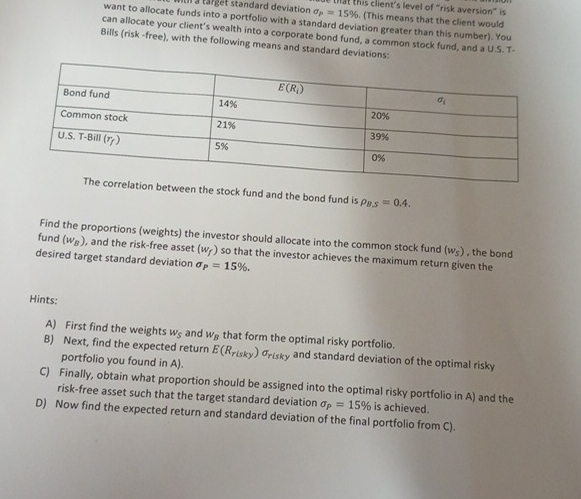

Question: standard deviation p = 1 5 % . can allocate Bills ( risk - free ) , client's wealth into a corporate bond fund, a

standard deviation

can allocate

Bills risk free client's wealth into a corporate bond fund, a greater than this number You

he following means and standard deviations: with then stock fund, and a US T

The correlation between the stock fund and the bond fund is

Find the proportions weights the investor should allocate into the common stock fund the bond

fund and the riskfree asset so that the investor achieves the maximum return given the

desired target standard deviation

Hints:

A First find the weights and that form the optimal risky portfolio.

B Next, find the expected return and standard deviation of the optimal risky

portfolio you found in A

C Finally, obtain what proportion should be assigned into the optimal risky portfolio in A and the

riskfree asset such that the target standard deviation is achieved.

D Now find the expected return and standard deviation of the final portfolio from C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock