Question: Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not

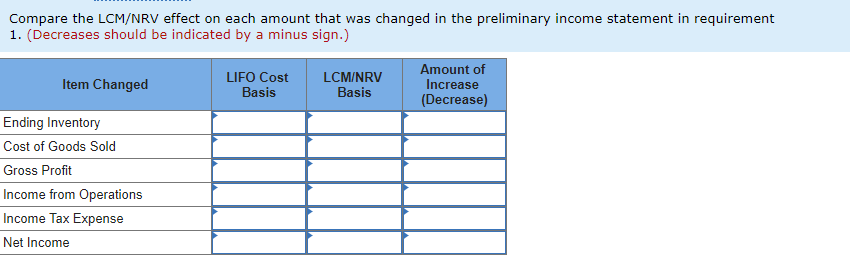

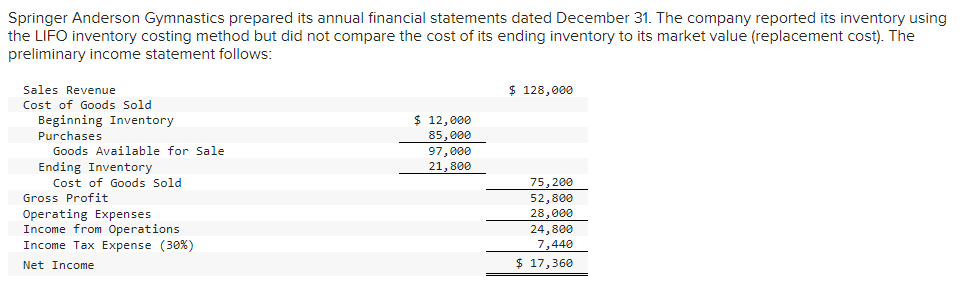

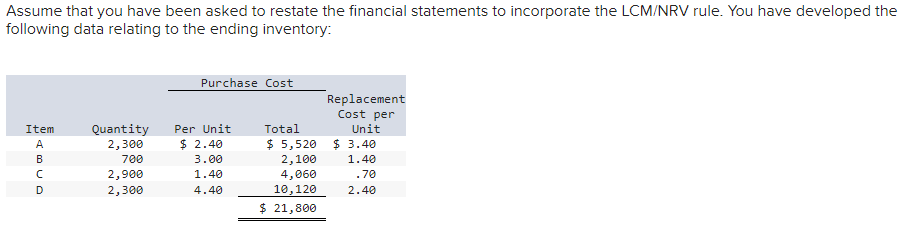

Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. (Decreases should be indicated by a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts