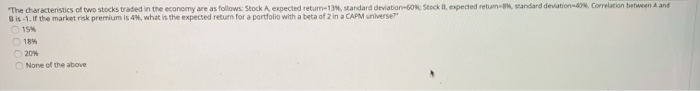

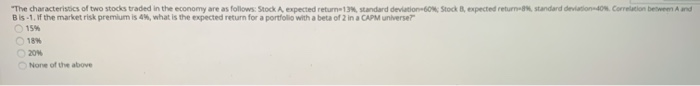

Question: standard deviation Correlation between A and The characteristics of two stocks traded in the economy are as follows: Stock A expected return-13. Standard deviation-60Stock, expeded

standard deviation Correlation between A and "The characteristics of two stocks traded in the economy are as follows: Stock A expected return-13. Standard deviation-60Stock, expeded retum- Bis -1. If the market risk premium is 4%, what is the expected return for a portfolio with a beta of 2 in a CAPM universe 154 184 20% None of the above Stock expected return standard deviation on Correction between A and "The characteristics of two stocks traded in the economy are as follows: Stock A expected return standard deviation Bis -1If the market risk premium is , what is the expected return for a portfolio with a beta of 2 in a CAPM universet 15% 18% 204 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts