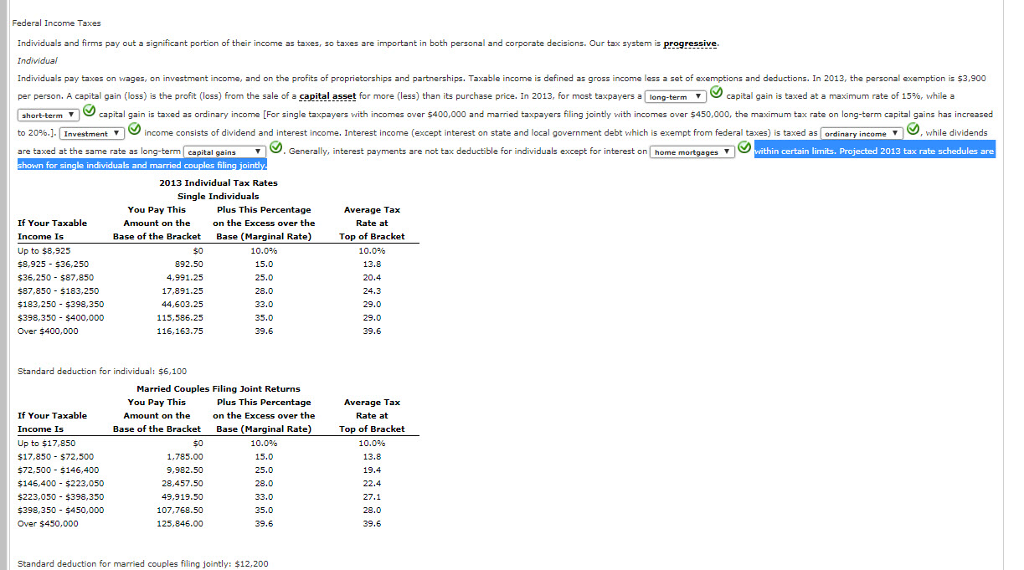

Question: Standard deduction for married couples filing jointly: $12,200 Quantitative Problem: Jenna is a single taxpayer with no dependents so she qualifies for one personal exemption.

Standard deduction for married couples filing jointly: $12,200

Quantitative Problem: Jenna is a single taxpayer with no dependents so she qualifies for one personal exemption. During 2013, she earned wages of $114,000. She doesn't itemize deductions, so she will take the standard deduction and her personal exemption to calculate 2013 taxable income. In addition, during the year she sold common stock that she had owned for five years for a net profit of $4,600. How much does Jenna owe to the IRS for taxes? Round your intermediated and final answers to the nearest cent.

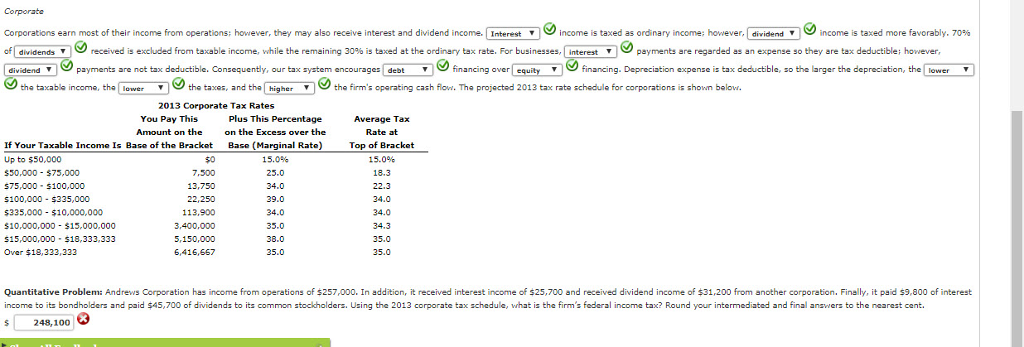

Federal Income Taxes Individuals and firms pay out a significant portion of their income as taxes, so taxes are important in both personal and corporate decisions. Our tax system is progressive Individuals pay taxes on wages, on invastmant income, and on the profits of propriatorships and partnerships. Taxable income is dafined as gross income less a sat of axemptions and deductions. In 2013, the personal examption is $3,900 per person. A capital gain loss he profit loss from the sale of a capital asset for more less than its purchase price In 2013 or most taxpayers a ong-te m short-term capital gain is axed as ordinary income For single taxpayers with 1ncomes over S400 0 and mar ed taxpayers ling or tly with incomes over 5450 0 0 the ma mum tax rate on long-term capita gains has 'ncreased to 20%. Invest ent income consists of dividend and interest income. Interest income except interest on state and local government debt which is exempt rom ederal taxes is taxed as o nary ne me while dividends are taxed at the same rate as long-term capial gains capital gain is taxed at a maximum rate of 15%, while a Generally, interest payments are not tax deductible for individuals except for interest on home n certain limits. Projected 2013 tax rate schedules are hown for single individuals and married couplos filing jointly 2013 Individual Tax Rates Single Individuals If Your Taxable Income Is Up to $8,925 $9,925 S36,250 $36.250 $87,850 87,850 $183,250 183,250 $398,350 $398,350-$400,000 Over $400,000 You Pay This Amount on the Base of the Bracket 892.50 4.991.25 17,891.25 44,603.25 115.586.25 116,163.75 Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 15.0 Average Tax Rate at Top of Bracket 10.0% 13.8 20.4 28.0 33.0 35.0 39.6 29.0 29.0 39.6 Standard deduction for individual: $6,100 Married Couples Filing Joint Returns You Pay This Amount on the on the Excess over the Plus This Percentage If Your Taxable Income Is Up to $17,850 $17.850 $72,500 $72,500-$146,400 $146,400 $223,050 $223,050 5398,350 5398,350 $450,000 Over $450,000 Average Tax Rate at Top of Bracket 10.0 13.8 19.4 22.4 27.1 28.0 39.6 Base (Marginal Rate) 10.0% 15.0 25.0 Base of the Bracket 1.785.00 9,982.50 28,457.50 49,919.50 107,768.50 125,846.00 33.0 25.0 39.6 Standard deduction for married couples filing jointly: $12,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts