Question: Splendid estimates it will be able to produce more candy using the second machine and thus increase its annual contribution margin. It also estimates there

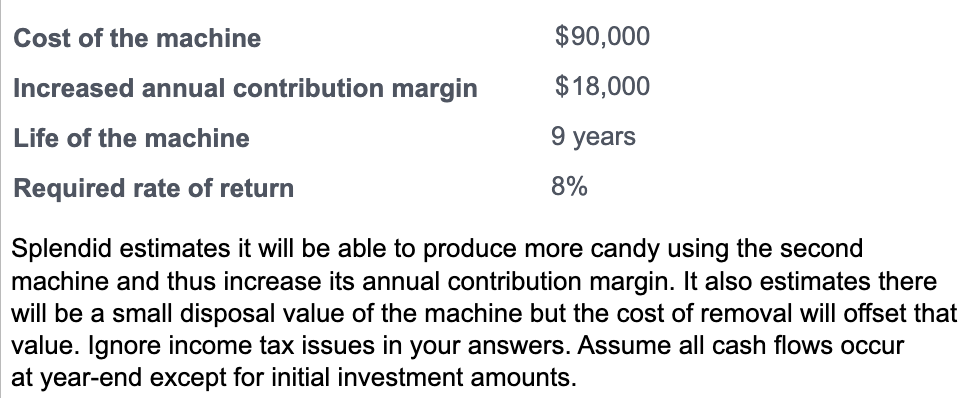

Splendid estimates it will be able to produce more candy using the second machine and thus increase its annual contribution margin. It also estimates there will be a small disposal value of the machine but the cost of removal will offset that value. Ignore income tax issues in your answers. Assume all cash flows occur at year-end except for initial investment amounts. Splendid Candy Company is considering purchasing a second chocolate dipping machine in order to expand its business. The information Splendid has accumulated regarding the new machine is: (Click the icon to view the information.) Read the requirements. Requirement 1. Calculate the following for the new machine: a. Net present value (NPV) (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts