Question: Spot-Free Car Wash is considering a new project whose life is 3 years. The initial equipment cost is $60,000 which is depreciated by $20,000 each

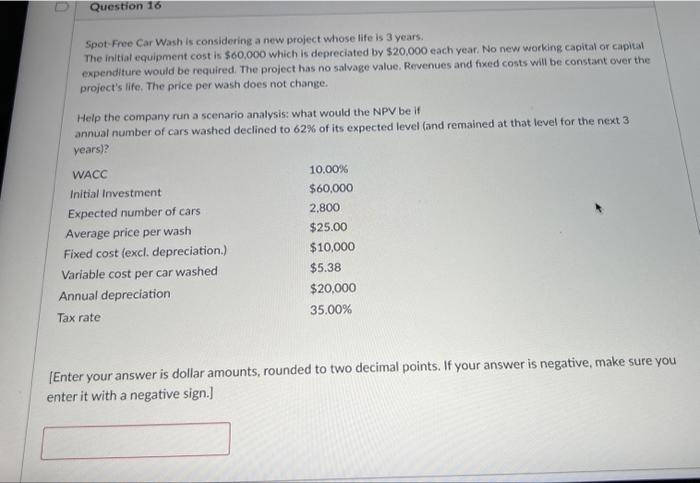

Spot-Free Car Wash is considering a new project whose life is 3 years. The initial equipment cost is $60,000 which is depreciated by $20,000 each year. No new working capital or capital expenditure would be required. The project has no salvage value. Revenues and fixed costs will be constant over the project's life. The price per wash does not chante. Help the company run a scenario analysis: what would the NPV be if annual number of cars washed declined to 62% of its expected level (and remained at that level for the next 3 years)? EEnter your answer is dollar amounts, rounded to two decimal points. If your answer is negative, make sure you enter it with a negative sign.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts