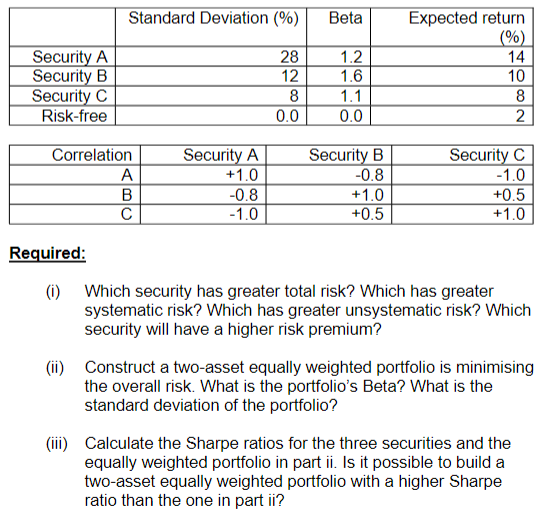

Question: Standard Deviation (%) Beta 28 12 Security A Security B Security C Risk-free 1.2 1.6 1.1 0.0 Expected return (%) 14 10 8 2 8

Standard Deviation (%) Beta 28 12 Security A Security B Security C Risk-free 1.2 1.6 1.1 0.0 Expected return (%) 14 10 8 2 8 0.0 Correlation B Security A +1.0 -0.8 -1.0 Security B -0.8 +1.0 +0.5 Security C -1.0 +0.5 +1.0 Required: (1) Which security has greater total risk? Which has greater systematic risk? Which has greater unsystematic risk? Which security will have a higher risk premium? (ii) Construct a two-asset equally weighted portfolio is minimising the overall risk. What is the portfolio's Beta? What is the standard deviation of the portfolio? (ii) Calculate the Sharpe ratios for the three securities and the equally weighted portfolio in part ii. Is it possible to build a two-asset equally weighted portfolio with a higher Sharpe ratio than the one in partii

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts