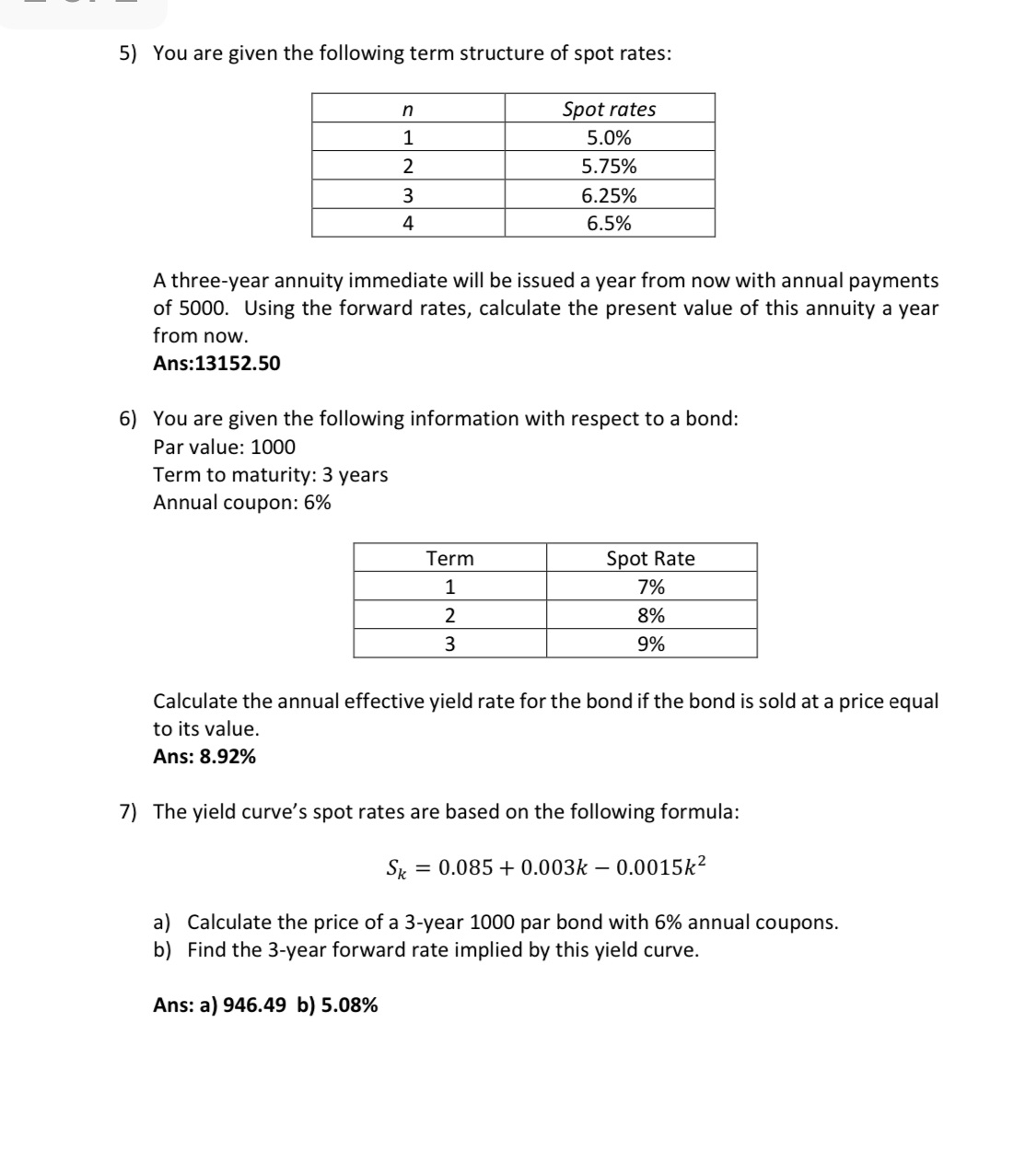

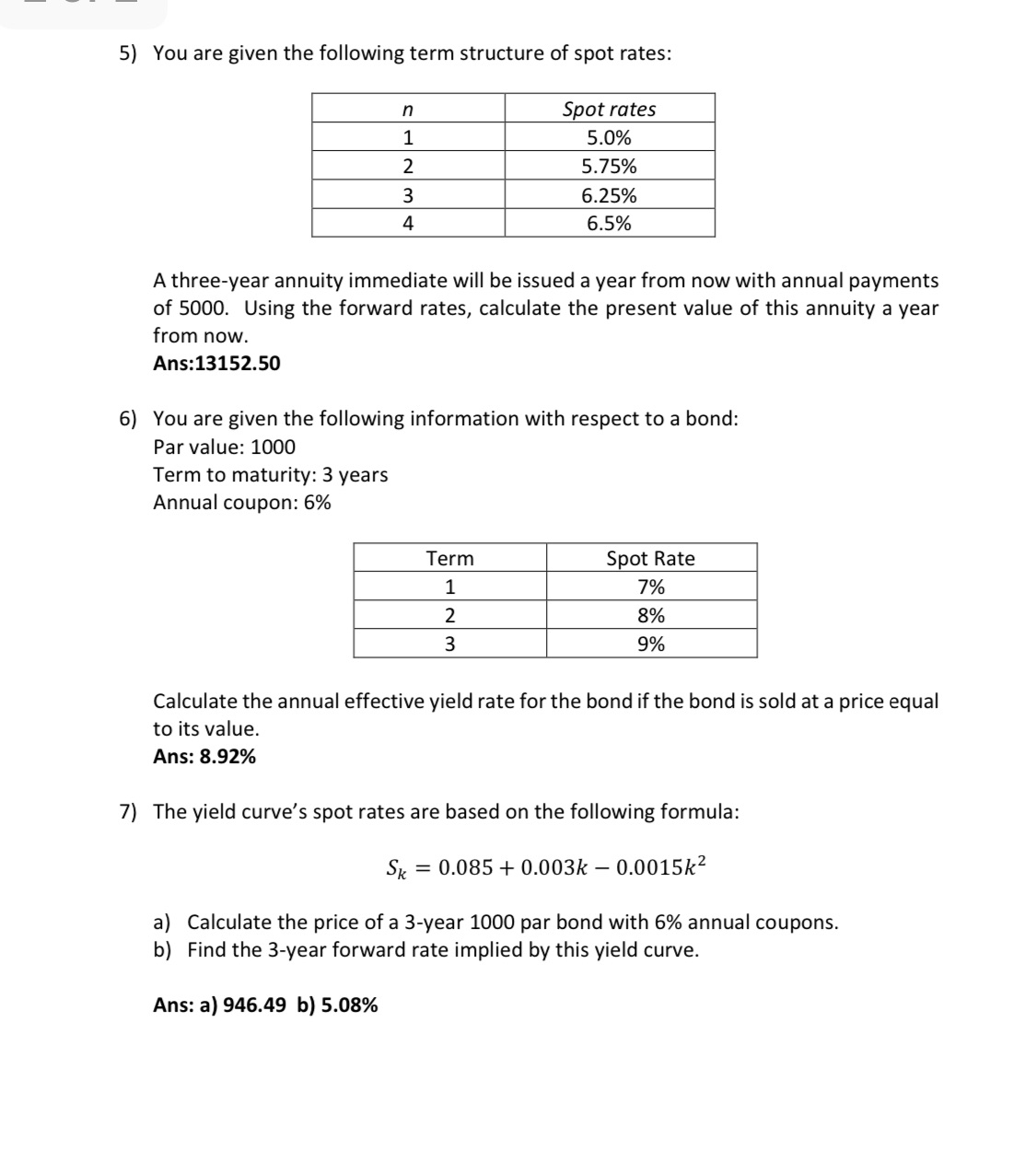

Question: Spot rates 5.0% 5.75% A three-year annuity immediate will be issued a year from now with annual payments of 5000. Using the forward rates, calculate

Spot rates 5.0% 5.75% A three-year annuity immediate will be issued a year from now with annual payments of 5000. Using the forward rates, calculate the present value of this annuity a year from now. Ans:13152.50 6) You are given the following information with respect to a bond: Par value: 1000 Term to maturity: 3 years Annual coupon: 6% Calculate the annual effective yield rate for the bond if the bond is sold at a price equal to its value. Ans: 8.92% 7) The yield curve's spot rates are based on the following formula: 5,; = 0.085 + 0.003k 0.00151:2 a) Calculate the price ofa 3-year 1000 par bond with 5% annual coupons. b) Find the 3-year forward rate implied by this yield curve. Ans: a) 946.49 b) 5.08%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts