Question: St . Thomas Yacht Services, Inc. completed its first month of operations and wishes to adjust the accounting records to ensure revenues and expenses are

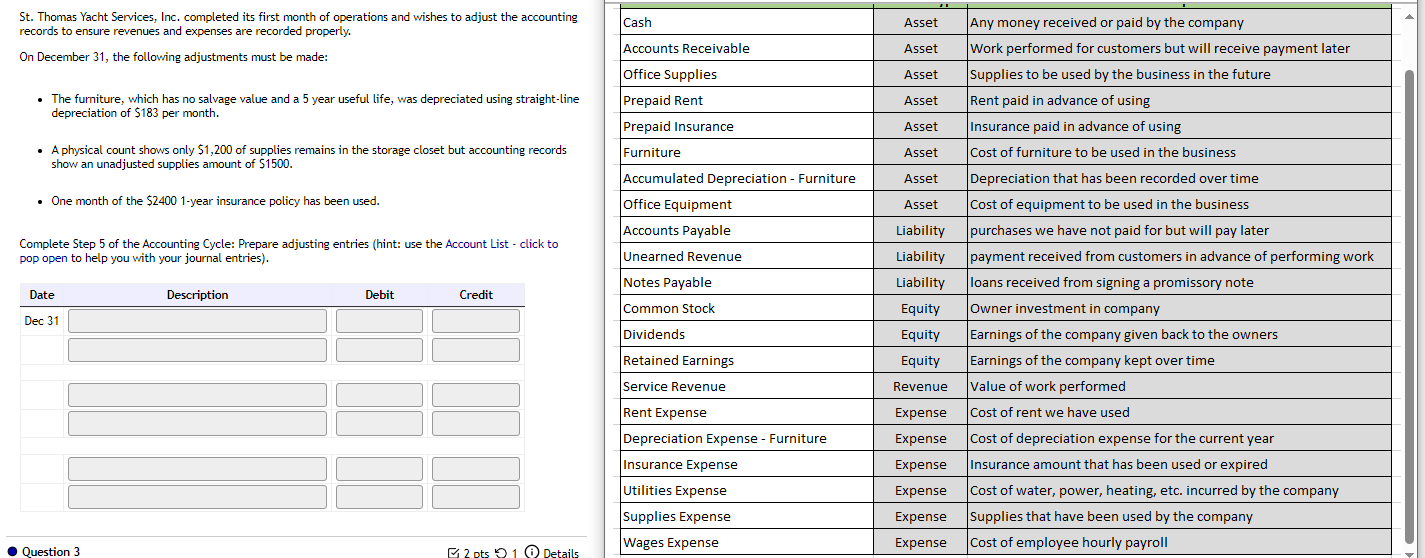

St Thomas Yacht Services, Inc. completed its first month of operations and wishes to adjust the accounting records to ensure revenues and expenses are recorded properly.

On December the following adjustments must be made:

The furniture, which has no salvage value and a year useful life, was depreciated using straightline depreciation of $ per month.

A physical count shows only $ of supplies remains in the storage closet but accounting records show an unadjusted supplies amount of $

One month of the $year insurance policy has been used.

Complete Step of the Accounting Cycle: Prepare adjusting entries hint: use the Account List click to pop open to help you with your journal entries

tableCashAsset,Any money received or paid by the companyAccounts Receivable,Asset,Work performed for customers but will receive payment laterOffice Supplies,Asset,Supplies to be used by the business in the futurePrepaid Rent,Asset,Rent paid in advance of usingPrepaid Insurance,Asset,Insurance paid in advance of usingFurnitureAsset,Cost of furniture to be used in the businessAccumulated Depreciation Furniture,Asset,Depreciation that has been recorded over timeOffice Equipment,Asset,Cost of equipment to be used in the businessAccounts Payable,Liability,purchases we have not paid for but will pay laterUnearned Revenue,Liability,payment received from customers in advance of performing workNotes Payable,Liability,loans received from signing a promissory noteCommon Stock,Equity,Owner investment in companyDividendsEquity,Earnings of the company given back to the ownersRetained Earnings,Equity,Earnings of the company kept over timeService Revenue,Revenue,Value of work performedRent Expense,Expense,Cost of rent we have usedDepreciation Expense Furniture,Expense,Cost of depreciation expense for the current yearInsurance Expense,Expense,Insurance amount that has been used or expiredUtilities Expense,Expense,Cost of water, power, heating, etc. incurred by the companySupplies Expense,Expense,Supplies that have been used by the companyWages Expense,Expense,Cost of employee hourly payroll

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock