Question: Square is evaluating how to finance their new project. Square expects to receive operating cash flow of $ 2000 and tax rate is 40%.

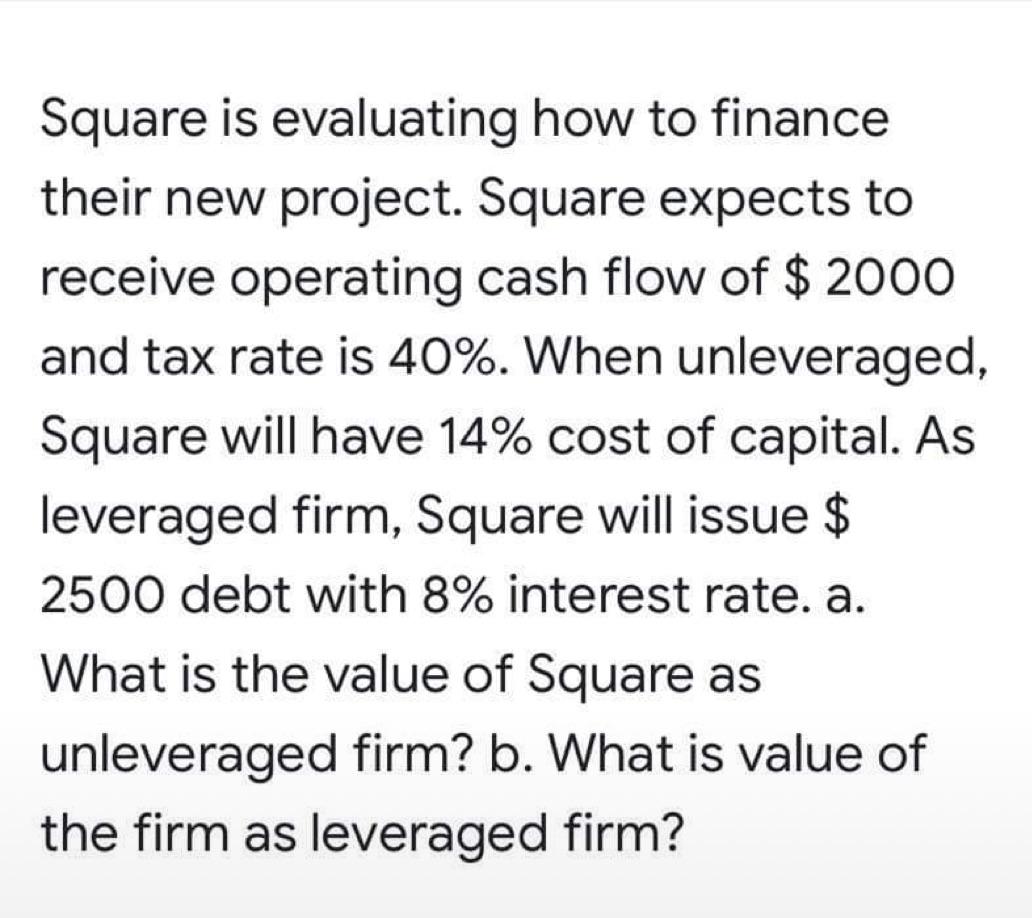

Square is evaluating how to finance their new project. Square expects to receive operating cash flow of $ 2000 and tax rate is 40%. When unleveraged, Square will have 14% cost of capital. As leveraged firm, Square will issue $ 2500 debt with 8% interest rate. a. What is the value of Square as unleveraged firm? b. What is value of the firm as leveraged firm?

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

To calculate the value of the firm under different leverage scenarios we can use the ModiglianiMille... View full answer

Get step-by-step solutions from verified subject matter experts