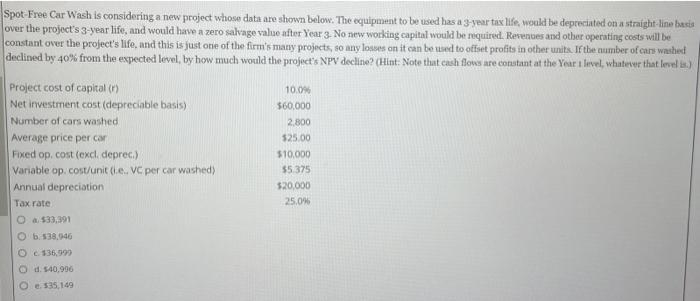

Question: Spot-Eree Car Wash is considering a new project whose data are shown below. The equipment to be used has a 3 -year tax life, would

Spot-Eree Car Wash is considering a new project whose data are shown below. The equipment to be used has a 3 -year tax life, would be depreciated on a straight-line hasia over the project's 3-year life, and would have a zero satvage value after Yeur 3- No new working capital would be required. Rerenues and other operating costs will be constant over the project's life. and this is just one of the firm's many projects, so any losses an it can be wed to offset profits in other units. If the aumber of curs washed declined by 40% from the expected level, by how much would the project's NPV decline? (Hint: Note that cash flows are constant at the Year i lisel, whaterer that lenel is.) a) 533,391 b. 139.946 c. 136.979 d. 540,996 e. 335,149

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts