Question: SR APSC 221 Assignment 2... APSC 221: Assignment 2 Winter 2024 Page 3 of 4 Question 5: Dealing with Uncertainty and Risk (11.25 marks) You

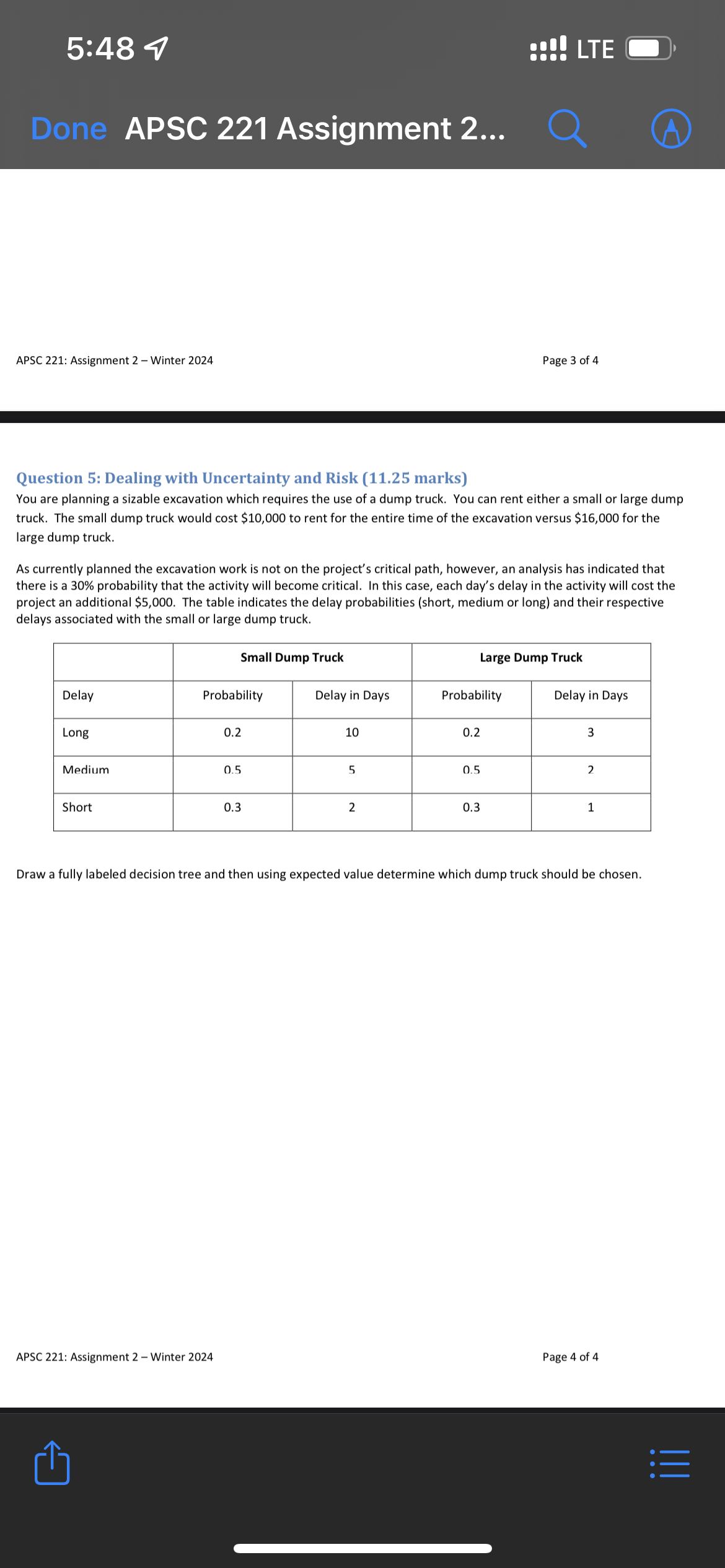

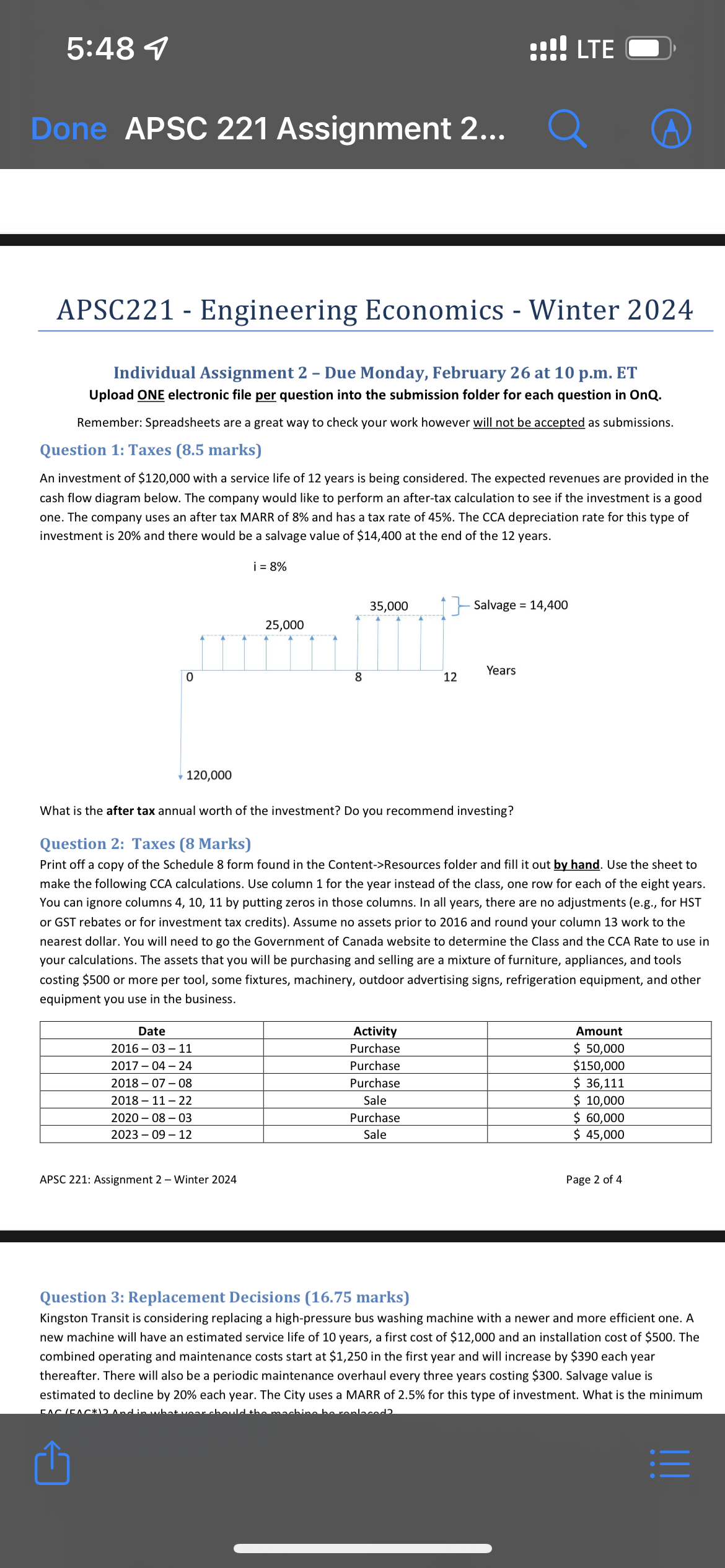

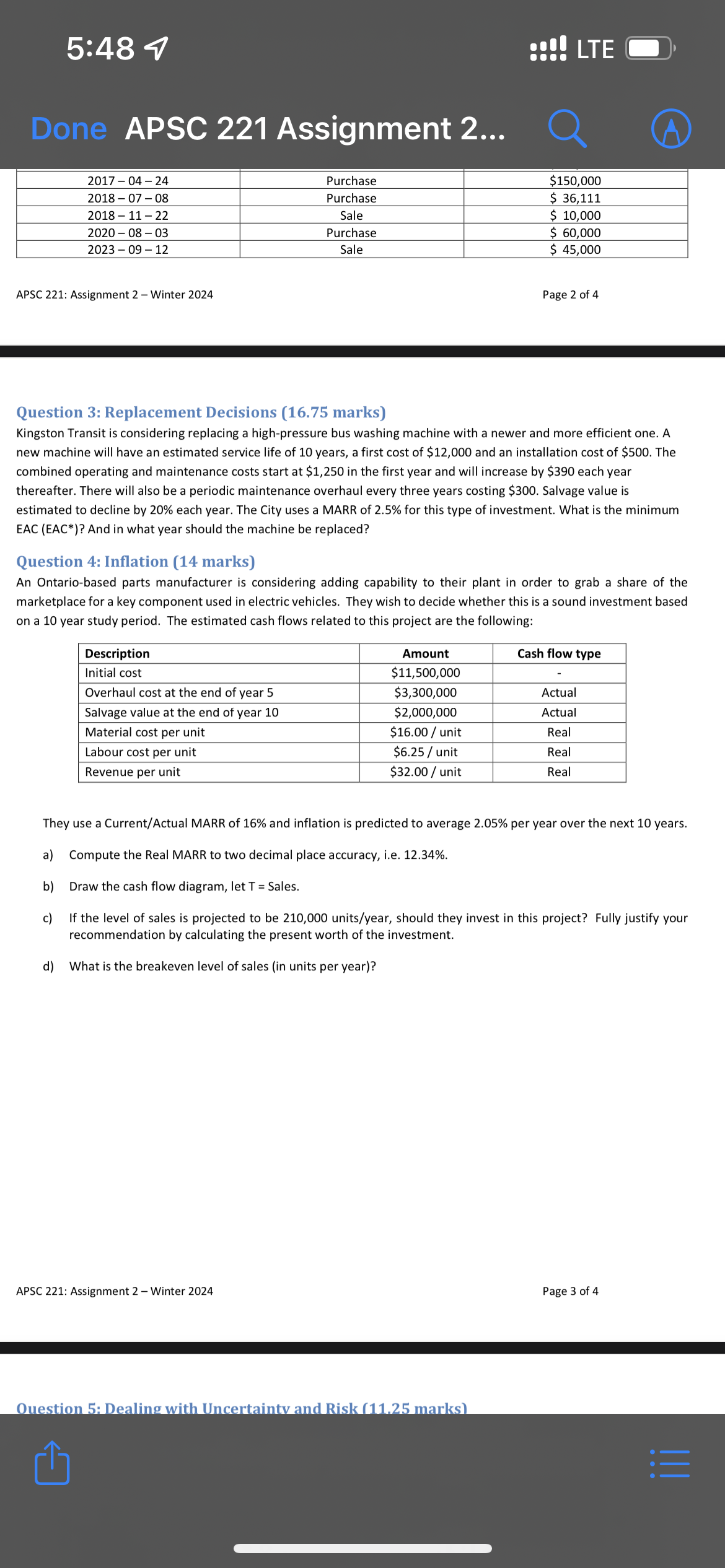

SR APSC 221 Assignment 2... APSC 221: Assignment 2 Winter 2024 Page 3 of 4 Question 5: Dealing with Uncertainty and Risk (11.25 marks) You are planning a sizable excavation which requires the use of a dump truck. You can rent either a small or large dump truck. The small dump truck would cost $10,000 to rent for the entire time of the excavation versus $16,000 for the large dump truck. As currently planned the excavation work is not on the project's critical path, however, an analysis has indicated that there is a 30% probability that the activity will become critical. In this case, each day's delay in the activity will cost the project an additional $5,000. The table indicates the delay probabilities (short, medium or long) and their respective delays associated with the small or large dump truck. Small Dump Truck Large Dump Truck Delay Probability Delay in Days Probability Delay in Days Long 0.2 10 0.2 3 Medium 0.5 5 0.5 2 Short 03 2 03 1 Draw a fully labeled decision tree and then using expected value determine which dump truck should be chosen. APSC 221: Assignment 2 Winter 2024 Page 4 of 4 SR APSC 221 Assignment 2... APSC221 - Engineering Economics - Winter 2024 Individual Assignment 2 - Due Monday, February 26 at 10 p.m. ET Upload ONE electronic file per question into the submission folder for each question in OnQ. Remember: Spreadsheets are a great way to check your work however will not be accepted as submissions. Question 1: Taxes (8.5 marks) An investment of $120,000 with a service life of 12 years is being considered. The expected revenues are provided in the cash flow diagram below. The company would like to perform an after-tax calculation to see if the investment is a good one. The company uses an after tax MARR of 8% and has a tax rate of 45%. The CCA depreciation rate for this type of investment is 20% and there would be a salvage value of $14,400 at the end of the 12 years. i=8% 35,000 t _} Salvage = 14,400 i Years + 120,000 What is the after tax annual worth of the investment? Do you recommend investing? Question 2: Taxes (8 Marks) Print off a copy of the Schedule 8 form found in the Content->Resources folder and fill it out by hand. Use the sheet to make the following CCA calculations. Use column 1 for the year instead of the class, one row for each of the eight years. You can ignore columns 4, 10, 11 by putting zeros in those columns. In all years, there are no adjustments (e.g., for HST or GST rebates or for investment tax credits). Assume no assets prior to 2016 and round your column 13 work to the nearest dollar. You will need to go the Government of Canada website to determine the Class and the CCA Rate to use in your calculations. The assets that you will be purchasing and selling are a mixture of furniture, appliances, and tools costing $500 or more per tool, some fixtures, machinery, outdoor advertising signs, refrigeration equipment, and other equipment you use in the business. Date Activity Amount 2016-03-11 Purchase S 50,000 2017 -04-24 Purchase $150,000 2018-07-08 Purchase $ 36,111 2018-11-22 Sale $ 10,000 2020-0803 Purchase $ 60,000 2023 -09-12 Sale $ 45,000 APSC 221: Assignment 2 Winter 2024 Page2 of 4 Question 3: Replacement Decisions (16.75 marks) Kingston Transit is considering replacing a high-pressure bus washing machine with a newer and more efficient one. A new machine will have an estimated service life of 10 years, a first cost of $12,000 and an installation cost of $500. The combined operating and maintenance costs start at $1,250 in the first year and will increase by $390 each year thereafter. There will also be a periodic maintenance overhaul every three years costing $300. Salvage value is estimated to decline by 20% each year. The City uses a MARR of 2.5% for this type of investment. What is the minimum SN A SRR B APSC 221 Assignment 2... 2017-04-24 Purchase $150,000 2018-07-08 Purchase S 36,111 2018-11-22 Sale $ 10,000 2020-08 03 Purchase S 60,000 2023 -09-12 Sale $ 45,000 APSC 221: Assignment 2 Winter 2024 Page2 of 4 Question 3: Replacement Decisions (16.75 marks) Kingston Transit is considering replacing a high-pressure bus washing machine with a newer and more efficient one. A new machine will have an estimated service life of 10 years, a first cost of $12,000 and an installation cost of $500. The combined operating and maintenance costs start at $1,250 in the first year and will increase by $390 each year thereafter. There will also be a periodic maintenance overhaul every three years costing $300. Salvage value is estimated to decline by 20% each year. The City uses a MARR of 2.5% for this type of investment. What is the minimum EAC (EAC*)? And in what year should the machine be replaced? Question 4: Inflation (14 marks) An Ontario-based parts manufacturer is considering adding capability to their plant in order to grab a share of the marketplace for a key component used in electric vehicles. They wish to decide whether this is a sound investment based on a 10 year study period. The estimated cash flows related to this project are the following: Description Amount Cash flow type Initial cost $11,500,000 2 Overhaul cost at the end of year 5 3,300,000 Actual Salvage value at the end of year 10 $2,000,000 Actual Material cost per unit $16.00 / unit Real Labour cost per unit $6.25 / unit Real Revenue per unit $32.00 / unit Real They use a Current/Actual MARR of 16% and inflation is predicted to average 2.05% per year over the next 10 years. a) Compute the Real MARR to two decimal place accuracy, i.e. 12.34%. b) Draw the cash flow diagram, let T = Sales. c) If the level of sales is projected to be 210,000 units/year, should they invest in this project? Fully justify your recommendation by calculating the present worth of the investment. d) Whatis the breakeven level of sales (in units per year)? APSC 221: Assignment 2 Winter 2024 Page 3 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts