Question: Standard Direct Materials Cost per Unit from Variance Data The following data relating to direct materials cost for October of the current year are taken

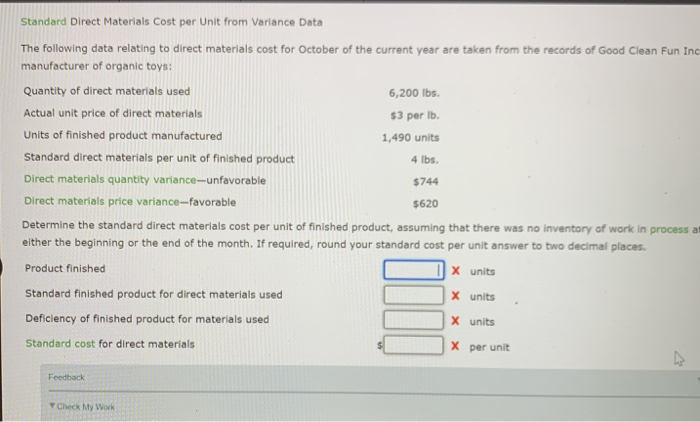

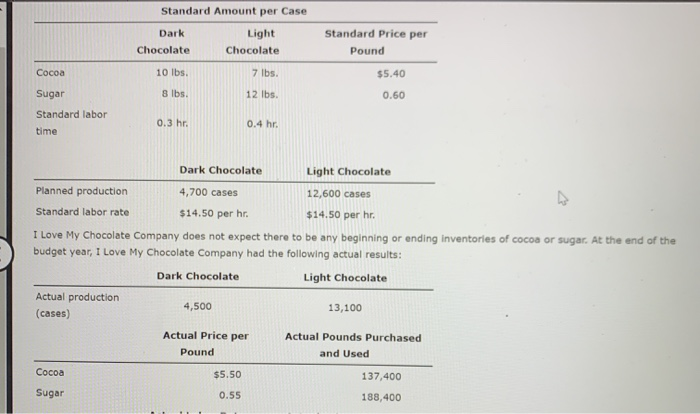

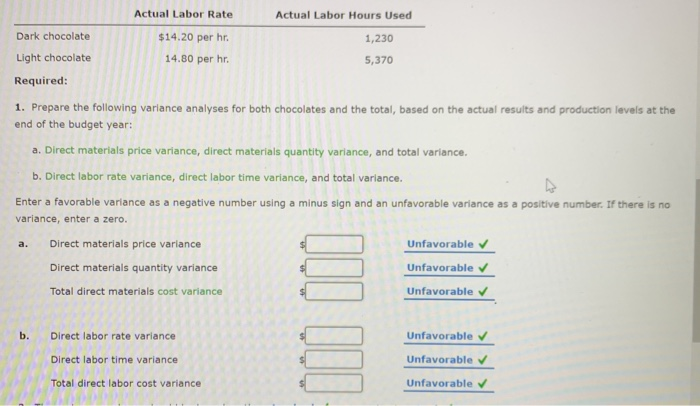

Standard Direct Materials Cost per Unit from Variance Data The following data relating to direct materials cost for October of the current year are taken from the records of Good Clean Fun Inc manufacturer of organic toys: Quantity of direct materials used Actual unit price of direct materials 6,200 lbs. $3 per lb. Units of finished product manufactured 1,490 units Standard direct materials per unit of finished product 4 lbs. Direct materials quantity variance-unfavorable $744 Direct materials price variance-favorable $620 Determine the standard direct materials cost per unit of finished product, assuming that there was no inventory of work in process at either the beginning or the end of the month. If required, round your standard cost per unit answer to two decimal places. Product finished X units units Standard finished product for direct materials used X Deficiency of finished product for materials used X units Standard cost for direct materials X per unit Feedback Check My Work Standard Amount per Case Dark Chocolate Light Chocolate Standard Price per Pound Cocoa 7 lbs. $5.40 10 lbs. 8 lbs. 12 lbs 0.60 Sugar Standard labor time 0.3 hr. 0.4 hr. Dark Chocolate Light Chocolate Planned production 4,700 cases $14.50 per hr 12,600 cases $14.50 per hr Standard labor rate I Love My Chocolate Company does not expect there to be any beginning or ending inventories of cocoa or sugar. At the end of the budget year, I Love My Chocolate Company had the following actual results: Dark Chocolate Light Chocolate Actual production 4,500 13,100 (cases) Actual Price per Actual Pounds Purchased Pound and Used Cocoa $5.50 137,400 Sugar 0.55 188,400 Actual Labor Rate Actual Labor Hours Used $14.20 per hr. Dark chocolate Light chocolate Required: 1,230 5,370 14.80 per hr. 1. Prepare the following variance analyses for both chocolates and the total, based on the actual results and production levels at the end of the budget year: a. Direct materials price variance, direct materials quantity variance, and total variance. b. Direct labor rate variance, direct labor time variance, and total variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. If there is no variance, enter a zero. Direct materials price variance $ Unfavorable Direct materials quantity variance JUU Unfavorable Total direct materials cost variance Unfavorable b. Direct labor rate variance Unfavorable Direct labor time variance Unfavorable Unfavorable Total direct labor cost variance A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts