Question: ssignment Saved E2-5 (Algo) Determining Financial Statement Effects of Several Transactions LO2-1, 2-3 Nike, Incorporated, with headquarters in Beaverton, Oregon, is one of the world's

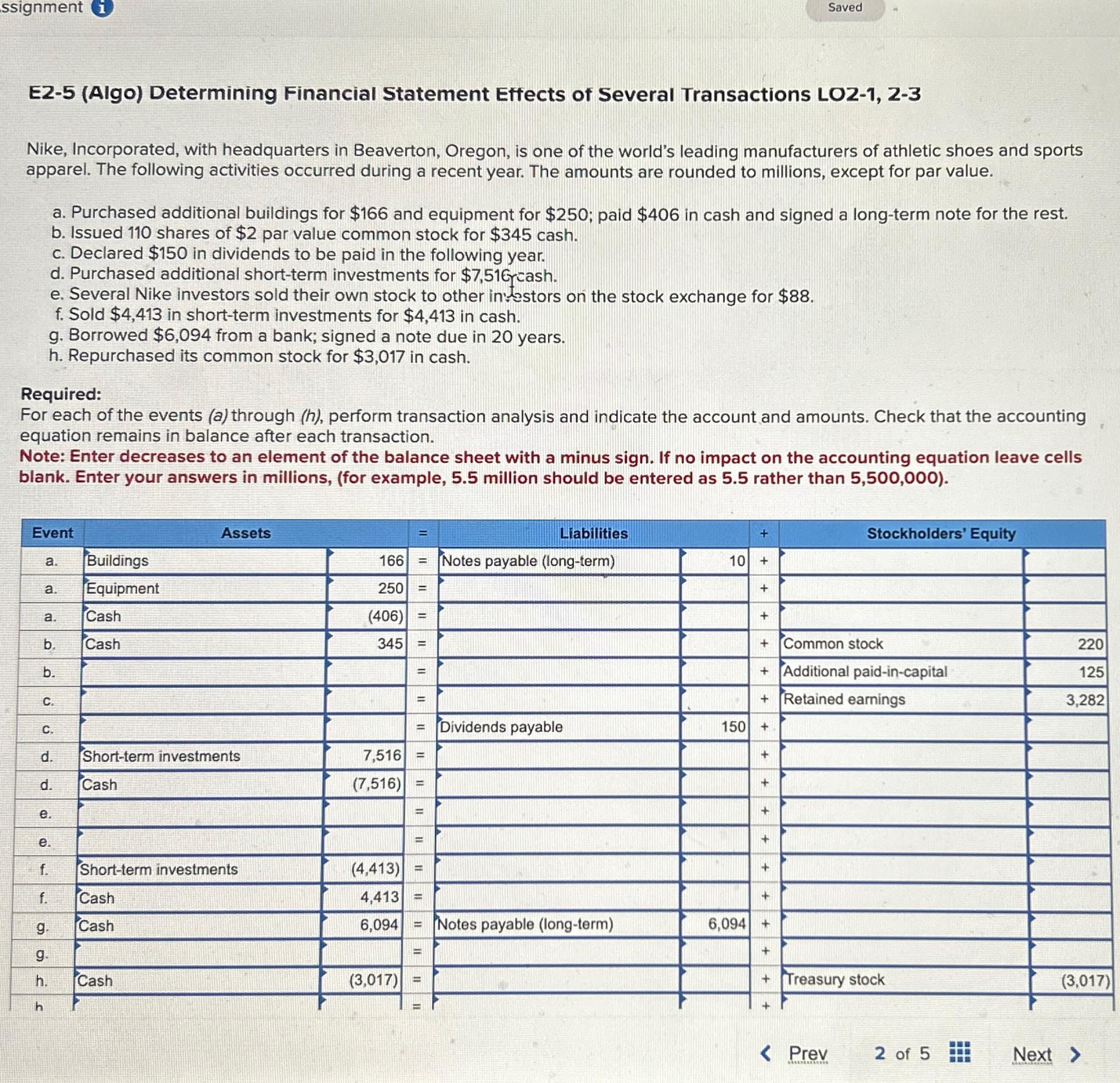

ssignment\ Saved\ E2-5 (Algo) Determining Financial Statement Effects of Several Transactions LO2-1, 2-3\ Nike, Incorporated, with headquarters in Beaverton, Oregon, is one of the world's leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions, except for par value.\ a. Purchased additional buildings for

$166and equipment for

$250; paid

$406in cash and signed a long-term note for the rest.\ b. Issued 110 shares of

$2par value common stock for

$345cash.\ c. Declared

$150in dividends to be paid in the following year.\ d. Purchased additional short-term investments for

$7,516rash.\ e. Several Nike investors sold their own stock to other in:-2stors on the stock exchange for

$88.\ f. Sold

$4,413in short-term investments for

$4,413in cash.\ g. Borrowed

$6,094from a bank; signed a note due in 20 years.\ h. Repurchased its common stock for

$3,017in cash.\ Required:\ For each of the events (a) through (

h), perform transaction analysis and indicate the account and amounts. Check that the accounting equation remains in balance after each transaction.\ Note: Enter decreases to an element of the balance sheet with a minus sign. If no impact on the accounting equation leave cells blank. Enter your answers in millions, (for example, 5.5 million should be entered as 5.5 rather than

5,500,000).\ \\\\table[[Event,Asse,,

=,Liabilities,,+,Stockholders' Equity,],[a.,Buildings,166,

=,Notes payable (long-term),10,+,,],[a.,Equipment,250,

=,,,+,,],[a.,Cash,

(406),

=,5,,+,,],[b.,Cash,345,

=,5,,+,Common stock,220],[b.,

F,,

=,5,,+,Additional paid-in-capital,125],[c.,

F,+,

=,5,

,+,Retained earnings,3,282],[c.,5,,

=,Dividends payable,150,+,,],[d.,Short-term investments,7,516,

=,5,,+,L,],[d.,Cash,

(7,516),

=,5,,+,-,],[e.,5,,

=,F,,+,5,],[e.,

F,,

=,,,+,

E,],[f.,Short-term investments,

(4,413),

=,5,,+,5,-],[f.,Cash,4,413,

=,,,+,,],[g.,Cash,6,094,

=,Notes payable (long-term),6,094,+,5,],[g.,5,,

=,,,+,5,],[h.,Cash,

(3,017),

=,,,+,Treasury stock,

(3,017)

E2-5 (Algo) Determining Financial Statement Effects of Several Transactions LO2-1, 2-3 Nike, Incorporated, with headquarters in Beaverton, Oregon, is one of the world's leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions, except for par value. a. Purchased additional buildings for $166 and equipment for $250; paid $406 in cash and signed a long-term note for the rest. b. Issued 110 shares of $2 par value common stock for $345 cash. c. Declared $150 in dividends to be paid in the following year. d. Purchased additional short-term investments for $7,516 rcash. e. Several Nike investors sold their own stock to other in:-2stors on the stock exchange for $88. f. Sold $4,413 in short-term investments for $4,413 in cash. g. Borrowed $6,094 from a bank; signed a note due in 20 years. h. Repurchased its common stock for $3,017 in cash. Required: For each of the events (a) through ( h ), perform transaction analysis and indicate the account and amounts. Check that the accounting equation remains in balance after each transaction. Note: Enter decreases to an element of the balance sheet with a minus sign. If no impact on the accounting equation leave cells blank. Enter your answers in millions, (for example, 5.5 million should be entered as 5.5 rather than 5,500,000 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts