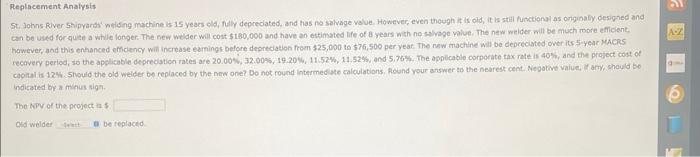

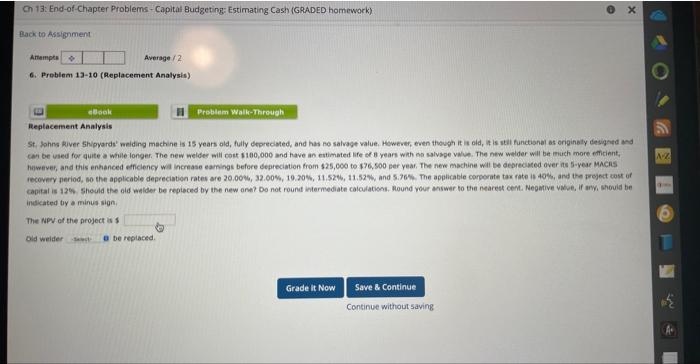

Question: St. Johns River Shipyarat' weileng machine is 15 yeaes eld, fully depredated, and has no salvage volve. However, even theugh it is old, it is

St. Johns River Shipyarat' weileng machine is 15 yeaes eld, fully depredated, and has no salvage volve. However, even theugh it is old, it is still funtional as ortginaty designed and can be used for quse a while longer. The new welder will cost $180,000 and have an estimated life of a years wath na salvage value. The new weicer will be much more efficent. hawever, and this enthanced efficiency wit increase earninge before depredation from 325,000 to $76,500 per yeat. The new machine will be depeceiated over its 5 -year Mack5 recavery period, so the apglicable deprecistica rates are 20.00%,32.00%,19.20%,11.52%,11.52%, and 5,76%. The applcable corporate tax rate is 40%, and the profect cost of capital is 12%. should the old welfer be replaced by the new one? Do not round intermed ate calculations. found your arswer to the nearest cent. Negotive vaiue, if arry, should be indicated by a minus wig7. The Wiry of the project in 5 . oid welder be replaced 6. Preblem 13-10 (Replacement Analysis) Replacement Analysis Car be used for quite a whille longer. The new welder aill cost 1100,000 and have an eatimated life of 8 years with na salvsge vaive. The new welder will be much more eftitinnt, huwever, and this enhenced efficlency wat increase eaniogs before depreciation from 425,000 to 476,500 per year, The new machine will be debrecated over its 5 -year MACns recovery neriod, so the apolicable depreciation rates are 20.00%4,32.00%,10.20%,11.52%,11.527% and 5.76%. The appicable corporate tax rate is 40% ard the freject cost of indicated by a minus sign, The NPes of the project is 3 Old weider be replaced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts