Question: Spreadsheet Exercise: Chapter 4 You have been assigned the task of putting together a statement for the ACME Company that shows its expected inflows and

| Spreadsheet Exercise: Chapter 4 | ||||||||

| You have been assigned the task of putting together a statement for the ACME Company that shows its expected inflows and outflows of cash over the months of July 2023 through December 2023. | ||||||||

| You have been given the following data for ACME Company: | ||||||||

| 1 | Expected gross sales for May through December, respectively, are $300,000, $290,000, $425,000, $500,000, $600,000, $625,000, $650,000, and $700,000. | |||||||

| 2 | 12% of the sales in any given month are collected during that month. However, the firm has a credit policy of 3/10 net 30, so factor a 3% discount into the current months sales collection. | |||||||

| 3 | 75% of the sales in any given month are collected during the following month after the sale. | |||||||

| 4 | 13% of the sales in any given month are collected during the second month following the sale. | |||||||

| 5 | The expected purchases of raw materials in any given month are based on 60% of the expected sales during the following month. | |||||||

| 6 | The firm pays 100% of its current months raw materials purchases in the following month. | |||||||

| 7 | Wages and salaries are paid on a monthly basis and are based on 6% of the current months expected sales. | |||||||

| 8 | Monthly lease payments are 2% of the current months expected sales. | |||||||

| 9 | The monthly advertising expense amounts to 3% of sales. | |||||||

| 10 | R&D expenditures are expected to be allocated to August, September, and October at the rate of 12% of sales in those months. | |||||||

| 11 | During December a prepayment of insurance for the following year will be made in the amount of $24,000. | |||||||

| 12 | During the months of July through December, the firm expects to have miscellaneous expenditures of $15,000, $20,000, $25,000, $30,000, $35,000, and $40,000, respectively. | |||||||

| 13 | Taxes will be paid in September in the amount of $40,000 and in December in the amount of $45,000. | |||||||

| 14 | The beginning cash balance in July is $15,000. | |||||||

| 15 | The target cash balance is $15,000. | |||||||

| To Do | ||||||||

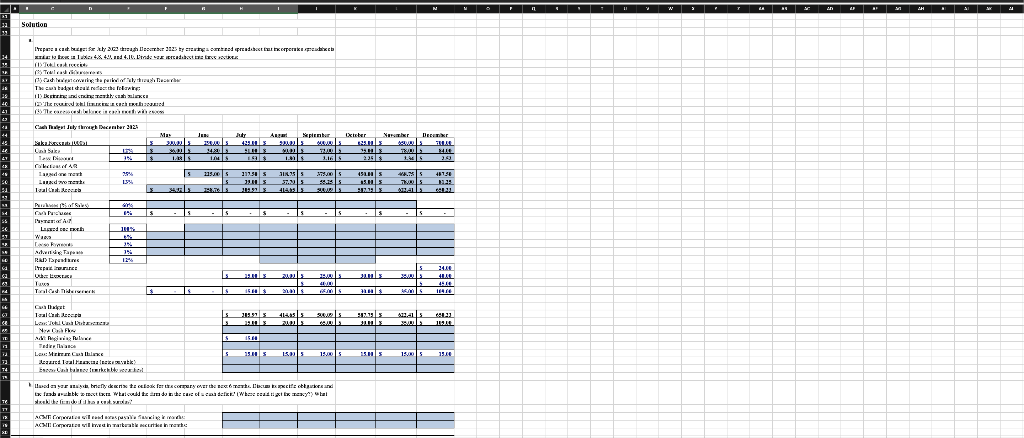

| a. | Prepare a cash budget for July 2023 through December 2023 by creating a combined spreadsheet that incorporates spreadsheets similar to those in Tables 4.8, 4.9, and 4.10. Divide your spreadsheet into three sections: | |||||||

| (1) Total cash receipts | ||||||||

| (2) Total cash disbursements | ||||||||

| (3) Cash budget covering the period of July through December | ||||||||

| The cash budget should reflect the following: | ||||||||

| (1) Beginning and ending monthly cash balances | ||||||||

| (2) The required total financing in each month required | ||||||||

| (3) The excess cash balance in each month with excess | ||||||||

| b. | Based on your analysis, briefly describe the outlook for this company over the next 6 months. Discuss its specific obligations and the funds available to meet them. What could the firm do in the case of a cash deficit? (Where could it get the money?) What should the firm do if it has a cash surplus? | |||||||

Please answer in cell reference. (=xx/xx).

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock