Question: Stan is going to work for the next 30 years and then retire. Starting the day he retires, he would like to withdraw $90,000 per

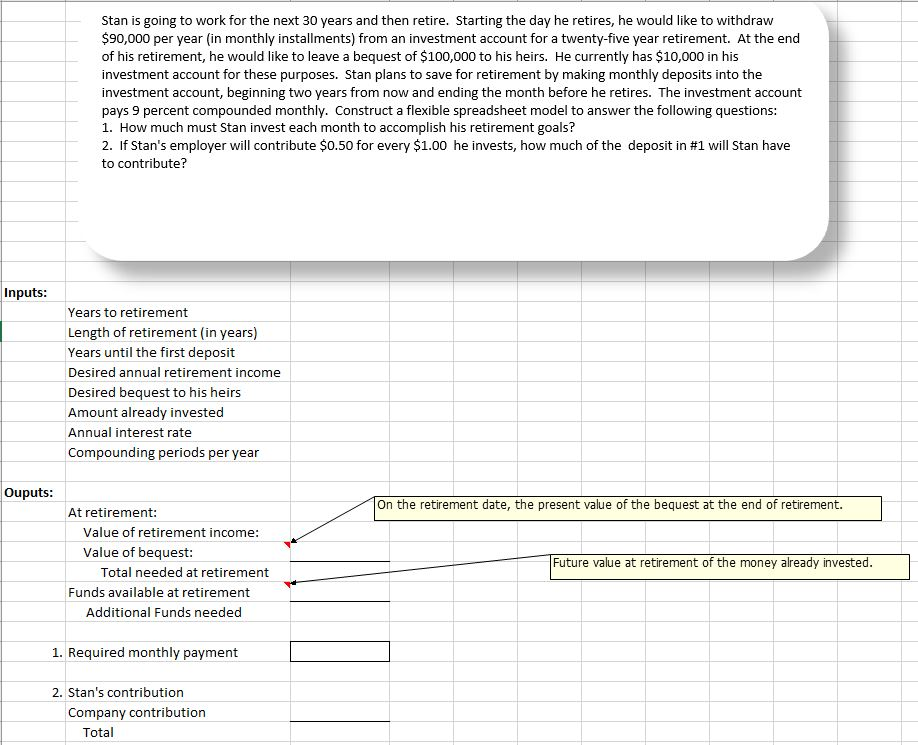

Stan is going to work for the next 30 years and then retire. Starting the day he retires, he would like to withdraw $90,000 per year (in monthly installments) from an investment account for a twenty-five year retirement. At the end of his retirement, he would like to leave a bequest of $100,000 to his heirs. He currently has $10,000 in his investment account for these purposes. Stan plans to save for retirement by making monthly deposits into the investment account, beginning two years from now and ending the month before he retires. The investment account pays 9 percent compounded monthly. Construct a flexible spreadsheet model to answer the following questions: 1. How much must Stan invest each month to accomplish his retirement goals? 2. If Stan's employer will contribute $0.50 for every $1.00 he invests, how much of the deposit in #1 will stan have to contribute? Inputs Years to retirement Length of retirement (in years) Years until the first deposit Desired annual retirement income Desired bequest to his heirs Amount already invested Annual interest rate Compounding periods per year Ouputs: On the retirement date, the present value of the bequest at the end of retirement. At retirement: Value of retirement income: Value of bequest: Future value at retirement of the money already invested Total needed at retirement Funds available at retirement Additional Funds needed 1. Required monthly payment 2. Stan's contribution Company contribution Total Stan is going to work for the next 30 years and then retire. Starting the day he retires, he would like to withdraw $90,000 per year (in monthly installments) from an investment account for a twenty-five year retirement. At the end of his retirement, he would like to leave a bequest of $100,000 to his heirs. He currently has $10,000 in his investment account for these purposes. Stan plans to save for retirement by making monthly deposits into the investment account, beginning two years from now and ending the month before he retires. The investment account pays 9 percent compounded monthly. Construct a flexible spreadsheet model to answer the following questions: 1. How much must Stan invest each month to accomplish his retirement goals? 2. If Stan's employer will contribute $0.50 for every $1.00 he invests, how much of the deposit in #1 will stan have to contribute? Inputs Years to retirement Length of retirement (in years) Years until the first deposit Desired annual retirement income Desired bequest to his heirs Amount already invested Annual interest rate Compounding periods per year Ouputs: On the retirement date, the present value of the bequest at the end of retirement. At retirement: Value of retirement income: Value of bequest: Future value at retirement of the money already invested Total needed at retirement Funds available at retirement Additional Funds needed 1. Required monthly payment 2. Stan's contribution Company contribution Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts