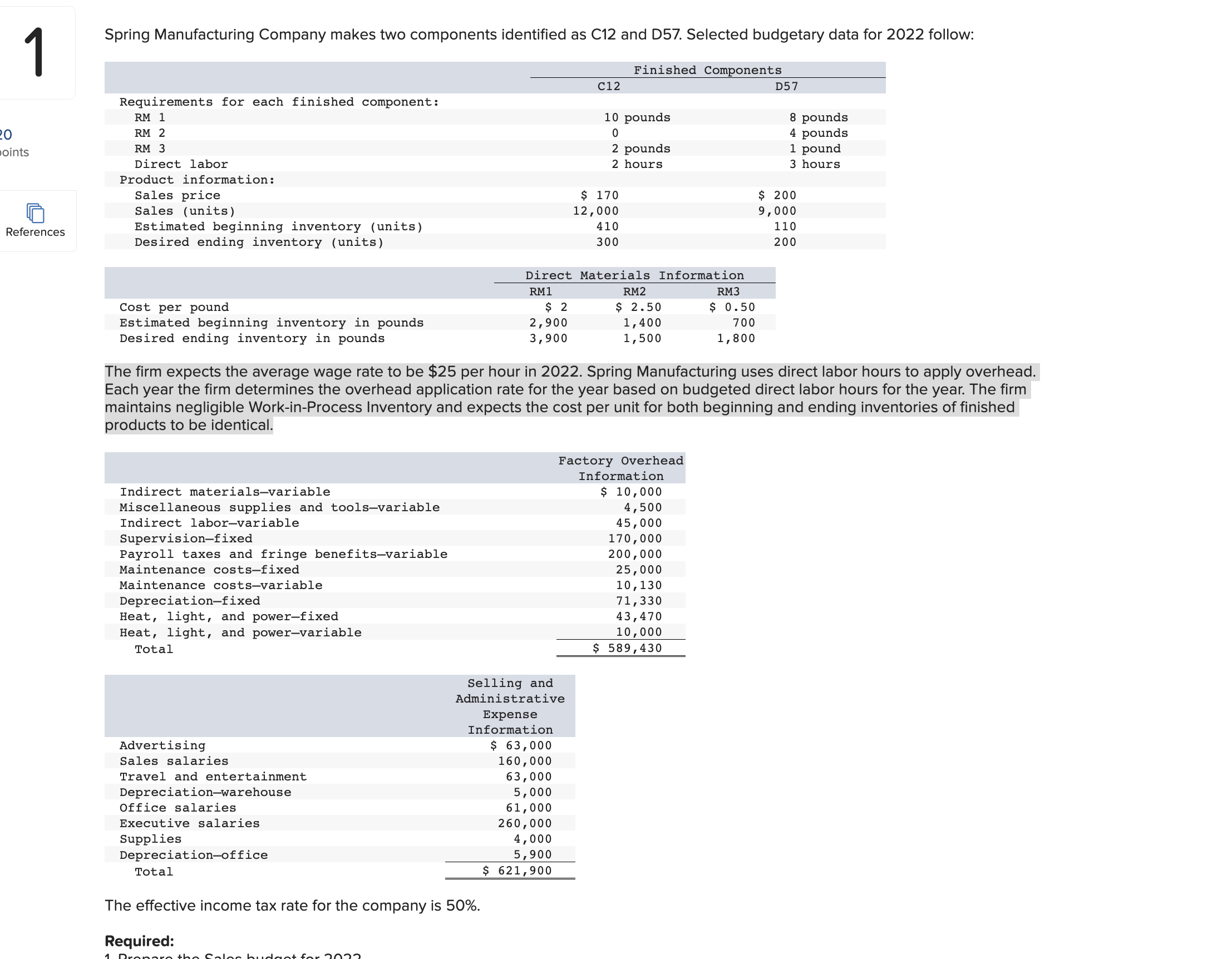

Question: Spring Manufacturing Company makes two components identified as C12 and D57. Selected budgetary data for 2022 follow: The firm expects the average wage rate to

Spring Manufacturing Company makes two components identified as C12 and D57. Selected budgetary data for 2022 follow:

The firm expects the average wage rate to be $25 per hour in 2022. Spring Manufacturing uses direct labor hours to apply overhead. Each year the firm determines the overhead application rate for the year based on budgeted direct labor hours for the year. The firm maintains negligible Work-in-Process Inventory and expects the cost per unit for both beginning and ending inventories of finished products to be identical.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock