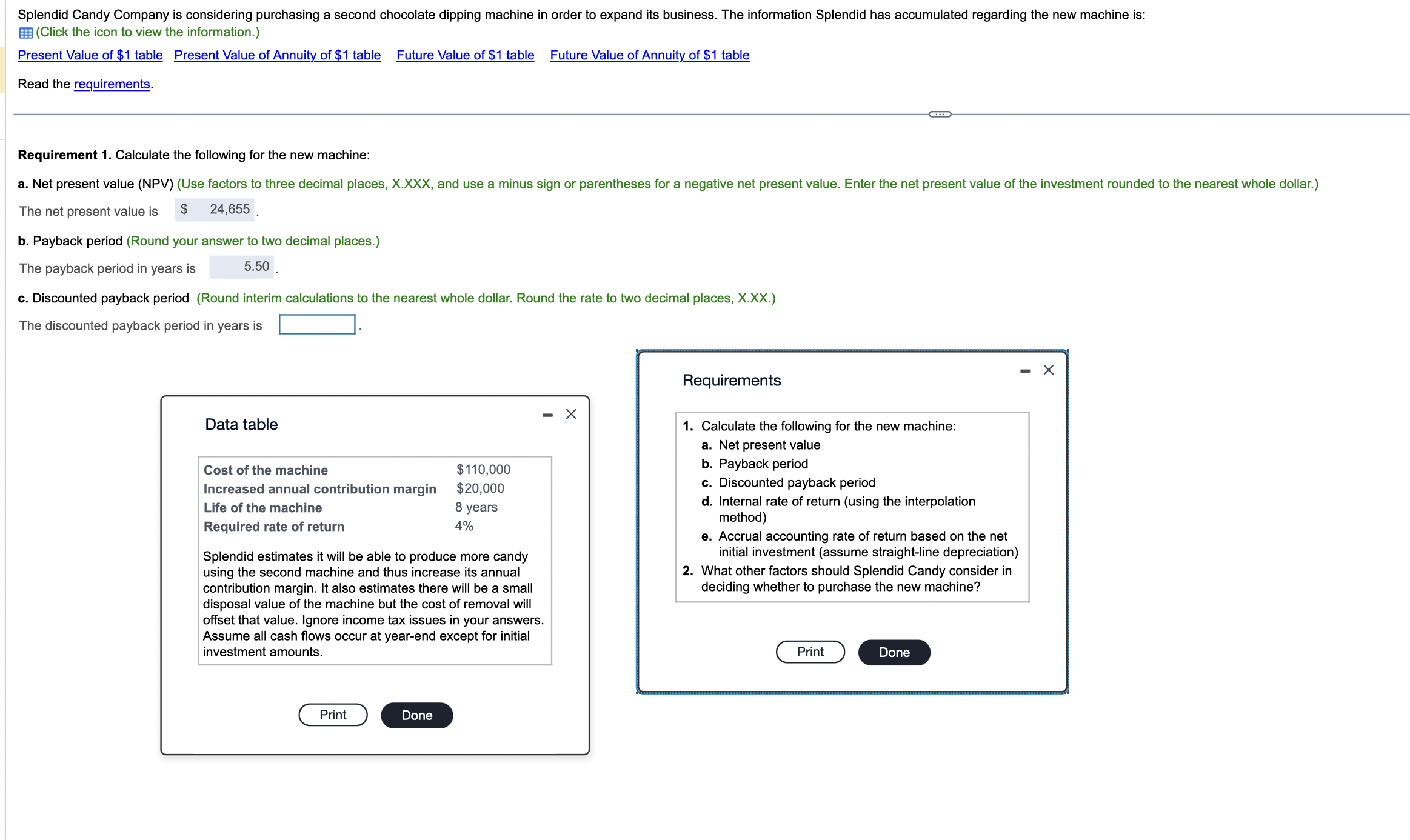

Splendid Candy Company is considering purchasing a second chocolate dipping machine in order to expand its business. The information Splendid has accumulated regarding the new machine is: (Click the icon to view the information.) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. Requirement 1. Calculate the following for the new machine: The net present value is b. Payback period (Round your answer to two decimal places.) The payback period in years is c. Discounted payback period (Round interim calculations to the nearest whole dollar. Round the rate to two decimal places, X.XX.) The discounted payback period in years is Requirements 1. Calculate the following for the new machine: a. Net present value b. Payback period c. Discounted payback period d. Internal rate of return (using the interpolation method) e. Accrual accounting rate of return based on the net initial investment (assume straight-line depreciation) 2. What other factors should Splendid Candy consider in deciding whether to purchase the new machine? disposal value of the machine but the cost of removal will offset that value. Ignore income tax issues in your answers. Assume all cash flows occur at year-end except for initial investment amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts