Question: Standard Costs & Variance Analysis (Chapter 9 & 9A) Assignment The X Company uses a standard cost system and sets its predetermined overhead rate on

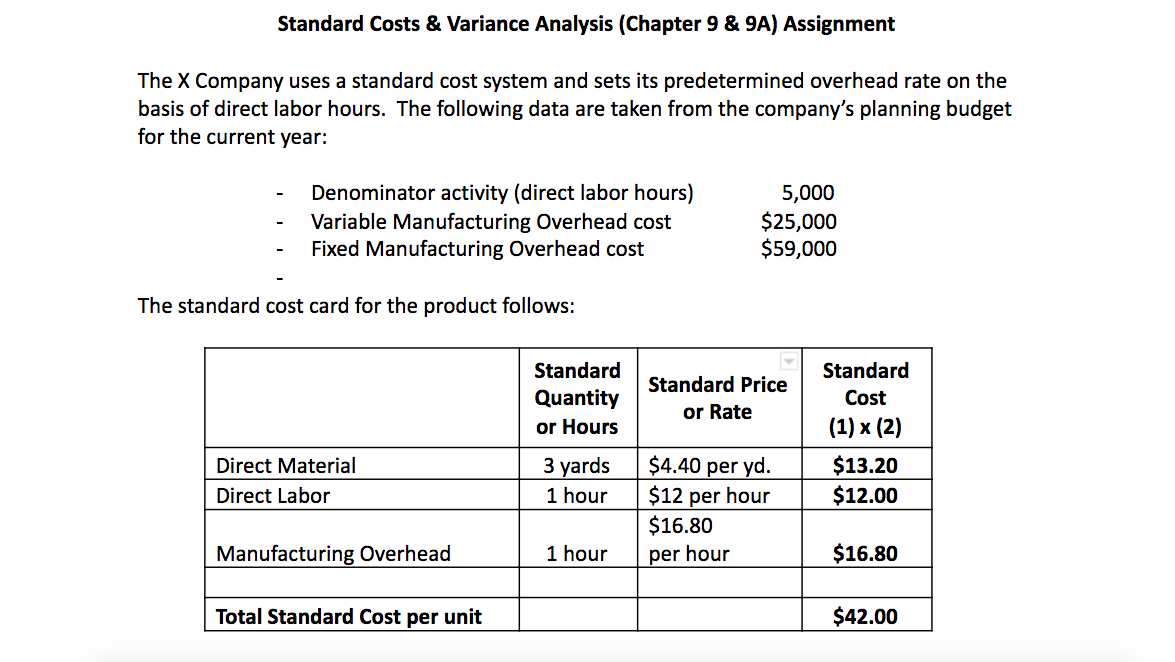

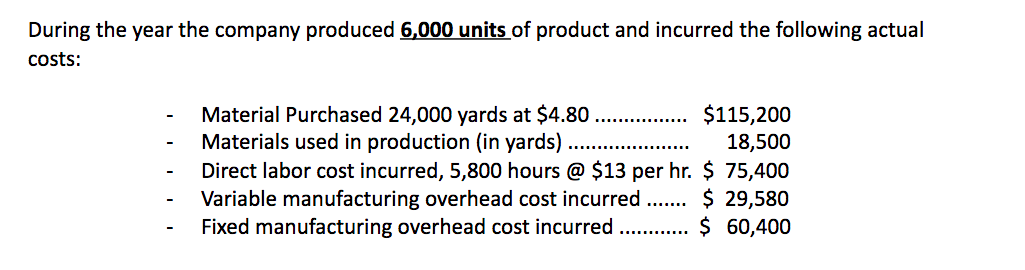

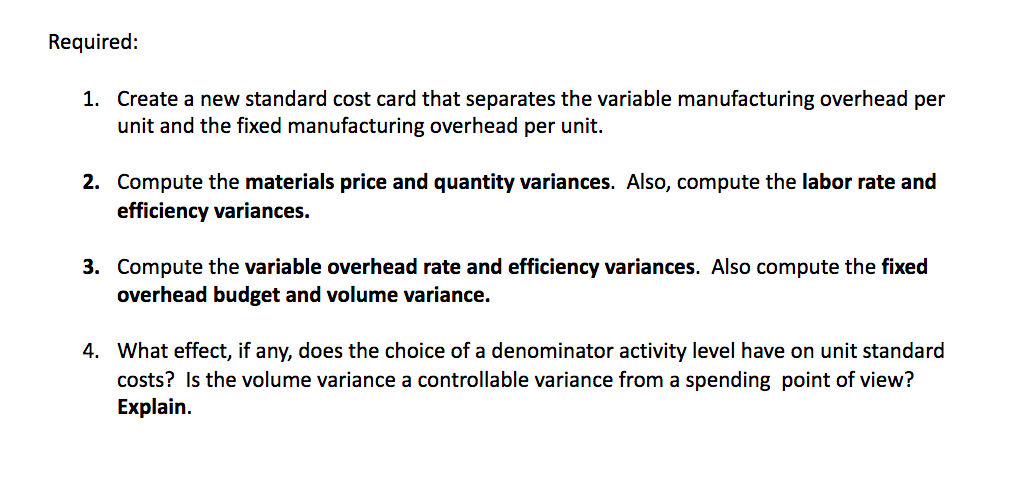

Standard Costs & Variance Analysis (Chapter 9 & 9A) Assignment The X Company uses a standard cost system and sets its predetermined overhead rate on the basis of direct labor hours. The following data are taken from the company's planning budget for the current year: Denominator activity (direct labor hours) Variable Manufacturing Overhead cost Fixed Manufacturing Overhead cost 5,000 $25,000 $59,000 The standard cost card for the product follows: Standard Quantity or Hours Standard Price or Rate Standard Cost (1) x (2) $13.20 $12.00 Direct Material Direct Labor 3 yards 1 hour $4.40 per yd. $12 per hour $16.80 Manufacturing Overhead 1 hour per hour $16.80 Total Standard Cost per unit $42.00 During the year the company produced 6,000 units of product and incurred the following actual costs: Material Purchased 24,000 yards at $4.80 $115,200 Materials used in production (in yards) 18,500 Direct labor cost incurred, 5,800 hours @ $13 per hr. $ 75,400 Variable manufacturing overhead cost incurred ..... $ 29,580 Fixed manufacturing overhead cost incurred .......... $ 60,400 Required: 1. Create a new standard cost card that separates the variable manufacturing overhead per unit and the fixed manufacturing overhead per unit. 2. Compute the materials price and quantity variances. Also, compute the labor rate and efficiency variances. 3. Compute the variable overhead rate and efficiency variances. Also compute the fixed overhead budget and volume variance. 4. What effect, if any, does the choice of a denominator activity level have on unit standard costs? Is the volume variance a controllable variance from a spending point of view? Explain. Standard Costs & Variance Analysis (Chapter 9 & 9A) Assignment The X Company uses a standard cost system and sets its predetermined overhead rate on the basis of direct labor hours. The following data are taken from the company's planning budget for the current year: Denominator activity (direct labor hours) Variable Manufacturing Overhead cost Fixed Manufacturing Overhead cost 5,000 $25,000 $59,000 The standard cost card for the product follows: Standard Quantity or Hours Standard Price or Rate Standard Cost (1) x (2) $13.20 $12.00 Direct Material Direct Labor 3 yards 1 hour $4.40 per yd. $12 per hour $16.80 Manufacturing Overhead 1 hour per hour $16.80 Total Standard Cost per unit $42.00 During the year the company produced 6,000 units of product and incurred the following actual costs: Material Purchased 24,000 yards at $4.80 $115,200 Materials used in production (in yards) 18,500 Direct labor cost incurred, 5,800 hours @ $13 per hr. $ 75,400 Variable manufacturing overhead cost incurred ..... $ 29,580 Fixed manufacturing overhead cost incurred .......... $ 60,400 Required: 1. Create a new standard cost card that separates the variable manufacturing overhead per unit and the fixed manufacturing overhead per unit. 2. Compute the materials price and quantity variances. Also, compute the labor rate and efficiency variances. 3. Compute the variable overhead rate and efficiency variances. Also compute the fixed overhead budget and volume variance. 4. What effect, if any, does the choice of a denominator activity level have on unit standard costs? Is the volume variance a controllable variance from a spending point of view? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts