Question: St. Blues Technologies' expected (next year) EBIT is $194.00, its tax rate is 37%, depreciation is $82.00, planned capital expenditures are $84.00, and planned INCREASES

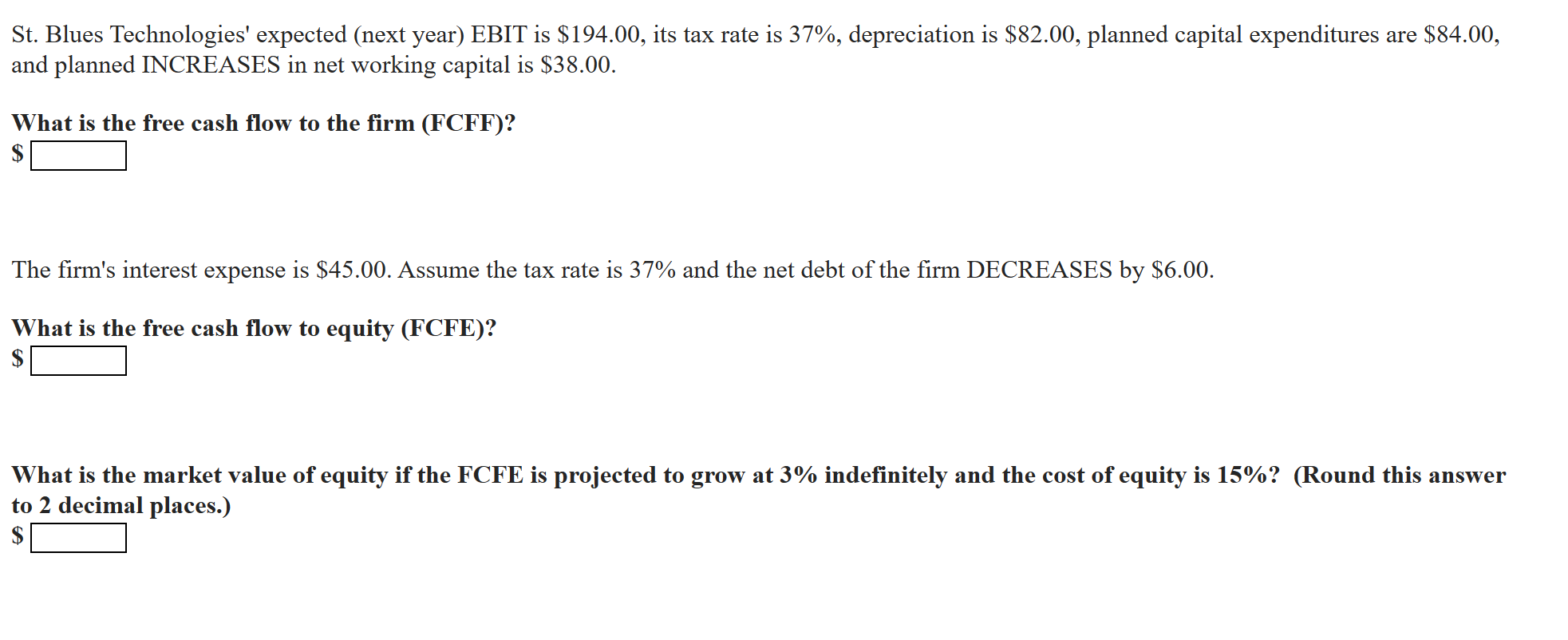

St. Blues Technologies' expected (next year) EBIT is $194.00, its tax rate is 37%, depreciation is $82.00, planned capital expenditures are $84.00, and planned INCREASES in net working capital is $38.00. What is the free cash flow to the firm (FCFF)? $ The firm's interest expense is $45.00. Assume the tax rate is 37% and the net debt of the firm DECREASES by $6.00. What is the free cash flow to equity (FCFE)? $ What is the market value of equity if the FCFE is projected to grow at 3% indefinitely and the cost of equity is 15\%? (Round this answer to 2 decimal places.) $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts