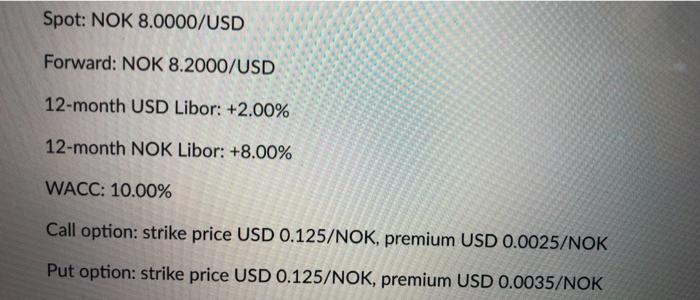

Question: Spot: NOK 8.0000/USD Forward: NOK 8.2000/USD 12-month USD Libor: +2.00% 12-month NOK Libor: +8.00% WACC: 10.00% Call option: strike price USD 0.125/NOK, premium USD 0.0025/NOK

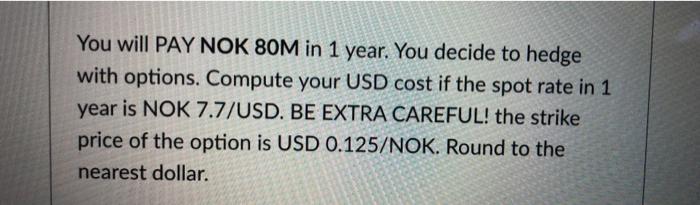

Spot: NOK 8.0000/USD Forward: NOK 8.2000/USD 12-month USD Libor: +2.00% 12-month NOK Libor: +8.00% WACC: 10.00% Call option: strike price USD 0.125/NOK, premium USD 0.0025/NOK Put option: strike price USD 0.125/NOK, premium USD 0.0035/NOK You will PAY NOK 80M in 1 year. You decide to hedge with options. Compute your USD cost if the spot rate in 1 year is NOK 7.7/USD. BE EXTRA CAREFUL! the strike price of the option is USD 0.125/NOK. Round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts