Question: Stacy Company issued five-year, 10% bonds with a face value of $10,000 on January 1, 2016. Interest is paid annually on December 31. The

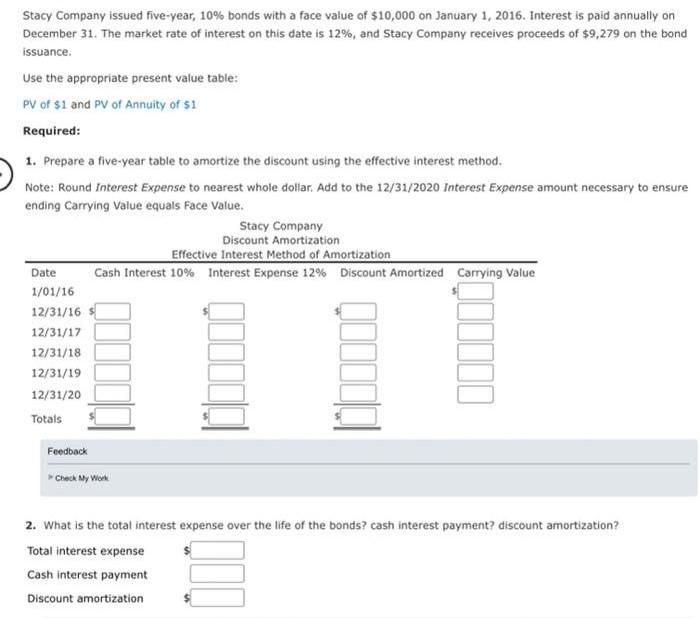

Stacy Company issued five-year, 10% bonds with a face value of $10,000 on January 1, 2016. Interest is paid annually on December 31. The market rate of interest on this date is 12%, and Stacy Company receives proceeds of $9,279 on the bond issuance. Use the appropriate present value table: PV of $1 and PV of Annuity of $1 Required: 1. Prepare a five-year table to amortize the discount using the effective interest method. Note: Round Interest Expense to nearest whole dollar. Add to the 12/31/2020 Interest Expense amount necessary to ensure ending Carrying Value equals Face Value. Stacy Company Discount Amortization Effective Interest Method of Amortization Cash Interest 10% Interest Expense 12% Discount Amortized Carrying Value Date 1/01/16 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 Totals Feedback > Check My Work 2. What is the total interest expense over the life of the bonds? cash interest payment? discount amortization? Total interest expense Cash interest payment Discount amortization

Step by Step Solution

There are 3 Steps involved in it

To prepare the table for amortizing the discount using the effective interest method we need to calc... View full answer

Get step-by-step solutions from verified subject matter experts